📅 July 31 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-07-31 06:30

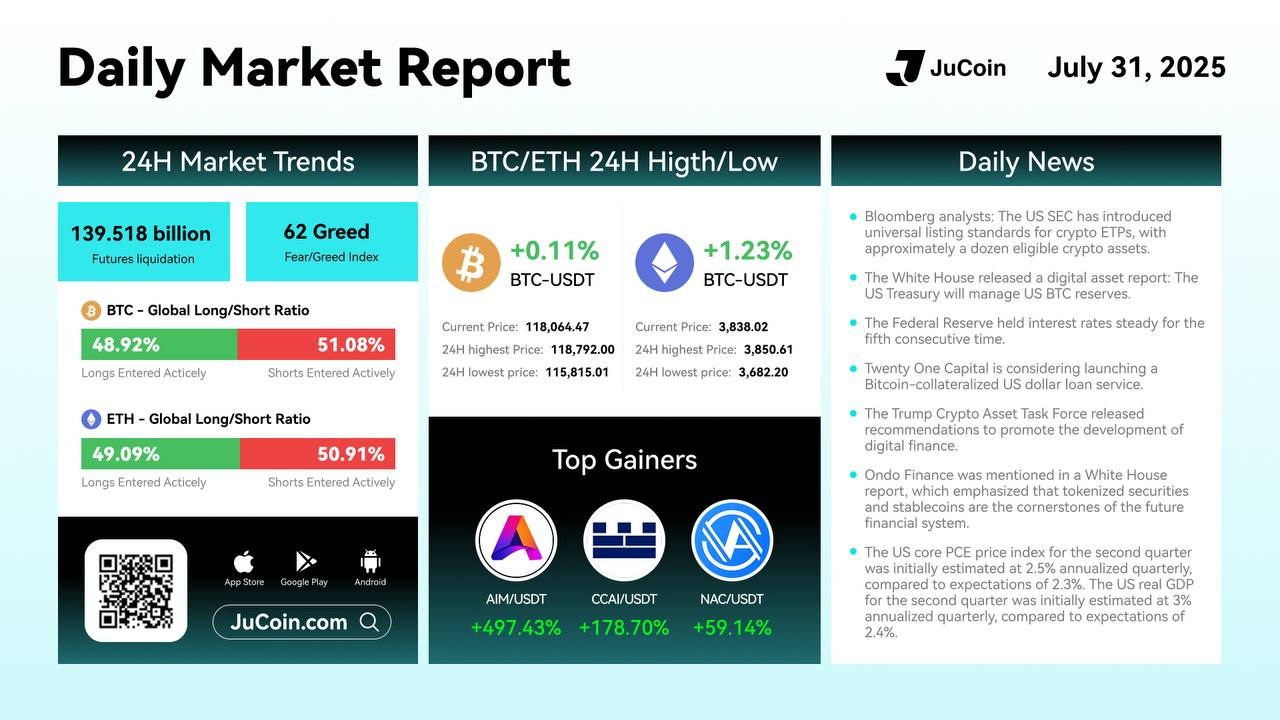

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👉 Trade Now: https://bit.ly/4eDheON

JuCoin Community

2025-07-31 06:28

$JU successfully reached 12 USDT, setting a new record high! The price rose 120x since its listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is a Market Order? A Complete Guide for Traders and Investors

Understanding Market Orders in Financial Trading

A market order is one of the most fundamental types of orders used in financial markets, including stock exchanges, cryptocurrency platforms, and other trading venues. It represents an instruction to buy or sell a security immediately at the best available current price. Because of its simplicity and speed, it is favored by many traders—especially those who prioritize quick execution over price certainty.

Market orders are distinct from other order types like limit or stop orders because they do not specify a particular price point. Instead, they focus on ensuring that the trade happens as swiftly as possible at whatever price the market offers at that moment. This makes them particularly useful during high-liquidity periods when prices tend to be stable enough for rapid transactions.

How Do Market Orders Work?

When you place a market order, your broker or trading platform executes it instantly by matching it with existing buy or sell orders in the market. The primary goal is immediate execution rather than obtaining an exact entry or exit point. As soon as your order reaches the exchange’s order book, it gets filled at the best available price—often within seconds.

However, because markets are dynamic and prices fluctuate rapidly—especially during volatile periods—the actual transaction price may differ slightly from what you expected when placing your order. This phenomenon is known as slippage and can sometimes lead to less favorable trade outcomes if not managed carefully.

Advantages of Using Market Orders

- Speed: They guarantee quick execution which is critical during fast-moving markets.

- Simplicity: Easy to understand and execute without setting specific parameters.

- Liquidity Dependence: Ideal in highly liquid markets where large volumes can be traded without significant impact on prices.

- Ideal for Immediate Entry/Exit: Suitable for day traders or investors responding to sudden market movements who need rapid action.

Risks Associated with Market Orders

While market orders offer speed and simplicity, they come with inherent risks that traders should consider:

- Price Uncertainty: Since these orders execute at current market prices—which can change rapidly—the final transaction might occur at a different (often worse) price than anticipated.

- Slippage: During volatile conditions or low liquidity scenarios, slippage can cause significant deviations between expected and actual execution prices.

- Market Volatility Impact: In highly volatile environments such as cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), rapid swings can lead to unexpected costs when executing large trades via market orders.

- Liquidity Constraints: In thinly traded assets or less liquid markets, there may be delays in execution or partial fills if sufficient volume isn't available immediately.

Market Orders in Cryptocurrency Trading

Cryptocurrency markets exemplify both the utility and risks associated with market orders due to their high volatility levels. Traders often rely on them when swift action is necessary—for example, capturing gains during sudden upward moves—or when entering positions quickly before prices shift dramatically.

However, given cryptocurrencies' unpredictable nature—with frequent sharp swings—using market orders requires caution; traders must be prepared for potential slippage that could significantly affect profitability.

Regulatory Environment & Technological Advances

Recent regulatory changes across various jurisdictions influence how exchanges handle order executions—including those involving market orders—to promote fair trading practices while preventing manipulative behaviors like quote stuffing or flash crashes.

Furthermore—and increasingly important—is technological progress through electronic trading platforms which have streamlined how quickly trades are executed globally. These advancements have reduced latency issues but also emphasize understanding underlying risks such as slippage under different conditions.

Best Practices When Using Market Orders

To maximize benefits while minimizing drawbacks:

- Use them primarily in highly liquid assets where bid-ask spreads are narrow.

- Avoid placing large-market orders during periods of extreme volatility unless necessary.

- Combine with stop-loss strategies to manage downside risk effectively.

- Monitor real-time data closely so you’re aware of potential rapid shifts affecting your trade's outcome.

In summary,

Market orders serve as essential tools within any trader’s arsenal due to their immediacy and straightforwardness but require careful application considering their inherent uncertainties amid fluctuating markets.

Semantic Keywords & Related Terms:Order types | Liquidity | Slippage | Bid-ask spread | High-frequency trading | Cryptocurrency volatility | Trade execution speed | Limit vs.market order | Electronic trading platforms

By understanding how these elements interact within modern financial ecosystems—from traditional stock exchanges to digital crypto marketplaces—traders can better navigate complex environments while safeguarding their investments against unforeseen risks associated with rapid trade executions.

References:

JCUSER-F1IIaxXA

2025-05-29 08:17

What is a market order?

What Is a Market Order? A Complete Guide for Traders and Investors

Understanding Market Orders in Financial Trading

A market order is one of the most fundamental types of orders used in financial markets, including stock exchanges, cryptocurrency platforms, and other trading venues. It represents an instruction to buy or sell a security immediately at the best available current price. Because of its simplicity and speed, it is favored by many traders—especially those who prioritize quick execution over price certainty.

Market orders are distinct from other order types like limit or stop orders because they do not specify a particular price point. Instead, they focus on ensuring that the trade happens as swiftly as possible at whatever price the market offers at that moment. This makes them particularly useful during high-liquidity periods when prices tend to be stable enough for rapid transactions.

How Do Market Orders Work?

When you place a market order, your broker or trading platform executes it instantly by matching it with existing buy or sell orders in the market. The primary goal is immediate execution rather than obtaining an exact entry or exit point. As soon as your order reaches the exchange’s order book, it gets filled at the best available price—often within seconds.

However, because markets are dynamic and prices fluctuate rapidly—especially during volatile periods—the actual transaction price may differ slightly from what you expected when placing your order. This phenomenon is known as slippage and can sometimes lead to less favorable trade outcomes if not managed carefully.

Advantages of Using Market Orders

- Speed: They guarantee quick execution which is critical during fast-moving markets.

- Simplicity: Easy to understand and execute without setting specific parameters.

- Liquidity Dependence: Ideal in highly liquid markets where large volumes can be traded without significant impact on prices.

- Ideal for Immediate Entry/Exit: Suitable for day traders or investors responding to sudden market movements who need rapid action.

Risks Associated with Market Orders

While market orders offer speed and simplicity, they come with inherent risks that traders should consider:

- Price Uncertainty: Since these orders execute at current market prices—which can change rapidly—the final transaction might occur at a different (often worse) price than anticipated.

- Slippage: During volatile conditions or low liquidity scenarios, slippage can cause significant deviations between expected and actual execution prices.

- Market Volatility Impact: In highly volatile environments such as cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), rapid swings can lead to unexpected costs when executing large trades via market orders.

- Liquidity Constraints: In thinly traded assets or less liquid markets, there may be delays in execution or partial fills if sufficient volume isn't available immediately.

Market Orders in Cryptocurrency Trading

Cryptocurrency markets exemplify both the utility and risks associated with market orders due to their high volatility levels. Traders often rely on them when swift action is necessary—for example, capturing gains during sudden upward moves—or when entering positions quickly before prices shift dramatically.

However, given cryptocurrencies' unpredictable nature—with frequent sharp swings—using market orders requires caution; traders must be prepared for potential slippage that could significantly affect profitability.

Regulatory Environment & Technological Advances

Recent regulatory changes across various jurisdictions influence how exchanges handle order executions—including those involving market orders—to promote fair trading practices while preventing manipulative behaviors like quote stuffing or flash crashes.

Furthermore—and increasingly important—is technological progress through electronic trading platforms which have streamlined how quickly trades are executed globally. These advancements have reduced latency issues but also emphasize understanding underlying risks such as slippage under different conditions.

Best Practices When Using Market Orders

To maximize benefits while minimizing drawbacks:

- Use them primarily in highly liquid assets where bid-ask spreads are narrow.

- Avoid placing large-market orders during periods of extreme volatility unless necessary.

- Combine with stop-loss strategies to manage downside risk effectively.

- Monitor real-time data closely so you’re aware of potential rapid shifts affecting your trade's outcome.

In summary,

Market orders serve as essential tools within any trader’s arsenal due to their immediacy and straightforwardness but require careful application considering their inherent uncertainties amid fluctuating markets.

Semantic Keywords & Related Terms:Order types | Liquidity | Slippage | Bid-ask spread | High-frequency trading | Cryptocurrency volatility | Trade execution speed | Limit vs.market order | Electronic trading platforms

By understanding how these elements interact within modern financial ecosystems—from traditional stock exchanges to digital crypto marketplaces—traders can better navigate complex environments while safeguarding their investments against unforeseen risks associated with rapid trade executions.

References:

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are Wave 3 Patterns in Trading?

Understanding Wave 3 patterns is essential for traders and investors who rely on technical analysis to forecast market movements. These patterns are rooted in Elliott Wave Theory (EWT), a well-established framework that describes how markets tend to move in repetitive, recognizable waves. Recognizing Wave 3 patterns can provide valuable insights into potential trend continuations and reversals, making them a vital component of strategic trading.

The Basics of Elliott Wave Theory

Elliott Wave Theory was developed by Ralph Nelson Elliott in the 1930s. It suggests that financial markets move in predictable cycles composed of five waves during trending phases, followed by three corrective waves. This pattern repeats across different timeframes and asset classes, from stocks and commodities to cryptocurrencies.

The five-wave sequence includes impulsive waves (1, 3, 5) that move with the trend and corrective waves (2, 4) that temporarily oppose it. Among these, the third wave is often considered the most significant due to its strength and length.

Characteristics of Wave 3 Patterns

Wave 3 is typically the longest and most powerful impulse wave within a five-wave cycle. It usually surpasses the magnitude of Wave 1 significantly—sometimes by a considerable margin—indicating strong market momentum. Traders often look for this pattern because it signals robust participation from buyers or sellers depending on whether it's an uptrend or downtrend.

In terms of structure, Wave 3 often exhibits rapid price movement with high volume activity. Its impulsive nature means it tends to be less prone to false signals compared to other waves; however, accurate identification remains crucial for effective trading decisions.

Sub-Waves Within Wave 3

Wave 3 can be subdivided into smaller segments called sub-waves labeled as 'a,' 'b,' and 'c.' These subdivisions help traders analyze shorter-term price actions within the broader wave pattern:

- a: Initial movement confirming continuation.

- b: A brief retracement or consolidation.

- c: The final push completing the wave before transitioning into correction or next phase.

Recognizing these sub-waves enhances precision when timing entries or exits based on wave analysis.

Why Is Identifying Wave 3 Important?

Spotting an emerging or ongoing Wave 3 provides traders with opportunities for substantial gains due to its impulsive nature. Since this wave reflects strong market conviction—either bullish or bearish—it offers clues about future price directions once completed.

Furthermore, understanding where you are within a five-wave sequence helps avoid premature trades based on incomplete patterns. For example:

- Entering too early during Waves 1 or before confirmation of Waves' progression might lead to false signals.

- Waiting until after Waves' completion ensures better risk management but requires patience as markets develop their full pattern.

Modern Developments Enhancing Pattern Recognition

While Elliott's original concepts remain foundational, recent technological advances have improved how traders identify these patterns today:

AI-Powered Analysis Tools

Artificial intelligence algorithms now analyze vast datasets rapidly—detecting subtle nuances in price action indicative of specific wave structures like Wave 3. These tools reduce human error associated with subjective interpretation while increasing prediction accuracy[1].

Application in Cryptocurrency Markets

The high volatility characteristic of cryptocurrencies makes traditional technical analysis challenging but also more rewarding when correctly applied. Traders leverage EWT-based strategies—including recognizing prominent Wave 3 formations—to capitalize on rapid moves typical within digital assets’ volatile environment.

Integration With Broader Strategies

Wave analysis isn't used alone; it's combined with other technical indicators such as Fibonacci retracements or volume profiles for more comprehensive decision-making frameworks suited for modern portfolio management strategies across diverse asset classes[2].

Limitations And Risks Of Relying On Pattern Recognition

Despite its strengths, Elliott’s approach has limitations worth noting:

Over-analysis: Complex wave structures may tempt traders into overthinking minor fluctuations rather than focusing on clear trends.

False Signals: Misidentification can lead traders astray—mistaking corrective phases for impulsive ones—or vice versa.

Market Volatility: Sudden news events can disrupt expected patterns altogether rendering some predictions invalid temporarily or permanently until new structures form again[3].

Therefore, prudent risk management—including stop-loss orders—and combining multiple analytical methods are recommended when trading based on Elliot’s wave principles.

How To Use Wave Patterns Effectively In Trading?

To maximize benefits from recognizing WAVE III formations:

- Confirm initial signs through multiple indicators such as volume spikes alongside price acceleration.

- Use Fibonacci levels aligned with anticipated targets derived from prior impulses.

- Monitor sub-waves closely; their development offers clues about potential trend exhaustion points.

- Be prepared for sudden reversals caused by external factors disrupting established patterns.

Final Thoughts: Navigating Market Trends With Confidence

Wave III plays a pivotal role within Elliott's framework due to its impulsiveness and strength during trending periods—a feature highly valued by technical analysts seeking reliable entry points amid volatile markets like cryptocurrencies today.[4] While modern tools enhance detection accuracy considerably compared to manual chart reading alone—the core principles remain relevant across all asset types.[5]

By understanding what constitutes a typical WAVE III pattern—and integrating this knowledge thoughtfully into broader trading strategies—you position yourself better equipped not only to identify lucrative opportunities but also manage risks effectively amidst unpredictable market conditions.

References

[1] Smith J., "AI Applications in Technical Analysis," Journal of Financial Technology Review (2022).

[2] Lee K., "Combining Fibonacci Retracements With Elliot Waves," Market Analysis Quarterly (2021).

[3] Patel R., "Limitations Of Elliot’s Theory In High Volatility Markets," Financial Analyst Journal (2020).

[4] Chen L., "Cryptocurrency Trading Using Elliott Waves," Crypto Market Insights (2022).

[5] Davis M., "Modern Adaptations Of Classic Technical Analysis," Trading Strategies Magazine (2020).

Note: Always combine multiple analytical approaches along with sound risk management practices when applying any technical theory like WAVE III recognition techniques.*

kai

2025-05-29 06:59

What are Wave 3 patterns in trading?

What Are Wave 3 Patterns in Trading?

Understanding Wave 3 patterns is essential for traders and investors who rely on technical analysis to forecast market movements. These patterns are rooted in Elliott Wave Theory (EWT), a well-established framework that describes how markets tend to move in repetitive, recognizable waves. Recognizing Wave 3 patterns can provide valuable insights into potential trend continuations and reversals, making them a vital component of strategic trading.

The Basics of Elliott Wave Theory

Elliott Wave Theory was developed by Ralph Nelson Elliott in the 1930s. It suggests that financial markets move in predictable cycles composed of five waves during trending phases, followed by three corrective waves. This pattern repeats across different timeframes and asset classes, from stocks and commodities to cryptocurrencies.

The five-wave sequence includes impulsive waves (1, 3, 5) that move with the trend and corrective waves (2, 4) that temporarily oppose it. Among these, the third wave is often considered the most significant due to its strength and length.

Characteristics of Wave 3 Patterns

Wave 3 is typically the longest and most powerful impulse wave within a five-wave cycle. It usually surpasses the magnitude of Wave 1 significantly—sometimes by a considerable margin—indicating strong market momentum. Traders often look for this pattern because it signals robust participation from buyers or sellers depending on whether it's an uptrend or downtrend.

In terms of structure, Wave 3 often exhibits rapid price movement with high volume activity. Its impulsive nature means it tends to be less prone to false signals compared to other waves; however, accurate identification remains crucial for effective trading decisions.

Sub-Waves Within Wave 3

Wave 3 can be subdivided into smaller segments called sub-waves labeled as 'a,' 'b,' and 'c.' These subdivisions help traders analyze shorter-term price actions within the broader wave pattern:

- a: Initial movement confirming continuation.

- b: A brief retracement or consolidation.

- c: The final push completing the wave before transitioning into correction or next phase.

Recognizing these sub-waves enhances precision when timing entries or exits based on wave analysis.

Why Is Identifying Wave 3 Important?

Spotting an emerging or ongoing Wave 3 provides traders with opportunities for substantial gains due to its impulsive nature. Since this wave reflects strong market conviction—either bullish or bearish—it offers clues about future price directions once completed.

Furthermore, understanding where you are within a five-wave sequence helps avoid premature trades based on incomplete patterns. For example:

- Entering too early during Waves 1 or before confirmation of Waves' progression might lead to false signals.

- Waiting until after Waves' completion ensures better risk management but requires patience as markets develop their full pattern.

Modern Developments Enhancing Pattern Recognition

While Elliott's original concepts remain foundational, recent technological advances have improved how traders identify these patterns today:

AI-Powered Analysis Tools

Artificial intelligence algorithms now analyze vast datasets rapidly—detecting subtle nuances in price action indicative of specific wave structures like Wave 3. These tools reduce human error associated with subjective interpretation while increasing prediction accuracy[1].

Application in Cryptocurrency Markets

The high volatility characteristic of cryptocurrencies makes traditional technical analysis challenging but also more rewarding when correctly applied. Traders leverage EWT-based strategies—including recognizing prominent Wave 3 formations—to capitalize on rapid moves typical within digital assets’ volatile environment.

Integration With Broader Strategies

Wave analysis isn't used alone; it's combined with other technical indicators such as Fibonacci retracements or volume profiles for more comprehensive decision-making frameworks suited for modern portfolio management strategies across diverse asset classes[2].

Limitations And Risks Of Relying On Pattern Recognition

Despite its strengths, Elliott’s approach has limitations worth noting:

Over-analysis: Complex wave structures may tempt traders into overthinking minor fluctuations rather than focusing on clear trends.

False Signals: Misidentification can lead traders astray—mistaking corrective phases for impulsive ones—or vice versa.

Market Volatility: Sudden news events can disrupt expected patterns altogether rendering some predictions invalid temporarily or permanently until new structures form again[3].

Therefore, prudent risk management—including stop-loss orders—and combining multiple analytical methods are recommended when trading based on Elliot’s wave principles.

How To Use Wave Patterns Effectively In Trading?

To maximize benefits from recognizing WAVE III formations:

- Confirm initial signs through multiple indicators such as volume spikes alongside price acceleration.

- Use Fibonacci levels aligned with anticipated targets derived from prior impulses.

- Monitor sub-waves closely; their development offers clues about potential trend exhaustion points.

- Be prepared for sudden reversals caused by external factors disrupting established patterns.

Final Thoughts: Navigating Market Trends With Confidence

Wave III plays a pivotal role within Elliott's framework due to its impulsiveness and strength during trending periods—a feature highly valued by technical analysts seeking reliable entry points amid volatile markets like cryptocurrencies today.[4] While modern tools enhance detection accuracy considerably compared to manual chart reading alone—the core principles remain relevant across all asset types.[5]

By understanding what constitutes a typical WAVE III pattern—and integrating this knowledge thoughtfully into broader trading strategies—you position yourself better equipped not only to identify lucrative opportunities but also manage risks effectively amidst unpredictable market conditions.

References

[1] Smith J., "AI Applications in Technical Analysis," Journal of Financial Technology Review (2022).

[2] Lee K., "Combining Fibonacci Retracements With Elliot Waves," Market Analysis Quarterly (2021).

[3] Patel R., "Limitations Of Elliot’s Theory In High Volatility Markets," Financial Analyst Journal (2020).

[4] Chen L., "Cryptocurrency Trading Using Elliott Waves," Crypto Market Insights (2022).

[5] Davis M., "Modern Adaptations Of Classic Technical Analysis," Trading Strategies Magazine (2020).

Note: Always combine multiple analytical approaches along with sound risk management practices when applying any technical theory like WAVE III recognition techniques.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Time Frames Do Market Orders Operate Within?

Understanding the time frames within which market orders operate is crucial for traders and investors aiming to optimize their trading strategies. Market orders are designed to execute quickly, but the actual timing can vary depending on several factors, including market conditions, asset class, and trading platforms. This article explores the typical time frames associated with market orders, their implications for trading decisions, and how technological advancements influence execution speed.

How Quickly Are Market Orders Executed?

Market orders are generally executed almost instantaneously in most liquid markets. When a trader places a market order—whether to buy or sell—they are instructing their broker or trading platform to fill the order at the best available current price. In highly liquid markets like major stock exchanges (e.g., NYSE or NASDAQ) or popular cryptocurrencies such as Bitcoin and Ethereum, this process often occurs within milliseconds to seconds.

The speed of execution depends heavily on the infrastructure of the trading platform and network latency. Modern electronic exchanges utilize high-frequency trading systems that can process thousands of transactions per second. As a result, in these environments, traders typically see their market orders filled almost immediately after submission.

However, during periods of extreme volatility—such as during significant news releases or sudden market crashes—the execution speed might be affected by increased order flow and system congestion. In such cases, even highly liquid assets may experience slight delays or partial fills.

Variability in Execution Time Due to Market Conditions

While under normal circumstances market orders tend to execute swiftly, certain conditions can extend this timeframe:

Low Liquidity Assets: For less traded securities or cryptocurrencies with lower daily volume (e.g., small-cap stocks), it may take longer for a market order to be fully filled because there aren't enough buyers or sellers at current prices.

Market Volatility: During rapid price swings—as seen during flash crashes—orders may be executed at significantly different prices than expected due to slippage.

Order Size: Large-market orders can take more time if they need to be broken into smaller chunks (partial fills) across multiple price levels.

Exchange Infrastructure: Different platforms have varying processing speeds; some may prioritize speed over other factors like cost efficiency.

Understanding these variables helps traders set realistic expectations about how quickly their trades will execute under different scenarios.

Impact of Asset Class on Order Timing

The asset class being traded influences typical time frames for executing market orders:

Stock Markets: Highly liquid stocks usually fill within seconds due to dense order books.

Cryptocurrency Markets: Major cryptocurrencies often see near-instantaneous executions thanks to 24/7 trading hours and high liquidity; however, less popular tokens might experience delays.

Forex Markets: The foreign exchange markets operate 24 hours daily across global centers; thus, execution times remain consistently fast but can vary slightly based on currency pair liquidity.

Futures & Commodities: These markets also tend toward quick fills but depend on contract liquidity levels.

In all cases where rapid trade execution is critical—for example day-trading—understanding these typical time frames helps manage risk effectively.

Technological Factors Influencing Execution Speed

Advancements in technology have significantly reduced delays associated with executing market orders:

High-Frequency Trading (HFT): HFT firms leverage algorithms that place large volumes of trades within microseconds. Retail traders benefit indirectly from this technology through faster exchange infrastructure.

Trading Platforms & APIs: Modern platforms offer real-time data feeds combined with automated order placement via APIs that minimize latency.

Order Routing Algorithms: Sophisticated routing systems direct your order through multiple venues seeking optimal prices while ensuring swift execution.

Decentralized Exchanges (DEXs): In cryptocurrency markets especially decentralized ones without central intermediaries—they rely heavily on blockchain confirmation times which could introduce slight delays compared to centralized exchanges but still aim for rapid settlement cycles.

These technological improvements mean that most retail investors now experience near-instantaneous fills when placing standard market orders under normal conditions.

Practical Considerations for Traders

While understanding general time frames is helpful — especially when planning trades — it's equally important not to assume absolute certainty about exact timing every single trade:

- Always account for potential slippage during volatile periods

- Use limit orders if precise entry/exit points matter more than immediate execution

- Be aware that partial fills could extend overall transaction completion

- Monitor network congestion indicators when operating in digital asset markets

By aligning expectations with real-world performance metrics influenced by technology and current conditions, traders can make better-informed decisions regarding timing strategies involving market orders.

In summary, while most modern financial markets facilitate rapid execution of market orders—often within milliseconds—the actual timeframe varies based on liquidity levels, asset classes, prevailing volatility—and technological infrastructure involved in processing trades. Recognizing these factors allows traders not only to optimize entry and exit points but also manage risks associated with swift yet sometimes unpredictable trade executions across diverse financial environments.

JCUSER-F1IIaxXA

2025-05-29 02:16

What time frames do market orders operate within?

What Time Frames Do Market Orders Operate Within?

Understanding the time frames within which market orders operate is crucial for traders and investors aiming to optimize their trading strategies. Market orders are designed to execute quickly, but the actual timing can vary depending on several factors, including market conditions, asset class, and trading platforms. This article explores the typical time frames associated with market orders, their implications for trading decisions, and how technological advancements influence execution speed.

How Quickly Are Market Orders Executed?

Market orders are generally executed almost instantaneously in most liquid markets. When a trader places a market order—whether to buy or sell—they are instructing their broker or trading platform to fill the order at the best available current price. In highly liquid markets like major stock exchanges (e.g., NYSE or NASDAQ) or popular cryptocurrencies such as Bitcoin and Ethereum, this process often occurs within milliseconds to seconds.

The speed of execution depends heavily on the infrastructure of the trading platform and network latency. Modern electronic exchanges utilize high-frequency trading systems that can process thousands of transactions per second. As a result, in these environments, traders typically see their market orders filled almost immediately after submission.

However, during periods of extreme volatility—such as during significant news releases or sudden market crashes—the execution speed might be affected by increased order flow and system congestion. In such cases, even highly liquid assets may experience slight delays or partial fills.

Variability in Execution Time Due to Market Conditions

While under normal circumstances market orders tend to execute swiftly, certain conditions can extend this timeframe:

Low Liquidity Assets: For less traded securities or cryptocurrencies with lower daily volume (e.g., small-cap stocks), it may take longer for a market order to be fully filled because there aren't enough buyers or sellers at current prices.

Market Volatility: During rapid price swings—as seen during flash crashes—orders may be executed at significantly different prices than expected due to slippage.

Order Size: Large-market orders can take more time if they need to be broken into smaller chunks (partial fills) across multiple price levels.

Exchange Infrastructure: Different platforms have varying processing speeds; some may prioritize speed over other factors like cost efficiency.

Understanding these variables helps traders set realistic expectations about how quickly their trades will execute under different scenarios.

Impact of Asset Class on Order Timing

The asset class being traded influences typical time frames for executing market orders:

Stock Markets: Highly liquid stocks usually fill within seconds due to dense order books.

Cryptocurrency Markets: Major cryptocurrencies often see near-instantaneous executions thanks to 24/7 trading hours and high liquidity; however, less popular tokens might experience delays.

Forex Markets: The foreign exchange markets operate 24 hours daily across global centers; thus, execution times remain consistently fast but can vary slightly based on currency pair liquidity.

Futures & Commodities: These markets also tend toward quick fills but depend on contract liquidity levels.

In all cases where rapid trade execution is critical—for example day-trading—understanding these typical time frames helps manage risk effectively.

Technological Factors Influencing Execution Speed

Advancements in technology have significantly reduced delays associated with executing market orders:

High-Frequency Trading (HFT): HFT firms leverage algorithms that place large volumes of trades within microseconds. Retail traders benefit indirectly from this technology through faster exchange infrastructure.

Trading Platforms & APIs: Modern platforms offer real-time data feeds combined with automated order placement via APIs that minimize latency.

Order Routing Algorithms: Sophisticated routing systems direct your order through multiple venues seeking optimal prices while ensuring swift execution.

Decentralized Exchanges (DEXs): In cryptocurrency markets especially decentralized ones without central intermediaries—they rely heavily on blockchain confirmation times which could introduce slight delays compared to centralized exchanges but still aim for rapid settlement cycles.

These technological improvements mean that most retail investors now experience near-instantaneous fills when placing standard market orders under normal conditions.

Practical Considerations for Traders

While understanding general time frames is helpful — especially when planning trades — it's equally important not to assume absolute certainty about exact timing every single trade:

- Always account for potential slippage during volatile periods

- Use limit orders if precise entry/exit points matter more than immediate execution

- Be aware that partial fills could extend overall transaction completion

- Monitor network congestion indicators when operating in digital asset markets

By aligning expectations with real-world performance metrics influenced by technology and current conditions, traders can make better-informed decisions regarding timing strategies involving market orders.

In summary, while most modern financial markets facilitate rapid execution of market orders—often within milliseconds—the actual timeframe varies based on liquidity levels, asset classes, prevailing volatility—and technological infrastructure involved in processing trades. Recognizing these factors allows traders not only to optimize entry and exit points but also manage risks associated with swift yet sometimes unpredictable trade executions across diverse financial environments.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Exclusive News Feeds Does InvestingPro Include?

InvestingPro is a comprehensive financial analysis platform that stands out for its exclusive news feeds tailored to meet the needs of both individual and institutional investors. These news feeds are designed to keep users informed about the latest developments across various financial markets, including stocks, cryptocurrencies, and economic indicators. By offering real-time updates and expert insights, InvestingPro helps investors make well-informed decisions in a rapidly changing environment.

Types of Exclusive News Feeds on InvestingPro

InvestingPro’s exclusive news feeds encompass several key categories that address different aspects of market analysis and investment strategies. These include breaking news updates, insider insights from industry professionals, market trend analyses, cryptocurrency-specific reports, and detailed economic indicator reviews.

Breaking News Updates

One of the core features of InvestingPro’s news service is its timely delivery of breaking news related to significant events impacting global financial markets. Whether it’s geopolitical tensions affecting oil prices or unexpected corporate earnings reports influencing stock movements, these updates enable investors to react swiftly. The platform ensures that users receive alerts as events unfold so they can adjust their strategies accordingly.

Insider Insights from Industry Experts

InvestingPro also provides access to insider insights—expert opinions and professional analysis from seasoned industry professionals. These insights often include nuanced perspectives on market movements or upcoming opportunities that may not be immediately apparent through raw data alone. Such insider information adds depth to an investor's understanding by highlighting potential risks or opportunities based on industry experience.

Market Trend Analysis

Understanding current market trends is crucial for making strategic investment decisions. InvestingPro’s exclusive feeds analyze ongoing trends—such as sector rotations or shifts in investor sentiment—and assess their potential impact on portfolios. This feature helps users anticipate future movements rather than just reacting to past data.

Cryptocurrency-Specific News Feeds

With the rise of digital assets like Bitcoin and Ethereum, investing platforms have expanded their coverage into cryptocurrencies. InvestingPro offers real-time updates on cryptocurrency prices alongside regulatory changes affecting this volatile asset class. Its crypto-focused news feed includes:

- Price fluctuations

- Market capitalization shifts

- Regulatory developments worldwide

- Emerging blockchain projects with investment potential

This dedicated coverage allows investors interested in digital assets to stay ahead in a highly dynamic environment where regulations can significantly influence market behavior.

Economic Indicators & Market Analysis Tools

Beyond immediate headlines, investing platforms like InvestingPro provide detailed analyses based on macroeconomic data such as inflation rates, GDP growth figures, unemployment statistics, and more. These economic indicators serve as foundational elements for understanding broader market conditions.

Furthermore, the platform integrates advanced technical tools for charting price patterns alongside fundamental analysis metrics—like company earnings reports—to give a holistic view of investment prospects across sectors or asset classes.

How These Exclusive Feeds Benefit Investors

The value proposition behind these exclusive feeds lies in delivering timely information combined with expert interpretation—an essential combination for effective decision-making in today’s fast-paced markets. Real-time alerts help mitigate risks associated with sudden volatility while strategic insights guide long-term planning.

For example:

- A sudden geopolitical event might trigger rapid stock sell-offs; quick access via breaking news allows traders to exit positions promptly.

- Regulatory announcements concerning cryptocurrencies could alter investment outlooks; staying updated ensures compliance and risk management.

- Economic data releases influence interest rate expectations; understanding these impacts supports bond or equity allocation adjustments accordingly.

By integrating these diverse sources into one platform equipped with AI-driven predictive models (introduced since 2023), investing professionals gain an edge over less-informed competitors who rely solely on traditional sources.

Ensuring Accuracy & Reliability

Given the importance of trustworthy information when making financial decisions — especially amid increasing regulatory scrutiny — InvestingPro emphasizes accuracy by partnering with reputable data providers and continuously updating its algorithms through machine learning enhancements. This focus minimizes misinformation risks while maximizing analytical precision across all its exclusive content streams.

Final Thoughts: Staying Ahead With Exclusive News Feeds

In today’s complex financial landscape where rapid changes are commonplace—from geopolitical upheavals to technological innovations—the ability to access reliable real-time information is vital for successful investing strategies. InvestingPro's curated suite of exclusive news feeds offers comprehensive coverage spanning traditional markets like stocks and bonds as well as emerging sectors such as cryptocurrencies—all backed by expert analysis supported by cutting-edge technology solutions designed specifically for discerning investors seeking an informational advantage.

JCUSER-WVMdslBw

2025-05-27 08:04

What exclusive news feeds does InvestingPro include?

What Exclusive News Feeds Does InvestingPro Include?

InvestingPro is a comprehensive financial analysis platform that stands out for its exclusive news feeds tailored to meet the needs of both individual and institutional investors. These news feeds are designed to keep users informed about the latest developments across various financial markets, including stocks, cryptocurrencies, and economic indicators. By offering real-time updates and expert insights, InvestingPro helps investors make well-informed decisions in a rapidly changing environment.

Types of Exclusive News Feeds on InvestingPro

InvestingPro’s exclusive news feeds encompass several key categories that address different aspects of market analysis and investment strategies. These include breaking news updates, insider insights from industry professionals, market trend analyses, cryptocurrency-specific reports, and detailed economic indicator reviews.

Breaking News Updates

One of the core features of InvestingPro’s news service is its timely delivery of breaking news related to significant events impacting global financial markets. Whether it’s geopolitical tensions affecting oil prices or unexpected corporate earnings reports influencing stock movements, these updates enable investors to react swiftly. The platform ensures that users receive alerts as events unfold so they can adjust their strategies accordingly.

Insider Insights from Industry Experts

InvestingPro also provides access to insider insights—expert opinions and professional analysis from seasoned industry professionals. These insights often include nuanced perspectives on market movements or upcoming opportunities that may not be immediately apparent through raw data alone. Such insider information adds depth to an investor's understanding by highlighting potential risks or opportunities based on industry experience.

Market Trend Analysis

Understanding current market trends is crucial for making strategic investment decisions. InvestingPro’s exclusive feeds analyze ongoing trends—such as sector rotations or shifts in investor sentiment—and assess their potential impact on portfolios. This feature helps users anticipate future movements rather than just reacting to past data.

Cryptocurrency-Specific News Feeds

With the rise of digital assets like Bitcoin and Ethereum, investing platforms have expanded their coverage into cryptocurrencies. InvestingPro offers real-time updates on cryptocurrency prices alongside regulatory changes affecting this volatile asset class. Its crypto-focused news feed includes:

- Price fluctuations

- Market capitalization shifts

- Regulatory developments worldwide

- Emerging blockchain projects with investment potential

This dedicated coverage allows investors interested in digital assets to stay ahead in a highly dynamic environment where regulations can significantly influence market behavior.

Economic Indicators & Market Analysis Tools

Beyond immediate headlines, investing platforms like InvestingPro provide detailed analyses based on macroeconomic data such as inflation rates, GDP growth figures, unemployment statistics, and more. These economic indicators serve as foundational elements for understanding broader market conditions.

Furthermore, the platform integrates advanced technical tools for charting price patterns alongside fundamental analysis metrics—like company earnings reports—to give a holistic view of investment prospects across sectors or asset classes.

How These Exclusive Feeds Benefit Investors

The value proposition behind these exclusive feeds lies in delivering timely information combined with expert interpretation—an essential combination for effective decision-making in today’s fast-paced markets. Real-time alerts help mitigate risks associated with sudden volatility while strategic insights guide long-term planning.

For example:

- A sudden geopolitical event might trigger rapid stock sell-offs; quick access via breaking news allows traders to exit positions promptly.

- Regulatory announcements concerning cryptocurrencies could alter investment outlooks; staying updated ensures compliance and risk management.

- Economic data releases influence interest rate expectations; understanding these impacts supports bond or equity allocation adjustments accordingly.

By integrating these diverse sources into one platform equipped with AI-driven predictive models (introduced since 2023), investing professionals gain an edge over less-informed competitors who rely solely on traditional sources.

Ensuring Accuracy & Reliability

Given the importance of trustworthy information when making financial decisions — especially amid increasing regulatory scrutiny — InvestingPro emphasizes accuracy by partnering with reputable data providers and continuously updating its algorithms through machine learning enhancements. This focus minimizes misinformation risks while maximizing analytical precision across all its exclusive content streams.

Final Thoughts: Staying Ahead With Exclusive News Feeds

In today’s complex financial landscape where rapid changes are commonplace—from geopolitical upheavals to technological innovations—the ability to access reliable real-time information is vital for successful investing strategies. InvestingPro's curated suite of exclusive news feeds offers comprehensive coverage spanning traditional markets like stocks and bonds as well as emerging sectors such as cryptocurrencies—all backed by expert analysis supported by cutting-edge technology solutions designed specifically for discerning investors seeking an informational advantage.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Do Subscription Costs in Crypto and Investment Compare Yearly?

Understanding the yearly costs associated with subscription services in the crypto and investment sectors is essential for investors aiming to optimize their financial strategies. As these sectors evolve rapidly, so do the pricing models, making it crucial to compare costs effectively to ensure value for money.

Overview of Subscription Models in Crypto and Investment Platforms

Subscription services in finance are diverse, reflecting different user needs—from casual traders to institutional investors. The most common models include flat fees, tiered pricing, performance-based fees, and free trials. Flat fee subscriptions typically involve a fixed annual or monthly payment that grants access to specific features or data sets. Tiered pricing offers multiple levels of service—basic, premium, or enterprise—allowing users to select options aligned with their investment goals and budgets.

Performance-based fees are more dynamic; they charge a percentage of profits generated through the platform’s tools or strategies. This model aligns service provider incentives with investor success but can lead to variable costs depending on market conditions. Free trials serve as an entry point for new users who want to evaluate platform capabilities before committing financially.

Recent Developments Impacting Subscription Costs

The landscape of crypto subscriptions is continually shifting due to technological innovations and regulatory changes. For example, platforms like Perplexity Finance now provide real-time cryptocurrency data—including historical charts and predictive analytics—which often come at a premium subscription cost but offer valuable insights for active traders.

Stablecoins such as World Liberty Financial’s USD1 have gained prominence by being used as settlement currencies in large-scale transactions like MGX’s $2 billion deal—highlighting how stablecoin-related services might influence future subscription expenses related to secure transaction processing.

Additionally, ETFs like Amplify Bloomberg AI Value Chain ETF utilize options strategies tied directly into Bitcoin price movements. Such innovative financial products may carry higher management fees but potentially offer more sophisticated risk management tools that justify their cost over traditional investment methods.

Comparing Yearly Subscription Costs: What Investors Need To Know

When evaluating yearly subscription expenses across platforms:

- Basic Subscriptions: These often range from $100-$500 annually for fundamental data access or educational content.

- Advanced Tools & Data: More comprehensive platforms offering real-time quotes, advanced analytics, or trading signals can cost between $500-$2,000 per year.

- Premium & Institutional Services: High-end solutions tailored for professional traders or institutions may exceed $5,000 annually due to personalized support and exclusive features.

It’s important not just to look at sticker prices but also consider what features are included relative to your investing style. For instance:

- Beginners might prioritize low-cost plans with basic market data.

- Active traders could benefit from real-time alerts and advanced charting tools.

- Long-term investors should assess whether paid research reports justify their annual expense.

Regularly reviewing these costs ensures alignment with evolving investment needs while avoiding unnecessary expenditure on underutilized features.

Factors Influencing Cost Variations Year Over Year

Several factors contribute significantly toward fluctuations in subscription prices annually:

Market Volatility: During periods of high volatility (e.g., crypto bull runs), demand for real-time data spikes—potentially increasing platform prices due to higher server loads or premium feature demands.

Regulatory Changes: New regulations can impose compliance costs on providers which may be passed onto consumers through increased subscription fees.

Technological Advancements: Innovations such as AI-driven analytics or blockchain security enhancements often require substantial R&D investments that could elevate service charges over time.

Competitive Landscape: Increased competition among platforms tends toward price reductions; however, niche services offering specialized insights might command higher premiums based on exclusivity.

Investors should stay informed about these dynamics since they directly impact long-term affordability when subscribing annually.

Strategies To Manage Subscription Expenses Effectively

Managing yearly costs involves strategic planning:

Start small by testing free trials before committing long-term investments into expensive packages.

Prioritize essential features aligned with your current investment strategy rather than opting for all-inclusive plans that may contain unused tools.

Regularly review your subscriptions’ performance against your goals; cancel those no longer providing value.

Consider bundling multiple services from one provider if discounts are available—a common practice among larger platforms aiming at customer retention.

By adopting disciplined budgeting practices around subscriptions—such as setting annual caps—you can maximize returns while minimizing unnecessary spending during volatile market phases.

Staying aware of how subscription costs evolve each year helps investors make smarter decisions amid an increasingly complex financial environment driven by rapid technological change and regulatory developments within crypto markets—and beyond into broader investment landscapes like ETFs tied into emerging assets such as Bitcoin options strategies.[^1][^4] Ultimately, aligning your spending with clear objectives ensures you leverage these digital resources effectively without overspending during unpredictable times.[^2][^3]

[^1]: Perplexity Finance provides cryptocurrency quotes including MMFUSD (MM Finance) USD (2025).[^2]: World Liberty Financial's USD1 stablecoin used in MGX's $2 billion deal (2025).[^3]: VanEck Video Gaming ETF latest price update available via Perplexity Finance (2025).[^4]: Amplify Bloomberg ETF employs options tied closely linked with Bitcoin movements (2025).

kai

2025-05-26 18:20

How do subscription costs compare yearly?

How Do Subscription Costs in Crypto and Investment Compare Yearly?

Understanding the yearly costs associated with subscription services in the crypto and investment sectors is essential for investors aiming to optimize their financial strategies. As these sectors evolve rapidly, so do the pricing models, making it crucial to compare costs effectively to ensure value for money.

Overview of Subscription Models in Crypto and Investment Platforms

Subscription services in finance are diverse, reflecting different user needs—from casual traders to institutional investors. The most common models include flat fees, tiered pricing, performance-based fees, and free trials. Flat fee subscriptions typically involve a fixed annual or monthly payment that grants access to specific features or data sets. Tiered pricing offers multiple levels of service—basic, premium, or enterprise—allowing users to select options aligned with their investment goals and budgets.

Performance-based fees are more dynamic; they charge a percentage of profits generated through the platform’s tools or strategies. This model aligns service provider incentives with investor success but can lead to variable costs depending on market conditions. Free trials serve as an entry point for new users who want to evaluate platform capabilities before committing financially.

Recent Developments Impacting Subscription Costs

The landscape of crypto subscriptions is continually shifting due to technological innovations and regulatory changes. For example, platforms like Perplexity Finance now provide real-time cryptocurrency data—including historical charts and predictive analytics—which often come at a premium subscription cost but offer valuable insights for active traders.

Stablecoins such as World Liberty Financial’s USD1 have gained prominence by being used as settlement currencies in large-scale transactions like MGX’s $2 billion deal—highlighting how stablecoin-related services might influence future subscription expenses related to secure transaction processing.

Additionally, ETFs like Amplify Bloomberg AI Value Chain ETF utilize options strategies tied directly into Bitcoin price movements. Such innovative financial products may carry higher management fees but potentially offer more sophisticated risk management tools that justify their cost over traditional investment methods.

Comparing Yearly Subscription Costs: What Investors Need To Know

When evaluating yearly subscription expenses across platforms:

- Basic Subscriptions: These often range from $100-$500 annually for fundamental data access or educational content.

- Advanced Tools & Data: More comprehensive platforms offering real-time quotes, advanced analytics, or trading signals can cost between $500-$2,000 per year.

- Premium & Institutional Services: High-end solutions tailored for professional traders or institutions may exceed $5,000 annually due to personalized support and exclusive features.

It’s important not just to look at sticker prices but also consider what features are included relative to your investing style. For instance:

- Beginners might prioritize low-cost plans with basic market data.

- Active traders could benefit from real-time alerts and advanced charting tools.

- Long-term investors should assess whether paid research reports justify their annual expense.

Regularly reviewing these costs ensures alignment with evolving investment needs while avoiding unnecessary expenditure on underutilized features.

Factors Influencing Cost Variations Year Over Year

Several factors contribute significantly toward fluctuations in subscription prices annually:

Market Volatility: During periods of high volatility (e.g., crypto bull runs), demand for real-time data spikes—potentially increasing platform prices due to higher server loads or premium feature demands.

Regulatory Changes: New regulations can impose compliance costs on providers which may be passed onto consumers through increased subscription fees.

Technological Advancements: Innovations such as AI-driven analytics or blockchain security enhancements often require substantial R&D investments that could elevate service charges over time.

Competitive Landscape: Increased competition among platforms tends toward price reductions; however, niche services offering specialized insights might command higher premiums based on exclusivity.

Investors should stay informed about these dynamics since they directly impact long-term affordability when subscribing annually.

Strategies To Manage Subscription Expenses Effectively

Managing yearly costs involves strategic planning:

Start small by testing free trials before committing long-term investments into expensive packages.

Prioritize essential features aligned with your current investment strategy rather than opting for all-inclusive plans that may contain unused tools.

Regularly review your subscriptions’ performance against your goals; cancel those no longer providing value.

Consider bundling multiple services from one provider if discounts are available—a common practice among larger platforms aiming at customer retention.

By adopting disciplined budgeting practices around subscriptions—such as setting annual caps—you can maximize returns while minimizing unnecessary spending during volatile market phases.

Staying aware of how subscription costs evolve each year helps investors make smarter decisions amid an increasingly complex financial environment driven by rapid technological change and regulatory developments within crypto markets—and beyond into broader investment landscapes like ETFs tied into emerging assets such as Bitcoin options strategies.[^1][^4] Ultimately, aligning your spending with clear objectives ensures you leverage these digital resources effectively without overspending during unpredictable times.[^2][^3]

[^1]: Perplexity Finance provides cryptocurrency quotes including MMFUSD (MM Finance) USD (2025).[^2]: World Liberty Financial's USD1 stablecoin used in MGX's $2 billion deal (2025).[^3]: VanEck Video Gaming ETF latest price update available via Perplexity Finance (2025).[^4]: Amplify Bloomberg ETF employs options tied closely linked with Bitcoin movements (2025).

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Many Chains Does Zapper Support?

Understanding the scope of blockchain compatibility in DeFi platforms is essential for investors and developers alike. Zapper, a prominent player in the decentralized finance ecosystem, has gained recognition for its ability to streamline asset management across multiple blockchain networks. This article explores how many chains Zapper supports, the significance of this multi-chain functionality, recent updates, and potential challenges associated with supporting numerous blockchains.

What Is Zapper and Its Role in DeFi?

Zapper functions as an all-in-one dashboard designed to simplify interaction with various DeFi protocols. It provides users with a centralized interface to view their crypto holdings, manage liquidity pools, yield farming positions, and lending activities without navigating multiple platforms or wallets. By integrating numerous blockchain networks into one platform, Zapper enhances user experience and promotes portfolio diversification—a core principle in risk management within decentralized finance.

The platform's primary appeal lies in its ability to connect different chains seamlessly. This cross-chain support allows users to access opportunities on Ethereum’s vast ecosystem while also exploring emerging protocols on other blockchains like Binance Smart Chain (BSC), Polygon (MATIC), Avalanche (AVAX), Solana (SOL), Polkadot (DOT), and Cosmos (ATOM).

How Many Blockchain Networks Does Zapper Support?

As of recent updates—up through 2025—Zapper supports over seven major blockchain networks:

- Ethereum (ETH): The foundational network for most DeFi activity.

- Binance Smart Chain (BSC): Known for low transaction fees and fast processing times.

- Polygon (MATIC): A layer 2 scaling solution that reduces congestion on Ethereum.

- Avalanche (AVAX): Offers high throughput with quick finality.

- Solana (SOL): Recognized for high performance and rapid transactions.

- Polkadot (DOT): Focused on interoperability between different blockchains.

- Cosmos (ATOM): A network facilitating communication among independent chains.

This list reflects a strategic focus on both established giants like Ethereum and emerging ecosystems such as Solana or Avalanche that are gaining traction due to their scalability advantages.

The Importance of Multi-Chain Support in DeFi

Supporting multiple chains is not merely a technical feature but a strategic necessity within the broader context of decentralized finance. Investors increasingly seek diversified exposure across various tokens and protocols hosted on different blockchains. Multi-chain compatibility enables them to:

- Access diverse investment opportunities

- Reduce dependency on any single network

- Optimize transaction costs by choosing cheaper networks

- Participate in niche ecosystems that may offer higher yields or unique assets

For platforms like Zapper, this multi-chain approach broadens their user base by accommodating users from different regions who prefer specific chains due to regulatory reasons or local infrastructure preferences.

Recent Developments Enhancing Chain Support

Over recent years, Zapper has actively expanded its chain support through several key initiatives:

Expansion into New Blockchains

In 2023–2024, Zapper extended support beyond traditional Ethereum-based assets by integrating with newer ecosystems such as Avalanche and Solana—both known for their scalability solutions tailored toward high-performance applications.

Protocol Integrations

The platform has also incorporated popular lending protocols like Aave and Compound during 2024—allowing users not only to view assets but also seamlessly lend or borrow cryptocurrencies directly from within the interface.

User Interface Improvements

To enhance usability amid increasing complexity from supporting more chains:

- Real-time price tracking

- Simplified navigation

- Enhanced security features

have been introduced progressively throughout 2024–2025.

These upgrades aim at maintaining performance standards despite expanding protocol integrations across diverse networks.

Challenges Associated With Supporting Multiple Chains

While multi-chain support offers significant benefits—including increased flexibility—it introduces notable risks:

Security Concerns

Each added chain presents unique vulnerabilities; smart contract bugs or exploits can compromise user funds if not properly managed or audited thoroughly across all supported networks.

Regulatory Risks

DeFi’s evolving legal landscape could impact certain chains differently depending upon jurisdictional regulations concerning tokens or protocol operations—potentially limiting access based on geographic location or compliance issues.

Scalability & Performance Issues

Handling data from several active blockchains demands robust infrastructure; failure here could lead to delays in portfolio updates or transaction processing errors affecting user trustworthiness over time.

Future Outlook: Expanding Cross-Chain Capabilities

Looking ahead into 2025–2026, platforms like Zapper are expected to further broaden their chain integrations as new ecosystems emerge—and existing ones improve scalability features—for example:

- Integration with additional Layer 2 solutions such as Arbitrum

- Inclusion of other interoperability-focused projects

- Enhanced security measures leveraging cross-chain bridges

Such developments will likely make multi-chain management even more seamless while addressing current limitations related to security risks.

By understanding how many chains ZAPPER supports—and why this matters—you gain insight into its role within the broader DeFi landscape. As it continues expanding its reach across diverse blockchain environments while balancing security concerns—a critical aspect rooted deeply in industry best practices—it remains well-positioned as an essential tool for modern crypto investors seeking comprehensive asset management solutions across multiple ecosystems.

If you’re considering using platforms like ZAPPER for managing your digital assets efficiently across various blockchains—or evaluating future investment opportunities—their ongoing expansion underscores the importance of versatile tools capable of navigating today’s complex decentralized environment effectively.

JCUSER-IC8sJL1q

2025-05-26 16:24

How many chains does Zapper support?

How Many Chains Does Zapper Support?

Understanding the scope of blockchain compatibility in DeFi platforms is essential for investors and developers alike. Zapper, a prominent player in the decentralized finance ecosystem, has gained recognition for its ability to streamline asset management across multiple blockchain networks. This article explores how many chains Zapper supports, the significance of this multi-chain functionality, recent updates, and potential challenges associated with supporting numerous blockchains.

What Is Zapper and Its Role in DeFi?

Zapper functions as an all-in-one dashboard designed to simplify interaction with various DeFi protocols. It provides users with a centralized interface to view their crypto holdings, manage liquidity pools, yield farming positions, and lending activities without navigating multiple platforms or wallets. By integrating numerous blockchain networks into one platform, Zapper enhances user experience and promotes portfolio diversification—a core principle in risk management within decentralized finance.

The platform's primary appeal lies in its ability to connect different chains seamlessly. This cross-chain support allows users to access opportunities on Ethereum’s vast ecosystem while also exploring emerging protocols on other blockchains like Binance Smart Chain (BSC), Polygon (MATIC), Avalanche (AVAX), Solana (SOL), Polkadot (DOT), and Cosmos (ATOM).

How Many Blockchain Networks Does Zapper Support?

As of recent updates—up through 2025—Zapper supports over seven major blockchain networks:

- Ethereum (ETH): The foundational network for most DeFi activity.

- Binance Smart Chain (BSC): Known for low transaction fees and fast processing times.

- Polygon (MATIC): A layer 2 scaling solution that reduces congestion on Ethereum.

- Avalanche (AVAX): Offers high throughput with quick finality.

- Solana (SOL): Recognized for high performance and rapid transactions.

- Polkadot (DOT): Focused on interoperability between different blockchains.

- Cosmos (ATOM): A network facilitating communication among independent chains.

This list reflects a strategic focus on both established giants like Ethereum and emerging ecosystems such as Solana or Avalanche that are gaining traction due to their scalability advantages.

The Importance of Multi-Chain Support in DeFi

Supporting multiple chains is not merely a technical feature but a strategic necessity within the broader context of decentralized finance. Investors increasingly seek diversified exposure across various tokens and protocols hosted on different blockchains. Multi-chain compatibility enables them to:

- Access diverse investment opportunities

- Reduce dependency on any single network

- Optimize transaction costs by choosing cheaper networks

- Participate in niche ecosystems that may offer higher yields or unique assets

For platforms like Zapper, this multi-chain approach broadens their user base by accommodating users from different regions who prefer specific chains due to regulatory reasons or local infrastructure preferences.

Recent Developments Enhancing Chain Support

Over recent years, Zapper has actively expanded its chain support through several key initiatives:

Expansion into New Blockchains

In 2023–2024, Zapper extended support beyond traditional Ethereum-based assets by integrating with newer ecosystems such as Avalanche and Solana—both known for their scalability solutions tailored toward high-performance applications.

Protocol Integrations

The platform has also incorporated popular lending protocols like Aave and Compound during 2024—allowing users not only to view assets but also seamlessly lend or borrow cryptocurrencies directly from within the interface.

User Interface Improvements

To enhance usability amid increasing complexity from supporting more chains:

- Real-time price tracking

- Simplified navigation

- Enhanced security features

have been introduced progressively throughout 2024–2025.

These upgrades aim at maintaining performance standards despite expanding protocol integrations across diverse networks.

Challenges Associated With Supporting Multiple Chains

While multi-chain support offers significant benefits—including increased flexibility—it introduces notable risks:

Security Concerns

Each added chain presents unique vulnerabilities; smart contract bugs or exploits can compromise user funds if not properly managed or audited thoroughly across all supported networks.

Regulatory Risks

DeFi’s evolving legal landscape could impact certain chains differently depending upon jurisdictional regulations concerning tokens or protocol operations—potentially limiting access based on geographic location or compliance issues.

Scalability & Performance Issues

Handling data from several active blockchains demands robust infrastructure; failure here could lead to delays in portfolio updates or transaction processing errors affecting user trustworthiness over time.

Future Outlook: Expanding Cross-Chain Capabilities

Looking ahead into 2025–2026, platforms like Zapper are expected to further broaden their chain integrations as new ecosystems emerge—and existing ones improve scalability features—for example:

- Integration with additional Layer 2 solutions such as Arbitrum

- Inclusion of other interoperability-focused projects

- Enhanced security measures leveraging cross-chain bridges

Such developments will likely make multi-chain management even more seamless while addressing current limitations related to security risks.

By understanding how many chains ZAPPER supports—and why this matters—you gain insight into its role within the broader DeFi landscape. As it continues expanding its reach across diverse blockchain environments while balancing security concerns—a critical aspect rooted deeply in industry best practices—it remains well-positioned as an essential tool for modern crypto investors seeking comprehensive asset management solutions across multiple ecosystems.

If you’re considering using platforms like ZAPPER for managing your digital assets efficiently across various blockchains—or evaluating future investment opportunities—their ongoing expansion underscores the importance of versatile tools capable of navigating today’s complex decentralized environment effectively.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Major Events That Defined the “DeFi Summer” of 2020

The summer of 2020 marked a pivotal moment in the evolution of decentralized finance (DeFi). This period, often referred to as "DeFi summer," was characterized by explosive growth, innovative protocols, and increased mainstream attention. Understanding the key events that shaped this era provides valuable insights into how DeFi transformed from niche experiments into a major component of the broader cryptocurrency ecosystem.

The Rise of Yield Farming and Its Impact on DeFi Growth

One of the most defining features of DeFi summer was the rapid rise of yield farming. This practice involves providing liquidity to various DeFi protocols in exchange for interest or rewards—often paid out in governance tokens or other cryptocurrencies. Yield farming incentivized users to lock their assets into protocols like Compound and Aave, which led to an influx of capital and skyrocketing token prices.

By mid-2020, yield farmers were actively seeking high-yield opportunities across multiple platforms. This activity not only boosted liquidity but also created a competitive environment where projects offered increasingly attractive incentives. As a result, tokens such as COMP (Compound) and LEND (Aave) experienced unprecedented price surges, significantly increasing their market capitalization.

This surge attracted both retail investors looking for quick gains and institutional players exploring new financial models on blockchain networks. The phenomenon underscored how community-driven incentives could accelerate adoption while highlighting risks related to market volatility and speculative behavior.

Uniswap V2 Launch: Enhancing Decentralized Trading

In May 2020, Uniswap launched its second version—Uniswap V2—which introduced notable improvements over its predecessor. The upgrade featured an upgraded liquidity pool mechanism that allowed users to provide liquidity using stablecoins or other cryptocurrencies directly within pools.

This development made decentralized trading more accessible by enabling seamless token swaps without relying on centralized exchanges. Liquidity providers could now earn fees proportionally based on their share in pools with greater flexibility—further democratizing access to trading activities within DeFi ecosystems.

Uniswap's user-friendly interface combined with these technical enhancements contributed significantly to its rapid growth during this period. It became one of the most widely used decentralized exchanges (DEXs), setting standards for future innovations in automated market makers (AMMs).

Stablecoins: Anchoring Value Amid Market Volatility

Stablecoins such as USDT (Tether), USDC (USD Coin), DAI, and others played an essential role during DeFi summer by providing stability amidst volatile crypto markets. These digital assets are pegged to fiat currencies like USD or EUR, offering traders and investors a reliable store of value when navigating fluctuating prices.