Popular Posts

What Is the Future of Solana in Blockchain and DeFi?

Solana has rapidly emerged as a leading blockchain platform, capturing attention with its high throughput, low latency, and innovative consensus mechanism. As the landscape of decentralized finance (DeFi) continues to evolve, many investors and developers are asking: what does the future hold for Solana? This article explores Solana’s current position, recent developments, challenges, and potential trajectory within the broader blockchain ecosystem.

Understanding Solana’s Technology and Ecosystem

Launched in 2017 by Anatoly Yakovenko along with Greg Fitzgerald and Stephen Akridge, Solana was designed to address common scalability issues faced by earlier blockchains like Bitcoin and Ethereum. Its core innovation is the Proof of History (PoH) consensus algorithm—a unique timestamping method that enables faster transaction processing without compromising security.

This architecture allows Solana to process thousands of transactions per second (TPS), making it highly suitable for applications requiring high throughput such as DeFi protocols, non-fungible tokens (NFTs), gaming platforms, and enterprise solutions. Its ability to scale efficiently positions it as a formidable competitor in an increasingly crowded market dominated by Ethereum but challenged by newer entrants like Binance Smart Chain or Polkadot.

The platform's robust ecosystem includes a variety of decentralized applications—ranging from lending protocols to stablecoins—and has attracted significant institutional interest. Notably, major players have invested millions into projects built on or related to Solana—highlighting confidence in its long-term potential.

Recent Price Movements Indicate Growing Adoption

As of May 2025, Solana’s native token SOL experienced a notable surge past $150 amid heightened trading activity. This price rally reflects increased investor confidence driven by several factors:

- Institutional Investment: The launch of financial products such as the SOLZ ETF has garnered attention from institutional investors. Bloomberg predicts high approval rates for these ETFs amid favorable regulatory trends.

- Ecosystem Expansion: New projects launching on Solana—including DeFi platforms offering yield farming or lending services—have contributed to demand.

- Market Sentiment: Broader bullish trends across cryptocurrencies have also played a role in boosting SOL prices temporarily.

However, analysts warn that this rally could be susceptible to short-term volatility due to macroeconomic factors affecting global markets or shifts within crypto sentiment itself.

Regulatory Environment: Opportunities & Risks

The evolving regulatory landscape remains one of the most critical factors influencing Solana's future prospects. While clarity around cryptocurrency regulations can foster investor confidence—and potentially lead to mainstream adoption—any adverse policy changes could hinder growth prospects significantly.

In 2025 alone, regulators worldwide are scrutinizing digital assets more closely; some countries have introduced stricter compliance requirements while others explore central bank digital currencies (CBDCs). For platforms like Solana that host numerous dApps—including those involved with DeFi—the risk lies in potential restrictions on certain activities such as yield farming or token issuance.

Nevertheless, proactive engagement with regulators coupled with transparent compliance strategies can help mitigate these risks over time.

Institutional Interest Signaling Long-Term Confidence

One notable development is Neptune Digital Assets Corp.'s increased holdings in Bitcoin alongside investments in Solana-based projects. Such moves suggest growing institutional recognition that blockchain ecosystems like Solana may offer sustainable growth opportunities beyond retail speculation alone.

Institutional backing often translates into greater liquidity support and credibility for blockchain networks—factors crucial for long-term success especially when competing against well-established chains like Ethereum which benefits from extensive developer communities but faces scalability issues itself.

Furthermore, large-scale investments tend to attract more developers seeking reliable infrastructure for their decentralized applications—a positive feedback loop reinforcing network effects over time.

Challenges Facing Future Growth

Despite promising signs ahead; several hurdles could impact how farSolano can go:

Market Volatility: Cryptocurrency markets are inherently volatile; sharp corrections can affect investor sentiment regardless of underlying technology.

Competition: Platforms such as Ethereum 2.0 upgrade efforts aim at improving scalability but still face congestion issues; Binance Smart Chain offers lower fees but less decentralization; Polkadot emphasizes interoperability—all vying for market share.

Security Concerns: As more complex dApps emerge on solanA’s network—including meme coins like $TRUMP launched early 2025—the risk profile increases regarding smart contract vulnerabilities or malicious attacks.

Addressing these challenges requires ongoing technological innovation combined with strategic community engagement and regulatory compliance efforts.

The Road Ahead: Will Solarna Maintain Its Momentum?

Looking forward into 2025+ , several key factors will influence whether solanA sustains its current momentum:

- Continued Ecosystem Development: Expanding partnerships with enterprises and onboarding new developers will be vital.

- Regulatory Adaptation: Navigating evolving legal frameworks effectively can prevent setbacks caused by policy shifts.

- Technological Innovation: Upgrades enhancing security features while maintaining speed will reinforce trust among users.

- Market Conditions: Broader economic stability may reduce volatility-driven sell-offs enabling steady growth trajectories.

While no project is immune from risks inherent within crypto markets; solanA's innovative architecture combined with increasing institutional interest suggests it could remain at the forefront among scalable Layer 1 blockchains if it manages these dynamics well.

Final Thoughts

Solano stands out today not just because of its impressive technical capabilities but also due to growing adoption across sectors—from DeFi protocols through NFTs—to enterprise use cases . Its ability to adapt amidst competition hinges on continuous innovation paired with strategic regulation navigation .

As we move further into this decade marked by rapid technological change , solanA's future appears promising—but cautious optimism remains prudent given inherent market uncertainties . Stakeholders should monitor ongoing developments closely while leveraging its strengths toward building resilient decentralized ecosystems.

Note: This overview aims at providing an informed perspective based on current data up until October 2023 plus recent developments noted through early 2025 — always consider ongoing updates when evaluating long-term prospects

JCUSER-F1IIaxXA

2025-05-09 03:47

what is the future of Solana ?

What Is the Future of Solana in Blockchain and DeFi?

Solana has rapidly emerged as a leading blockchain platform, capturing attention with its high throughput, low latency, and innovative consensus mechanism. As the landscape of decentralized finance (DeFi) continues to evolve, many investors and developers are asking: what does the future hold for Solana? This article explores Solana’s current position, recent developments, challenges, and potential trajectory within the broader blockchain ecosystem.

Understanding Solana’s Technology and Ecosystem

Launched in 2017 by Anatoly Yakovenko along with Greg Fitzgerald and Stephen Akridge, Solana was designed to address common scalability issues faced by earlier blockchains like Bitcoin and Ethereum. Its core innovation is the Proof of History (PoH) consensus algorithm—a unique timestamping method that enables faster transaction processing without compromising security.

This architecture allows Solana to process thousands of transactions per second (TPS), making it highly suitable for applications requiring high throughput such as DeFi protocols, non-fungible tokens (NFTs), gaming platforms, and enterprise solutions. Its ability to scale efficiently positions it as a formidable competitor in an increasingly crowded market dominated by Ethereum but challenged by newer entrants like Binance Smart Chain or Polkadot.

The platform's robust ecosystem includes a variety of decentralized applications—ranging from lending protocols to stablecoins—and has attracted significant institutional interest. Notably, major players have invested millions into projects built on or related to Solana—highlighting confidence in its long-term potential.

Recent Price Movements Indicate Growing Adoption

As of May 2025, Solana’s native token SOL experienced a notable surge past $150 amid heightened trading activity. This price rally reflects increased investor confidence driven by several factors:

- Institutional Investment: The launch of financial products such as the SOLZ ETF has garnered attention from institutional investors. Bloomberg predicts high approval rates for these ETFs amid favorable regulatory trends.

- Ecosystem Expansion: New projects launching on Solana—including DeFi platforms offering yield farming or lending services—have contributed to demand.

- Market Sentiment: Broader bullish trends across cryptocurrencies have also played a role in boosting SOL prices temporarily.

However, analysts warn that this rally could be susceptible to short-term volatility due to macroeconomic factors affecting global markets or shifts within crypto sentiment itself.

Regulatory Environment: Opportunities & Risks

The evolving regulatory landscape remains one of the most critical factors influencing Solana's future prospects. While clarity around cryptocurrency regulations can foster investor confidence—and potentially lead to mainstream adoption—any adverse policy changes could hinder growth prospects significantly.

In 2025 alone, regulators worldwide are scrutinizing digital assets more closely; some countries have introduced stricter compliance requirements while others explore central bank digital currencies (CBDCs). For platforms like Solana that host numerous dApps—including those involved with DeFi—the risk lies in potential restrictions on certain activities such as yield farming or token issuance.

Nevertheless, proactive engagement with regulators coupled with transparent compliance strategies can help mitigate these risks over time.

Institutional Interest Signaling Long-Term Confidence

One notable development is Neptune Digital Assets Corp.'s increased holdings in Bitcoin alongside investments in Solana-based projects. Such moves suggest growing institutional recognition that blockchain ecosystems like Solana may offer sustainable growth opportunities beyond retail speculation alone.

Institutional backing often translates into greater liquidity support and credibility for blockchain networks—factors crucial for long-term success especially when competing against well-established chains like Ethereum which benefits from extensive developer communities but faces scalability issues itself.

Furthermore, large-scale investments tend to attract more developers seeking reliable infrastructure for their decentralized applications—a positive feedback loop reinforcing network effects over time.

Challenges Facing Future Growth

Despite promising signs ahead; several hurdles could impact how farSolano can go:

Market Volatility: Cryptocurrency markets are inherently volatile; sharp corrections can affect investor sentiment regardless of underlying technology.

Competition: Platforms such as Ethereum 2.0 upgrade efforts aim at improving scalability but still face congestion issues; Binance Smart Chain offers lower fees but less decentralization; Polkadot emphasizes interoperability—all vying for market share.

Security Concerns: As more complex dApps emerge on solanA’s network—including meme coins like $TRUMP launched early 2025—the risk profile increases regarding smart contract vulnerabilities or malicious attacks.

Addressing these challenges requires ongoing technological innovation combined with strategic community engagement and regulatory compliance efforts.

The Road Ahead: Will Solarna Maintain Its Momentum?

Looking forward into 2025+ , several key factors will influence whether solanA sustains its current momentum:

- Continued Ecosystem Development: Expanding partnerships with enterprises and onboarding new developers will be vital.

- Regulatory Adaptation: Navigating evolving legal frameworks effectively can prevent setbacks caused by policy shifts.

- Technological Innovation: Upgrades enhancing security features while maintaining speed will reinforce trust among users.

- Market Conditions: Broader economic stability may reduce volatility-driven sell-offs enabling steady growth trajectories.

While no project is immune from risks inherent within crypto markets; solanA's innovative architecture combined with increasing institutional interest suggests it could remain at the forefront among scalable Layer 1 blockchains if it manages these dynamics well.

Final Thoughts

Solano stands out today not just because of its impressive technical capabilities but also due to growing adoption across sectors—from DeFi protocols through NFTs—to enterprise use cases . Its ability to adapt amidst competition hinges on continuous innovation paired with strategic regulation navigation .

As we move further into this decade marked by rapid technological change , solanA's future appears promising—but cautious optimism remains prudent given inherent market uncertainties . Stakeholders should monitor ongoing developments closely while leveraging its strengths toward building resilient decentralized ecosystems.

Note: This overview aims at providing an informed perspective based on current data up until October 2023 plus recent developments noted through early 2025 — always consider ongoing updates when evaluating long-term prospects

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JuTrust Insurance is a Web3.0 open API interface. The Solth Trust protocol has been integrated into JuTrust Insurance. 30% of the funds entered by users into Solth Trust will automatically enter the insurance pool, which is used to underwrite risk policies for the amount entered by users into Sloth Trust. JuTrust will automatically capture user withdrawal records as a basis for statistical claims.

💎Compensation triggering mechanism

🔣The core service of the project is closed, and tokens cannot be withdrawn.

🔣And other force majeure factors determined by the platform.

👉 Read More:https://bit.ly/4foWISj

JuCoin Community

2025-08-04 10:23

Sloth Trust officially joins JuTrust insurance warehouse

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Bitcoin hits 108k and she’s crying 😭 Because I’m still broke. Why? I’m an altcoin holder 🧻 It be like that sometimes

Check out our YouTube Channel 👉

#AltcoinHolder #BitcoinVsAlts #CryptoPain

JuCoin Media

2025-08-01 11:26

Investing in Cryptocurrency Means Bitcoin Pumps, Alts Dump 🎢

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

USELESS leverages the motto "useless is fun" to create a unique meme-driven ecosystem combining entertainment with real decentralized governance. Since launching in 2021, it has attracted tens of thousands of active users and secured liquidity across multiple DEX platforms.

💰 Core Features:

-

1 billion total supply with ~850 million currently circulating

Innovative burn-and-mint dual adjustment mechanism

U-DAO on-chain governance system for holder proposals and voting

Live on PancakeSwap & Uniswap with $5M+ daily trading volumes

🔥 Dynamic Tokenomics:

-

Quarterly Burns: Community votes to buy back and burn 1-5% of circulating supply

Monthly Mints: 0.5-2% strategic minting for community rewards and development

Liquidity Support: 10% reserved for DEX liquidity mining rewards

Governance Staking: Stake tokens in U-DAO for voting rights and rewards

🎯 Participation Strategy: 1️⃣ Stake 10,000+ USELESS in U-DAO to gain proposal and voting rights 2️⃣ Provide liquidity on PancakeSwap/Uniswap for LP rewards and fee sharing 3️⃣ Join monthly "Burn Parties" and meme contests for airdrops 4️⃣ Engage with NFT and DeFi partnership opportunities

🏆 Community Highlights:

-

"Useless Fund" proposal approved by 65% of holders

Regular meme contests and community-driven content creation

Strategic partnerships with NFT projects and DeFi protocols

Strong community engagement and governance participation

💡 Investment Thesis: USELESS stands out in the meme token space by combining genuine entertainment value with robust governance mechanisms. The dynamic supply adjustment model and active community governance create sustainable value beyond typical meme token speculation.

Read the complete in-depth analysis: 👇

https://blog.jucoin.com/useless-coin-project-analysis/?utm_source=blog

#USELESS #MemeToken #DecentralizedGovernance #DeFi #CommunityDriven #PancakeSwap #Uniswap #BurnMechanism #U-DAO #JuCoin #Blockchain #Tokenomics #LiquidityMining #NFT #Web3 #Governance

JU Blog

2025-08-01 08:57

🎭 USELESS: The "Most Useless" Meme Token with Serious Governance Power!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

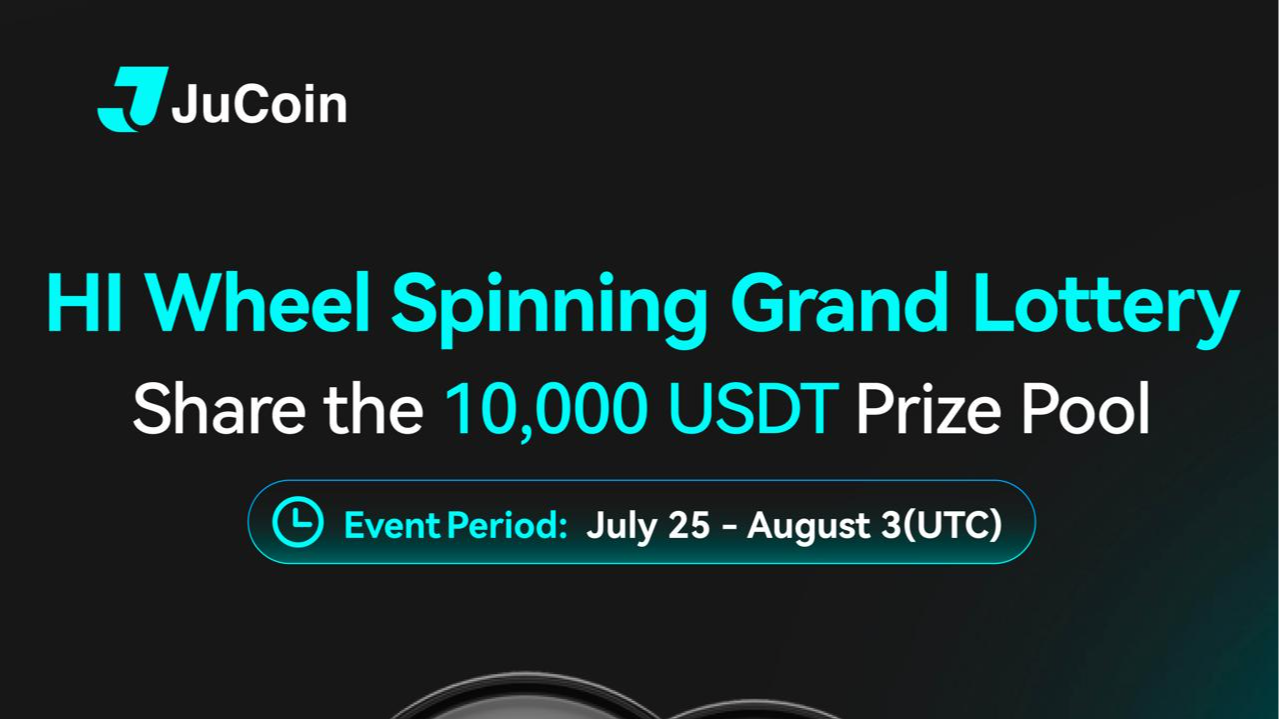

Time: 2025/7/25 13:00 - 2025/8/3 15:59 (UTC)

🔷Completing regular tasks, daily tasks, and step-by-step tasks can earn you a chance to win a USDT airdrop and share a prize pool of 10,000 USDT.

JuCoin Community

2025-07-31 06:22

HI Wheel Draw: Share the 10,000 USDT prize pool!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

kai

2025-06-09 07:27

What precedents are being set by countries adopting Bitcoin?

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Most Popular NFT Platforms on Solana?

The rise of Non-Fungible Tokens (NFTs) has transformed digital ownership, art, and collectibles. Among various blockchain networks supporting NFTs, Solana has gained significant attention due to its high speed and low transaction costs. This article explores the most popular NFT platforms on Solana, providing insights into their features, recent developments, and their role in shaping the ecosystem.

Why Is Solana a Preferred Blockchain for NFTs?

Solana's architecture is designed for scalability and efficiency. Its ability to process thousands of transactions per second at minimal fees makes it an attractive platform for artists, collectors, and developers. Unlike Ethereum—which often faces congestion and high gas fees—Solana offers a smoother experience for minting, buying, selling, and trading NFTs. This efficiency has led to a vibrant marketplace with diverse offerings ranging from digital art to virtual real estate.

Leading NFT Marketplaces on Solana

Magic Eden: The Dominant Marketplace

Magic Eden stands out as one of the most prominent NFT marketplaces on Solana. It provides a user-friendly interface that simplifies the process of creating or trading NFTs across categories such as art collections, gaming assets, and virtual land parcels. Its community-driven approach fosters active engagement through events like auctions or collaborations with artists.

Recently, Magic Eden expanded its feature set by introducing fractional ownership—allowing multiple users to co-own expensive NFTs—and staking programs that enable holders to earn rewards over time. These innovations have contributed significantly to its growth trajectory amid increasing competition.

DeGods: Community-Centric NFT Project

DeGods started as a community-led initiative before evolving into an integrated marketplace with its own native token ($DeGods). The project emphasizes exclusivity through limited editions linked with unique experiences or access rights within its ecosystem.

What sets DeGods apart is its focus on governance—allowing token holders influence platform decisions—and fostering strong community bonds via social events or collaborations with other projects. Its innovative approach has attracted substantial investor interest while boosting market value.

SOL Mint: Simplified NFT Creation Platform

For creators looking to mint NFTs directly onto Solana without complex technical hurdles—SOL Mint offers an accessible solution. It supports various formats including images (JPEG/PNG), 3D models, and more advanced assets like animations.

Its intuitive interface integrates seamlessly with popular wallets such as Phantom or Solflare — making it easier than ever for artists or brands to launch their collections quickly. Recent updates have added support for more complex asset types along with improved tools that streamline the creation process further.

Star Atlas: Gaming Meets Blockchain

Star Atlas combines blockchain technology with immersive gaming experiences by utilizing NFTs as in-game assets within a vast sci-fi universe built on Solana’s network infrastructure. Players can explore planets or trade rare items represented by unique tokens while participating in strategic battles or alliances.

This platform exemplifies how gaming ecosystems are leveraging blockchain tech not only for ownership but also for economic participation through play-to-earn models—a trend gaining momentum across multiple sectors within crypto space.

Recent Developments Impacting the Solana NFT Ecosystem

The broader adoption of blockchain technology continues influencing how platforms evolve:

Tokenization of US Equities: In May 2025, Kraken launched 24/7 tokenized US stocks—including giants like Apple & Tesla—via SPL tokens on Solana[1]. Such initiatives could attract institutional investors seeking diversified exposure beyond traditional markets; this increased financial activity may spill over into higher demand for digital assets including NFTs.

Real-Time Bitcoin Payments: Block Inc.’s announcement at Bitcoin 2025 conference about enabling instant Bitcoin payments demonstrates growing mainstream acceptance of cryptocurrencies[2]. While not directly related to NFTs on Solana today—their integration signals broader trust in crypto infrastructure which benefits all sectors including digital collectibles.

Market Volatility & Regulatory Changes: The volatile nature of cryptocurrency markets impacts NFT valuations significantly; sudden price swings can affect both creators’ revenue streams and collectors’ investments. Additionally—with evolving regulations around ownership rights or tax implications—the future landscape remains uncertain but potentially more structured once clearer guidelines are established globally.

Challenges Facing the Growth of Solarina-Based NFT Platforms

Despite rapid growth potential driven by technological advantages:

Market Fluctuations: Price volatility remains one of the biggest challenges affecting liquidity levels across platforms.

Regulatory Environment: As governments worldwide scrutinize cryptocurrencies more closely—including aspects related specifically to digital assets—the regulatory landscape could impose restrictions that hinder innovation.

Competition from Other Blockchains: Ethereum still dominates many segments despite high fees; competing chains like Binance Smart Chain (BSC) or Polygon offer alternative options which might divert some users away from Solana-based solutions if they offer similar features at lower costs elsewhere.

How These Platforms Shape Digital Ownership & Collectibles Market

The popularity of these platforms underscores several key trends:

- Decentralized Community Engagement – Projects like DeGods foster active governance models where owners influence development decisions.

- Integration With Gaming & Virtual Worlds – Platforms such as Star Atlas demonstrate how gaming ecosystems leverage blockchain tech not just for ownership but also economic participation.

- Ease Of Use For Creators – Tools provided by SOL Mint simplify onboarding new artists into Web3 spaces without requiring deep technical knowledge.

- Innovative Financial Instruments – Fractionalization (Magic Eden) allows shared ownership; staking programs incentivize long-term holding among users seeking passive income streams.

Final Thoughts

As one of the fastest-growing sectors within blockchain technology today — especially supported by robust networks like Solano —NFT platforms continue transforming how we create value digitally—from art collectionsto immersive gaming worldsand beyond . Their success hinges upon technological innovation , community engagement ,and navigating regulatory landscapes effectively . Whether you’re an artist aimingto showcase your workor an investor exploring new opportunities,the current ecosystem offers numerous avenues worth exploring .

References

[1] Kraken launches 24/7 tokenized US equities trading on Solano.

[2] Block unveils real-time Bitcoin payments through Square.

JCUSER-F1IIaxXA

2025-06-07 16:42

What are the most popular NFT platforms on Solana?

What Are the Most Popular NFT Platforms on Solana?

The rise of Non-Fungible Tokens (NFTs) has transformed digital ownership, art, and collectibles. Among various blockchain networks supporting NFTs, Solana has gained significant attention due to its high speed and low transaction costs. This article explores the most popular NFT platforms on Solana, providing insights into their features, recent developments, and their role in shaping the ecosystem.

Why Is Solana a Preferred Blockchain for NFTs?

Solana's architecture is designed for scalability and efficiency. Its ability to process thousands of transactions per second at minimal fees makes it an attractive platform for artists, collectors, and developers. Unlike Ethereum—which often faces congestion and high gas fees—Solana offers a smoother experience for minting, buying, selling, and trading NFTs. This efficiency has led to a vibrant marketplace with diverse offerings ranging from digital art to virtual real estate.

Leading NFT Marketplaces on Solana

Magic Eden: The Dominant Marketplace

Magic Eden stands out as one of the most prominent NFT marketplaces on Solana. It provides a user-friendly interface that simplifies the process of creating or trading NFTs across categories such as art collections, gaming assets, and virtual land parcels. Its community-driven approach fosters active engagement through events like auctions or collaborations with artists.

Recently, Magic Eden expanded its feature set by introducing fractional ownership—allowing multiple users to co-own expensive NFTs—and staking programs that enable holders to earn rewards over time. These innovations have contributed significantly to its growth trajectory amid increasing competition.

DeGods: Community-Centric NFT Project

DeGods started as a community-led initiative before evolving into an integrated marketplace with its own native token ($DeGods). The project emphasizes exclusivity through limited editions linked with unique experiences or access rights within its ecosystem.

What sets DeGods apart is its focus on governance—allowing token holders influence platform decisions—and fostering strong community bonds via social events or collaborations with other projects. Its innovative approach has attracted substantial investor interest while boosting market value.

SOL Mint: Simplified NFT Creation Platform

For creators looking to mint NFTs directly onto Solana without complex technical hurdles—SOL Mint offers an accessible solution. It supports various formats including images (JPEG/PNG), 3D models, and more advanced assets like animations.

Its intuitive interface integrates seamlessly with popular wallets such as Phantom or Solflare — making it easier than ever for artists or brands to launch their collections quickly. Recent updates have added support for more complex asset types along with improved tools that streamline the creation process further.

Star Atlas: Gaming Meets Blockchain

Star Atlas combines blockchain technology with immersive gaming experiences by utilizing NFTs as in-game assets within a vast sci-fi universe built on Solana’s network infrastructure. Players can explore planets or trade rare items represented by unique tokens while participating in strategic battles or alliances.

This platform exemplifies how gaming ecosystems are leveraging blockchain tech not only for ownership but also for economic participation through play-to-earn models—a trend gaining momentum across multiple sectors within crypto space.

Recent Developments Impacting the Solana NFT Ecosystem

The broader adoption of blockchain technology continues influencing how platforms evolve:

Tokenization of US Equities: In May 2025, Kraken launched 24/7 tokenized US stocks—including giants like Apple & Tesla—via SPL tokens on Solana[1]. Such initiatives could attract institutional investors seeking diversified exposure beyond traditional markets; this increased financial activity may spill over into higher demand for digital assets including NFTs.

Real-Time Bitcoin Payments: Block Inc.’s announcement at Bitcoin 2025 conference about enabling instant Bitcoin payments demonstrates growing mainstream acceptance of cryptocurrencies[2]. While not directly related to NFTs on Solana today—their integration signals broader trust in crypto infrastructure which benefits all sectors including digital collectibles.

Market Volatility & Regulatory Changes: The volatile nature of cryptocurrency markets impacts NFT valuations significantly; sudden price swings can affect both creators’ revenue streams and collectors’ investments. Additionally—with evolving regulations around ownership rights or tax implications—the future landscape remains uncertain but potentially more structured once clearer guidelines are established globally.

Challenges Facing the Growth of Solarina-Based NFT Platforms

Despite rapid growth potential driven by technological advantages:

Market Fluctuations: Price volatility remains one of the biggest challenges affecting liquidity levels across platforms.

Regulatory Environment: As governments worldwide scrutinize cryptocurrencies more closely—including aspects related specifically to digital assets—the regulatory landscape could impose restrictions that hinder innovation.

Competition from Other Blockchains: Ethereum still dominates many segments despite high fees; competing chains like Binance Smart Chain (BSC) or Polygon offer alternative options which might divert some users away from Solana-based solutions if they offer similar features at lower costs elsewhere.

How These Platforms Shape Digital Ownership & Collectibles Market

The popularity of these platforms underscores several key trends:

- Decentralized Community Engagement – Projects like DeGods foster active governance models where owners influence development decisions.

- Integration With Gaming & Virtual Worlds – Platforms such as Star Atlas demonstrate how gaming ecosystems leverage blockchain tech not just for ownership but also economic participation.

- Ease Of Use For Creators – Tools provided by SOL Mint simplify onboarding new artists into Web3 spaces without requiring deep technical knowledge.

- Innovative Financial Instruments – Fractionalization (Magic Eden) allows shared ownership; staking programs incentivize long-term holding among users seeking passive income streams.

Final Thoughts

As one of the fastest-growing sectors within blockchain technology today — especially supported by robust networks like Solano —NFT platforms continue transforming how we create value digitally—from art collectionsto immersive gaming worldsand beyond . Their success hinges upon technological innovation , community engagement ,and navigating regulatory landscapes effectively . Whether you’re an artist aimingto showcase your workor an investor exploring new opportunities,the current ecosystem offers numerous avenues worth exploring .

References

[1] Kraken launches 24/7 tokenized US equities trading on Solano.

[2] Block unveils real-time Bitcoin payments through Square.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Primary Functions of the U.S. SEC?

The U.S. Securities and Exchange Commission (SEC) is a cornerstone of the American financial regulatory landscape. Established to protect investors and ensure fair markets, the SEC plays a vital role in maintaining confidence in the securities industry. Understanding its core functions provides insight into how it influences financial markets, investor protection, and capital formation.

Regulation of Securities Markets

One of the SEC’s fundamental responsibilities is overseeing all aspects of securities trading within the United States. This includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other investment products. The agency sets rules for market participants—such as broker-dealers—and monitors trading activities to prevent manipulative practices like insider trading or pump-and-dump schemes.

Through registration requirements and ongoing disclosures by publicly traded companies, the SEC ensures transparency in securities markets. This transparency allows investors to make informed decisions based on accurate information about company performance, financial health, and risks involved.

Investor Protection

Protecting investors remains at the heart of the SEC’s mission. The agency enforces laws that require companies to disclose material information—such as quarterly earnings reports or significant corporate events—that could influence an investor’s decision-making process.

Additionally, through educational initiatives and enforcement actions against fraudulent actors or misleading practices, the SEC aims to create a safer environment for both individual retail investors and institutional stakeholders. Recent high-profile cases involving securities fraud highlight its commitment to holding violators accountable while fostering trust in capital markets.

Enforcement of Securities Laws

The SEC actively investigates violations of federal securities laws with an emphasis on deterring misconduct before it occurs through deterrence measures such as fines or sanctions after violations are identified. Its enforcement division pursues cases related to insider trading, accounting frauds, misrepresentations during public offerings (IPOs), or failure by companies to comply with disclosure obligations.

Enforcement actions not only penalize wrongdoers but also serve as deterrents across industries by signaling that illegal activities will face consequences—a critical component for maintaining market integrity.

Facilitating Capital Formation

Beyond regulation and enforcement lies another crucial function: facilitating capital formation for businesses seeking growth opportunities through public offerings or other means like private placements. The SEC establishes frameworks that enable companies—especially startups—to raise funds from public markets while adhering to legal standards designed to protect investors.

By streamlining processes such as initial public offerings (IPOs) registration procedures while ensuring adequate disclosure requirements are met, it helps balance access to capital with investor safety—a delicate equilibrium essential for economic development.

Recent Developments Impacting Its Role

In recent years—and notably in 2025—the SEC has been active amid evolving financial landscapes:

- Cryptocurrency Regulation: As digital assets gain popularity—including meme coins—the agency faces challenges regulating these new instruments without stifling innovation.

- New Investment Products: Delays in approving ETFs like Litecoin reflect cautious scrutiny aimed at preventing market manipulation.

- Market Movements & Industry Changes: High-profile filings such as Chime's IPO demonstrate ongoing efforts toward facilitating legitimate capital raising avenues despite regulatory hurdles.

- High-profile Enforcement Cases: Actions against firms involved in fraudulent schemes reinforce its commitment toward safeguarding market integrity.

These developments underscore how dynamic its functions are amidst technological advancements and shifting investment trends.

How Does It Affect Investors & Companies?

For individual investors—whether retail traders or institutional entities—the SEC's oversight offers reassurance that markets operate under rules designed for fairness and transparency. For companies seeking funding through public offerings or new investment vehicles like ETFs or cryptocurrencies—they must navigate strict compliance standards set forth by this regulator which can influence product approval timelines but ultimately aim at protecting all stakeholders involved.

Challenges Facing Modern Regulatory Functions

Despite its critical role, several challenges complicate effective regulation:

- Rapid technological innovations such as blockchain-based assets demand adaptive legal frameworks.

- Market volatility caused by geopolitical events can test existing regulations' robustness.

- Balancing innovation with risk mitigation requires continuous policy updates based on emerging trends.

These factors necessitate ongoing vigilance from regulators committed not only to enforcing current laws but also proactively shaping future policies aligned with evolving market realities.

How Does The U.S. SEC Maintain Market Integrity?

Maintaining trust within financial markets involves multiple strategies—from rigorous enforcement actions targeting misconduct; transparent disclosure requirements; proactive engagement with industry stakeholders; adapting regulations around emerging sectors like cryptocurrencies; upholding fair trading practices; ensuring compliance among issuers; conducting thorough investigations into suspicious activities—all contribute towards preserving confidence among investors worldwide.

Final Thoughts: The Evolving Role Of The U.S. Securities And Exchange Commission

As global economies become increasingly interconnected—with innovations such as digital currencies transforming traditional finance—the role of the U.S.-based regulator remains more vital than ever before. Its primary functions encompass overseeing securities transactions responsibly while fostering an environment conducive for economic growth through efficient capital formation mechanisms—all underpinned by robust enforcement measures designed explicitly for safeguarding investor interests.

Understanding these core responsibilities highlights why strong regulatory oversight is essential—not just for protecting individual investments but also ensuring overall stability within America’s dynamic financial system.

Keywords: U.S., Securities Exchange Commission (SEC), regulation of securities markets , investor protection , securities laws enforcement , facilitating capital formation , cryptocurrency regulation , IPO process , ETF approval process

JCUSER-IC8sJL1q

2025-05-29 09:36

What are the primary functions of the U.S. SEC?

What Are the Primary Functions of the U.S. SEC?

The U.S. Securities and Exchange Commission (SEC) is a cornerstone of the American financial regulatory landscape. Established to protect investors and ensure fair markets, the SEC plays a vital role in maintaining confidence in the securities industry. Understanding its core functions provides insight into how it influences financial markets, investor protection, and capital formation.

Regulation of Securities Markets

One of the SEC’s fundamental responsibilities is overseeing all aspects of securities trading within the United States. This includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other investment products. The agency sets rules for market participants—such as broker-dealers—and monitors trading activities to prevent manipulative practices like insider trading or pump-and-dump schemes.

Through registration requirements and ongoing disclosures by publicly traded companies, the SEC ensures transparency in securities markets. This transparency allows investors to make informed decisions based on accurate information about company performance, financial health, and risks involved.

Investor Protection

Protecting investors remains at the heart of the SEC’s mission. The agency enforces laws that require companies to disclose material information—such as quarterly earnings reports or significant corporate events—that could influence an investor’s decision-making process.

Additionally, through educational initiatives and enforcement actions against fraudulent actors or misleading practices, the SEC aims to create a safer environment for both individual retail investors and institutional stakeholders. Recent high-profile cases involving securities fraud highlight its commitment to holding violators accountable while fostering trust in capital markets.

Enforcement of Securities Laws

The SEC actively investigates violations of federal securities laws with an emphasis on deterring misconduct before it occurs through deterrence measures such as fines or sanctions after violations are identified. Its enforcement division pursues cases related to insider trading, accounting frauds, misrepresentations during public offerings (IPOs), or failure by companies to comply with disclosure obligations.

Enforcement actions not only penalize wrongdoers but also serve as deterrents across industries by signaling that illegal activities will face consequences—a critical component for maintaining market integrity.

Facilitating Capital Formation

Beyond regulation and enforcement lies another crucial function: facilitating capital formation for businesses seeking growth opportunities through public offerings or other means like private placements. The SEC establishes frameworks that enable companies—especially startups—to raise funds from public markets while adhering to legal standards designed to protect investors.

By streamlining processes such as initial public offerings (IPOs) registration procedures while ensuring adequate disclosure requirements are met, it helps balance access to capital with investor safety—a delicate equilibrium essential for economic development.

Recent Developments Impacting Its Role

In recent years—and notably in 2025—the SEC has been active amid evolving financial landscapes:

- Cryptocurrency Regulation: As digital assets gain popularity—including meme coins—the agency faces challenges regulating these new instruments without stifling innovation.

- New Investment Products: Delays in approving ETFs like Litecoin reflect cautious scrutiny aimed at preventing market manipulation.

- Market Movements & Industry Changes: High-profile filings such as Chime's IPO demonstrate ongoing efforts toward facilitating legitimate capital raising avenues despite regulatory hurdles.

- High-profile Enforcement Cases: Actions against firms involved in fraudulent schemes reinforce its commitment toward safeguarding market integrity.

These developments underscore how dynamic its functions are amidst technological advancements and shifting investment trends.

How Does It Affect Investors & Companies?

For individual investors—whether retail traders or institutional entities—the SEC's oversight offers reassurance that markets operate under rules designed for fairness and transparency. For companies seeking funding through public offerings or new investment vehicles like ETFs or cryptocurrencies—they must navigate strict compliance standards set forth by this regulator which can influence product approval timelines but ultimately aim at protecting all stakeholders involved.

Challenges Facing Modern Regulatory Functions

Despite its critical role, several challenges complicate effective regulation:

- Rapid technological innovations such as blockchain-based assets demand adaptive legal frameworks.

- Market volatility caused by geopolitical events can test existing regulations' robustness.

- Balancing innovation with risk mitigation requires continuous policy updates based on emerging trends.

These factors necessitate ongoing vigilance from regulators committed not only to enforcing current laws but also proactively shaping future policies aligned with evolving market realities.

How Does The U.S. SEC Maintain Market Integrity?

Maintaining trust within financial markets involves multiple strategies—from rigorous enforcement actions targeting misconduct; transparent disclosure requirements; proactive engagement with industry stakeholders; adapting regulations around emerging sectors like cryptocurrencies; upholding fair trading practices; ensuring compliance among issuers; conducting thorough investigations into suspicious activities—all contribute towards preserving confidence among investors worldwide.

Final Thoughts: The Evolving Role Of The U.S. Securities And Exchange Commission

As global economies become increasingly interconnected—with innovations such as digital currencies transforming traditional finance—the role of the U.S.-based regulator remains more vital than ever before. Its primary functions encompass overseeing securities transactions responsibly while fostering an environment conducive for economic growth through efficient capital formation mechanisms—all underpinned by robust enforcement measures designed explicitly for safeguarding investor interests.

Understanding these core responsibilities highlights why strong regulatory oversight is essential—not just for protecting individual investments but also ensuring overall stability within America’s dynamic financial system.

Keywords: U.S., Securities Exchange Commission (SEC), regulation of securities markets , investor protection , securities laws enforcement , facilitating capital formation , cryptocurrency regulation , IPO process , ETF approval process

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Benefits of Using a Liquidity Pool?

Liquidity pools are transforming the landscape of decentralized finance (DeFi) by offering a new way to facilitate cryptocurrency trading. As DeFi platforms continue to grow in popularity, understanding the advantages of liquidity pools becomes essential for both investors and traders. This article explores the key benefits, backed by current trends and technological insights, providing a comprehensive overview aligned with user intent.

Enhancing Market Efficiency Through Liquidity Pools

One of the primary benefits of liquidity pools is their ability to improve market efficiency. Traditional exchanges rely on order books where buyers and sellers place individual orders, which can lead to wider spreads—the difference between bid and ask prices. In contrast, liquidity pools aggregate assets from multiple users into a single pool that powers decentralized exchanges like Uniswap or SushiSwap.

This pooling mechanism reduces bid-ask spreads significantly because trades are executed against the pooled assets rather than matching individual orders. As a result, traders benefit from more competitive prices and faster execution times. For users seeking quick transactions at fair market rates, this efficiency is crucial—especially in volatile markets where price discrepancies can be costly.

Increasing Trading Volume and Market Stability

Liquidity pools enable higher trading volumes by providing ample capital for executing large trades without causing significant price slippage. When there’s sufficient liquidity within these pools, it becomes easier for traders to buy or sell sizable amounts without impacting asset prices drastically.

This increased capacity supports overall market stability by preventing sudden price swings caused by low liquidity—a common issue on traditional exchanges during high volatility periods. For DeFi platforms aiming for sustainable growth, maintaining robust liquidity is vital; it encourages more participants to trade confidently knowing they can execute transactions smoothly.

Reducing Slippage During Transactions

Slippage occurs when there’s a difference between expected transaction prices and actual execution prices—often due to insufficient liquidity or rapid market movements. High slippage can erode profits or increase costs for traders executing large orders.

Liquidity pools mitigate this problem effectively because they always hold enough assets to accommodate trades promptly. By ensuring continuous availability of funds within these pools, users experience less price deviation during trade execution—even in fast-moving markets—making trading more predictable and less risky.

Opportunities for Liquidity Providers: Earning Fees

Another compelling advantage involves incentives for those who contribute assets to these pools—liquidity providers (LPs). When users deposit tokens into a pool, they earn fees generated from each trade that occurs within that pool. These fees are typically distributed proportionally based on each provider's contribution size.

For many LPs, this creates an attractive passive income stream while supporting platform operations. The potential returns depend on trading activity levels; higher volume generally translates into higher earnings for providers—a win-win scenario fostering ecosystem growth through community participation.

Transparency and Decentralization via Blockchain Technology

The core strength of liquidity pools lies in their foundation on blockchain technology—which guarantees transparency and decentralization. All transactions involving deposits or withdrawals are recorded immutably on public ledgers accessible worldwide.

This openness ensures that no central authority controls fund movements or fee distributions; instead, smart contracts automate processes securely without human intervention once deployed correctly. Such transparency builds trust among participants who want assurance their assets are managed fairly—and aligns with broader principles underpinning blockchain innovation: security through decentralization combined with open access data records.

Diversification Risks Managed Through Asset Pooling

Pooling various cryptocurrencies helps diversify risk—a critical consideration amid volatile markets typical in crypto ecosystems today. Instead of holding one asset susceptible to sharp declines (e.g., Bitcoin drops), LPs benefit from exposure across multiple tokens stored within the same pool.

Diversification reduces vulnerability associated with single-asset holdings while enabling LPs—and even regular traders—to spread potential losses across different digital assets rather than risking everything on one coin's performance alone.

Recent Trends Amplifying Benefits

The rise of DeFi has accelerated adoption rates globally as platforms like Uniswap have demonstrated how effective automated market makers (AMMs) powered by liquidity pools can be compared with traditional centralized exchanges (CEXs). Moreover:

Stablecoins Integration: Incorporating stablecoins such as USDC or USDT into liquidity pools provides stability amid crypto volatility since these tokens maintain relatively constant values.

Platform Competition: The proliferation of DeFi protocols fosters innovation—offering better incentives like higher yields or lower fees—to attract more LPs.

Security Improvements: Developers continually enhance smart contract security measures following past exploits; however, vulnerabilities still pose risks requiring ongoing vigilance.

Challenges That Could Impact Future Growth

Despite numerous advantages, several challenges could hinder long-term sustainability:

Regulatory Environment: Governments worldwide scrutinize DeFi activities increasingly closely; unclear regulations might impose restrictions affecting platform operations.

Smart Contract Risks: Vulnerabilities remain inherent risks due to coding errors or malicious exploits leading potentially to significant financial losses.

Market Volatility: Sudden downturns may devalue pooled assets rapidly—impacting both LP returns and overall platform stability.

User Education Needs: Complex mechanisms require adequate user education; lack thereof could lead newcomers making costly mistakes.

Final Thoughts: Navigating Benefits Amid Challenges

Liquidity pools have revolutionized decentralized trading by offering improved efficiency, increased volume capacity, reduced slippage risks—and opportunities for passive income through fee sharing—all underpinned by transparent blockchain technology facilitating risk diversification across multiple digital assets.

However—as adoption accelerates—the ecosystem must address regulatory uncertainties alongside technical vulnerabilities such as smart contract security issues while educating new users about best practices in DeFi participation.. Doing so will ensure sustained growth rooted in trustworthiness & resilience within this innovative financial frontier.

Keywords: Liquidity Pools Benefits | Decentralized Finance | Crypto Trading Efficiency | Yield Farming | Smart Contract Security | Stablecoins Integration

JCUSER-F1IIaxXA

2025-05-29 07:47

What are the benefits of using a liquidity pool?

What Are the Benefits of Using a Liquidity Pool?

Liquidity pools are transforming the landscape of decentralized finance (DeFi) by offering a new way to facilitate cryptocurrency trading. As DeFi platforms continue to grow in popularity, understanding the advantages of liquidity pools becomes essential for both investors and traders. This article explores the key benefits, backed by current trends and technological insights, providing a comprehensive overview aligned with user intent.

Enhancing Market Efficiency Through Liquidity Pools

One of the primary benefits of liquidity pools is their ability to improve market efficiency. Traditional exchanges rely on order books where buyers and sellers place individual orders, which can lead to wider spreads—the difference between bid and ask prices. In contrast, liquidity pools aggregate assets from multiple users into a single pool that powers decentralized exchanges like Uniswap or SushiSwap.

This pooling mechanism reduces bid-ask spreads significantly because trades are executed against the pooled assets rather than matching individual orders. As a result, traders benefit from more competitive prices and faster execution times. For users seeking quick transactions at fair market rates, this efficiency is crucial—especially in volatile markets where price discrepancies can be costly.

Increasing Trading Volume and Market Stability

Liquidity pools enable higher trading volumes by providing ample capital for executing large trades without causing significant price slippage. When there’s sufficient liquidity within these pools, it becomes easier for traders to buy or sell sizable amounts without impacting asset prices drastically.

This increased capacity supports overall market stability by preventing sudden price swings caused by low liquidity—a common issue on traditional exchanges during high volatility periods. For DeFi platforms aiming for sustainable growth, maintaining robust liquidity is vital; it encourages more participants to trade confidently knowing they can execute transactions smoothly.

Reducing Slippage During Transactions

Slippage occurs when there’s a difference between expected transaction prices and actual execution prices—often due to insufficient liquidity or rapid market movements. High slippage can erode profits or increase costs for traders executing large orders.

Liquidity pools mitigate this problem effectively because they always hold enough assets to accommodate trades promptly. By ensuring continuous availability of funds within these pools, users experience less price deviation during trade execution—even in fast-moving markets—making trading more predictable and less risky.

Opportunities for Liquidity Providers: Earning Fees

Another compelling advantage involves incentives for those who contribute assets to these pools—liquidity providers (LPs). When users deposit tokens into a pool, they earn fees generated from each trade that occurs within that pool. These fees are typically distributed proportionally based on each provider's contribution size.

For many LPs, this creates an attractive passive income stream while supporting platform operations. The potential returns depend on trading activity levels; higher volume generally translates into higher earnings for providers—a win-win scenario fostering ecosystem growth through community participation.

Transparency and Decentralization via Blockchain Technology

The core strength of liquidity pools lies in their foundation on blockchain technology—which guarantees transparency and decentralization. All transactions involving deposits or withdrawals are recorded immutably on public ledgers accessible worldwide.

This openness ensures that no central authority controls fund movements or fee distributions; instead, smart contracts automate processes securely without human intervention once deployed correctly. Such transparency builds trust among participants who want assurance their assets are managed fairly—and aligns with broader principles underpinning blockchain innovation: security through decentralization combined with open access data records.

Diversification Risks Managed Through Asset Pooling

Pooling various cryptocurrencies helps diversify risk—a critical consideration amid volatile markets typical in crypto ecosystems today. Instead of holding one asset susceptible to sharp declines (e.g., Bitcoin drops), LPs benefit from exposure across multiple tokens stored within the same pool.

Diversification reduces vulnerability associated with single-asset holdings while enabling LPs—and even regular traders—to spread potential losses across different digital assets rather than risking everything on one coin's performance alone.

Recent Trends Amplifying Benefits

The rise of DeFi has accelerated adoption rates globally as platforms like Uniswap have demonstrated how effective automated market makers (AMMs) powered by liquidity pools can be compared with traditional centralized exchanges (CEXs). Moreover:

Stablecoins Integration: Incorporating stablecoins such as USDC or USDT into liquidity pools provides stability amid crypto volatility since these tokens maintain relatively constant values.

Platform Competition: The proliferation of DeFi protocols fosters innovation—offering better incentives like higher yields or lower fees—to attract more LPs.

Security Improvements: Developers continually enhance smart contract security measures following past exploits; however, vulnerabilities still pose risks requiring ongoing vigilance.

Challenges That Could Impact Future Growth

Despite numerous advantages, several challenges could hinder long-term sustainability:

Regulatory Environment: Governments worldwide scrutinize DeFi activities increasingly closely; unclear regulations might impose restrictions affecting platform operations.

Smart Contract Risks: Vulnerabilities remain inherent risks due to coding errors or malicious exploits leading potentially to significant financial losses.

Market Volatility: Sudden downturns may devalue pooled assets rapidly—impacting both LP returns and overall platform stability.

User Education Needs: Complex mechanisms require adequate user education; lack thereof could lead newcomers making costly mistakes.

Final Thoughts: Navigating Benefits Amid Challenges

Liquidity pools have revolutionized decentralized trading by offering improved efficiency, increased volume capacity, reduced slippage risks—and opportunities for passive income through fee sharing—all underpinned by transparent blockchain technology facilitating risk diversification across multiple digital assets.

However—as adoption accelerates—the ecosystem must address regulatory uncertainties alongside technical vulnerabilities such as smart contract security issues while educating new users about best practices in DeFi participation.. Doing so will ensure sustained growth rooted in trustworthiness & resilience within this innovative financial frontier.

Keywords: Liquidity Pools Benefits | Decentralized Finance | Crypto Trading Efficiency | Yield Farming | Smart Contract Security | Stablecoins Integration

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Buy HAWK Tokens: A Step-by-Step Guide

Understanding how to purchase HAWK tokens is essential for investors interested in the growing DeFi ecosystem built on blockchain technology. As a native asset of the HAWK platform, these tokens enable users to access decentralized financial services such as lending, borrowing, and trading digital assets. This guide provides a comprehensive overview of the process, ensuring you can confidently acquire HAWK tokens while understanding their role within the broader crypto landscape.

What Are HAWK Tokens and Why Are They Valuable?

Before diving into how to buy HAWK tokens, it’s important to understand what they are and why they matter. HAWK tokens serve as the primary currency within their ecosystem, facilitating transactions like lending and borrowing on a decentralized platform that leverages smart contracts for automation. Their value is driven by factors such as tokenomics models—designed with supply management mechanisms—and their utility in various DeFi applications.

The token's integration into blockchain technology ensures transparency and security through immutable transaction records. Additionally, partnerships with prominent blockchain firms have bolstered its credibility, making it an attractive option for both individual investors and institutional players seeking secure financial solutions outside traditional banking systems.

Where Can You Buy HAWK Tokens?

The first step in acquiring HAWK tokens is identifying suitable platforms where they are listed. As of May 2025, several major cryptocurrency exchanges have included HAWK trading pairs due to increased demand following recent listings.

Popular exchanges offering access to HAWK include:

- Binance: One of the largest global crypto exchanges with high liquidity.

- Coinbase Pro: Known for regulatory compliance and user-friendly interface.

- KuCoin: Offers diverse altcoin options including newer projects like HAWK.

- Decentralized Exchanges (DEXs): Platforms like Uniswap or PancakeSwap may list wrapped or paired versions depending on network compatibility.

Always verify that your chosen exchange supports direct trading pairs involving fiat currencies or stablecoins against which you can trade for other cryptocurrencies before converting into HAWK.

How To Purchase HAWK Tokens Step-by-Step

1. Set Up a Secure Cryptocurrency Wallet

To buy and store your HAWK tokens securely, you'll need a compatible digital wallet. Depending on whether you're using centralized exchanges or DEXs:

- For centralized platforms (like Binance), create an account directly on their website.

- For DEXs (like Uniswap), set up a non-custodial wallet such as MetaMask or Trust Wallet that supports Ethereum-based assets if applicable.

Ensure your wallet has sufficient funds in supported cryptocurrencies—typically USDT (Tether), ETH (Ethereum), or BNB (Binance Coin)—to facilitate trades.

2. Register & Verify Your Exchange Account

Most reputable exchanges require identity verification under KYC regulations:

- Complete registration by providing personal details.

- Upload identification documents if necessary.

This process enhances security and allows higher withdrawal limits but may take some time depending on platform procedures.