🚨 Announcement on Abnormal Application Data of Mini IPO AJE Project

Due to the abnormal application data of the AJE project in the Mini IPO section, we have received feedback from multiple community users that the AJE project application has been unable to complete the withdrawal operation for several consecutive days. The platform attaches great importance to the safety of user assets, has initiated a risk control mechanism, suspended trading at the request of the project party, verified the situation with the AJE team, and assisted the project team in completing the data verification work.

👉 Details: https://support.jucoin.blog/hc/en-001/articles/49548798192025?utm_campaign=relisting_AJE&utm_source=twitter&utm_medium=post

JuCoin Official

2025-08-06 08:12

🚨 Announcement on Abnormal Application Data of Mini IPO AJE Project

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

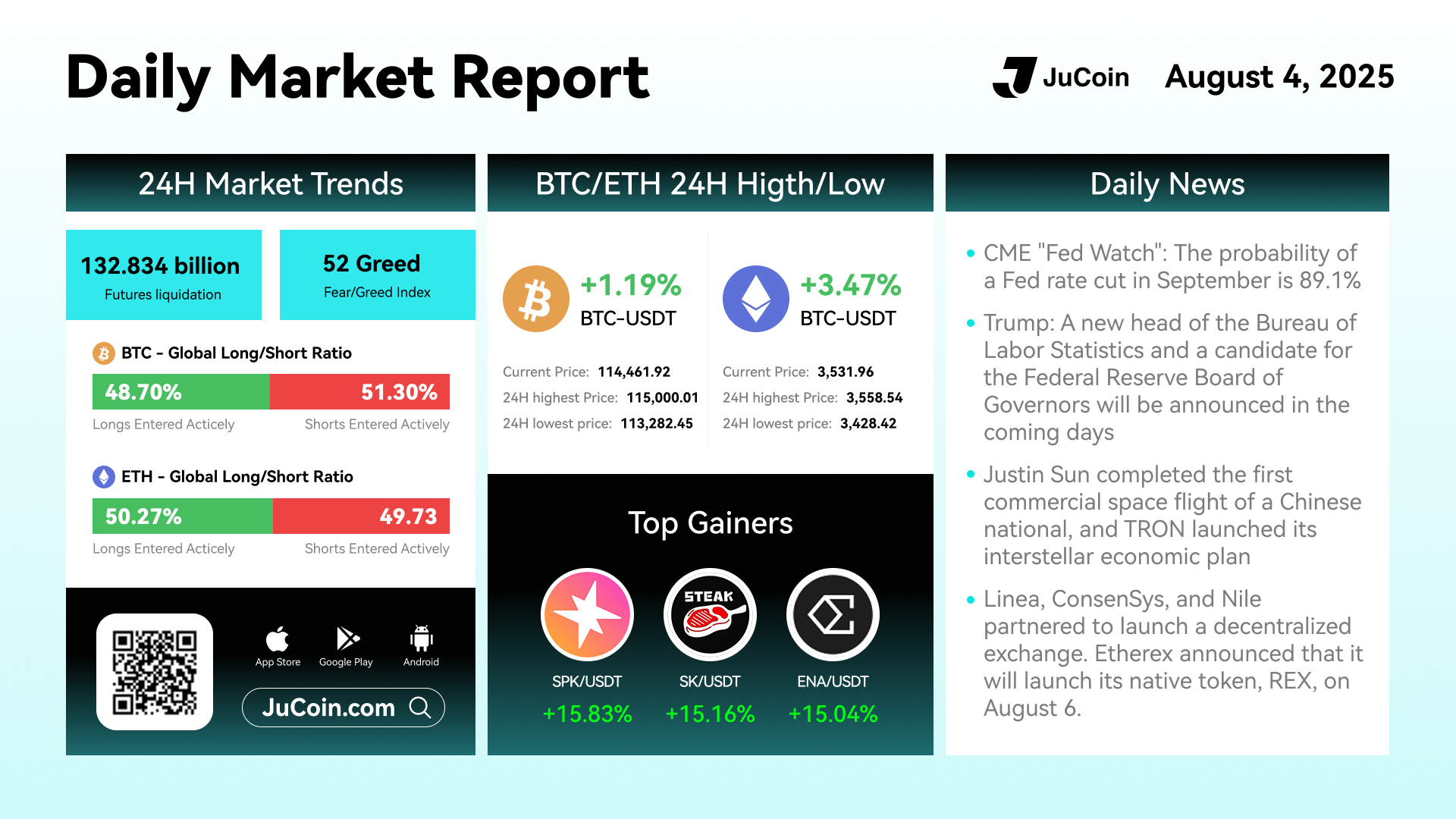

📅 August 4 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-04 04:34

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

From 16:06 to 16:09 (UTC+8) on August 1, ETHUSDT futures experienced a price spike, resulting in approximately $2.87M in abnormal profits for some users and $7.3M in abnormal losses for others.

💪🏻To fully protect the interests of all platform users, we have decided:

✅Full release of abnormal profits: Users who profited during the incident will not be subject to clawbacks, with a total of approximately 2.87million USDT being distributed.

✅Full compensation for abnormal losses: Users who incurred losses during the incident will be fully compensated by the platform, including those in unrealized loss positions. The total compensation amounts to approximately 7.3 million USDT.

👌JuCoin will bear a total compensation exceeding $10 million USDT for this incident. All compensations will be completed by 24:00 (UTC+8) on August 8.

We will continue to optimize system stability to ensure every user receives the protection they deserve, even in extreme market conditions.

👉More: https://bit.ly/46E2woC

JuCoin Community

2025-08-01 16:58

🚨Statement on August 1, 2025 Futures System Anomaly and Compensation Decision

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

TA used to be charts, indicators, and KD lines 🎯 Now it’s just tweets, vibes, and memes 🫥 Accurate enough, right?

Check out our YouTube Channel 👉

#TechnicalAnalysis #MemeTrading #CryptoTA

JuCoin Media

2025-08-01 11:35

Technical Analysis Cryptocurrency 📊 | The Only Chart That Matters

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

TA used to be charts, indicators, and KD lines 🎯 Now it’s just tweets, vibes, and memes 🫥 Accurate enough, right?

Check out our YouTube Channel 👉

#TechnicalAnalysis #MemeTrading #CryptoTA

JuCoin Media

2025-08-01 11:33

Technical Analysis Cryptocurrency 📊 | The Only Chart That Matters

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

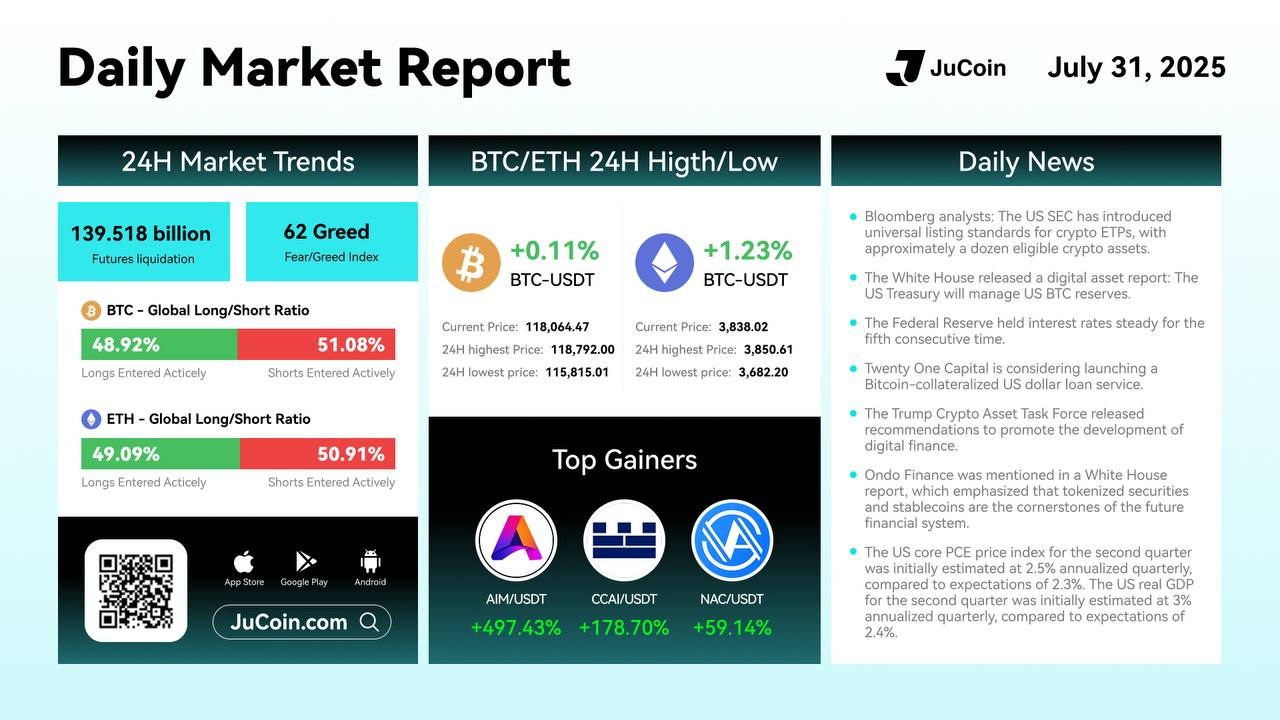

📅 July 31 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-07-31 06:30

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👉 Trade Now: https://bit.ly/4eDheON

JuCoin Community

2025-07-31 06:28

$JU successfully reached 12 USDT, setting a new record high! The price rose 120x since its listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Do Credit Spreads Compare to Other Investment Strategies?

Understanding the role of credit spreads in investment decision-making is essential for investors seeking to optimize their portfolios. While credit spreads are a key indicator within fixed-income markets, they are often compared with other strategies such as equity investing, diversification techniques, and alternative assets. This article explores how credit spread-based strategies stack up against other approaches, providing clarity on their advantages and limitations.

What Are Credit Spread Strategies?

Credit spread strategies involve analyzing the difference in yields between bonds of similar credit quality but different maturities or risk profiles. Investors leverage this information to identify opportunities for higher returns or risk mitigation. For example, buying high-yield bonds when spreads are wide can offer attractive income potential if market conditions improve. Conversely, narrowing spreads might signal a safer environment suitable for more conservative investments.

These strategies are rooted in market sentiment and economic outlooks; widening spreads often indicate increased default risk or economic downturns, while narrowing spreads suggest confidence and stability. As such, credit spread analysis provides real-time insights into market health that can inform tactical investment decisions.

Comparing Credit Spreads with Equity Investment Strategies

Equity investing focuses on purchasing shares of companies with growth potential or dividend income. Unlike fixed-income securities where returns depend largely on interest rates and credit risk perceptions (reflected through credit spreads), equities are driven by company performance, earnings growth, and broader economic factors.

While both approaches aim for capital appreciation or income generation:

- Risk Profile: Equities tend to be more volatile than bonds; however, they also offer higher return potential over the long term.

- Market Sensitivity: Equity prices react sharply to corporate news and macroeconomic shifts; bond markets respond primarily through changes in interest rates and credit conditions.

- Diversification Benefits: Combining equities with fixed-income instruments like bonds can reduce overall portfolio volatility—credit spreads help gauge when bond markets may be more attractive relative to stocks.

In essence, while equity strategies focus on company fundamentals and growth prospects, credit spread-based bond strategies provide insight into macroeconomic risks that influence debt markets.

How Do Credit Spread Strategies Compare With Diversification Techniques?

Diversification is a fundamental principle across all investment styles—spreading investments across asset classes reduces exposure to any single source of risk. Using credit spreads as part of a diversification strategy involves adjusting bond holdings based on perceived risks indicated by spread movements.

For example:

- When credit spreads widen significantly due to economic uncertainty or rising default fears, an investor might reduce exposure to high-yield bonds.

- Conversely, narrowing spreads could signal an opportunity to increase allocations toward corporate debt for better yield prospects without taking excessive additional risk.

Compared with broad diversification across stocks and commodities alone,

- Credit Spread Analysis Offers Tactical Edge: It allows investors to fine-tune their fixed-income allocations based on current market signals.

- Limitations: Relying solely on spread movements without considering other factors like macroeconomic data may lead to misjudgments during volatile periods when signals become noisy.

Thus, integrating credit spread analysis enhances traditional diversification by adding a layer of tactical insight specific to bond markets' dynamics.

Comparing Credit Spreads With Alternative Asset Classes

Alternative investments include real estate (REITs), commodities (gold), hedge funds, private equity—and increasingly cryptocurrencies. These assets often serve as hedges against inflation or sources of uncorrelated returns but come with distinct risks compared to traditional bonds influenced by credit spreads.

For instance:

- Cryptocurrencies have shown high volatility unrelated directly to traditional financial indicators like interest rates or default risks reflected in bond yields.

- Real estate investments tend not directly tied but can be affected indirectly through broader economic conditions impacting borrowing costs signaled via widening or narrowing credits spreds.

Investors comparing these options should consider:

- The liquidity profile

- Risk-return characteristics

- Correlation patterns during different economic cycles

While alternative assets diversify away from fixed-income risks indicated by changing credits spreds—they do not replace the predictive power that analyzing these spreds offers regarding macroeconomic health.

Strengths & Limitations of Using Credit Spreads Compared To Other Strategies

Credit-spread-based investing provides valuable insights into market sentiment about default risk which is crucial during periods of economic stress—such as recessions—or rapid rate hikes by central banks[1]. Its strength lies in its abilityto act as an early warning system for deteriorating financial conditions before they fully materialize in stock prices or GDP figures[2].

However,

Strengths:

– Provides timely signals about systemic risks– Enhances tactical asset allocation decisions– Helps identify undervalued debt securities during turbulent times

Limitations:

– Can be misleading if used without considering macroeconomic context– Sensitive to liquidity shocks affecting bond markets disproportionately– Not always predictive during unprecedented events like pandemics

Compared with passive buy-and-hold equity approaches—which rely heavily on long-term fundamentals—credit-spread trading demands active management skills but offers potentially higher short-term gains if executed correctly.

Integrating Multiple Approaches for Better Portfolio Management

The most effective investment portfolios typically combine multiple strategies tailored accordingto individual goalsandrisk tolerance.[3] Incorporating insights fromcreditspread analysis alongside equity valuation modelsand diversifications techniques creates a balanced approach capableof navigating varyingmarket environments effectively.[4]

For example,

- Usecreditspread trendsas partof your macroeconomic outlook assessment,

- Combine thiswith fundamental analysisof individual stocks,

- Maintain diversified holdingsacross asset classes including equities,reits,and commodities,

- Adjust allocations dynamically basedon evolving signalsfrom all sources,

This integrated approach leverages each strategy's strengths while mitigating weaknesses inherentin any single method.

Final Thoughts: Choosing Between Different Investment Approaches

When evaluating whether tousecredit-spread-basedstrategies versus others,it’s importantto consider yourinvestment horizon,timeframe,andrisk appetite.[5] Fixed-income tactics centered around monitoringcreditspreds excel at capturing short-to-medium-term shiftsin market sentimentanddefault expectations,but may underperformduring prolonged bull runsor whenmacro indicators diverge frombond-market signals.[6]

Meanwhile,equity-focusedinvestmentsoffergrowthpotentialbutcomewithhighervolatilityand longer recovery periodsafter downturns.[7] Diversification remains key—blending multiple methods ensures resilienceagainst unpredictablemarket shockswhile aligningwith personalfinancial goals.[8]

By understanding how each approach compares—and recognizingthe unique advantagesofferedbycredit-spread analysis—youcan crafta well-informedstrategy suitedtothe currentmarket landscape.

References

[1] Smith J., "The Role Of Credit Spreads In Economic Forecasting," Journal Of Financial Markets 2022

[2] Lee A., "Market Sentiment Indicators And Their Predictive Power," Financial Analysts Journal 2023

[3] Brown P., "Portfolio Diversification Techniques," Investopedia 2020

[4] Johnson M., "Combining Asset Allocation Models," CFA Institute Publications 2021

[5] Davis R., "Investment Time Horizons And Strategy Selection," Harvard Business Review 2019

[6] Patel S., "Risks Of Fixed Income Investing During Economic Cycles," Bloomberg Markets 2020

[7] Nguyen T., "Equity vs Bond Investing During Market Volatility," Wall Street Journal 2021

[8] Carter L., "Building Resilient Portfolios Through Multi-Asset Strategies," Financial Times 2022

Lo

2025-06-09 22:25

How do credit spreads compare to other investment strategies?

How Do Credit Spreads Compare to Other Investment Strategies?

Understanding the role of credit spreads in investment decision-making is essential for investors seeking to optimize their portfolios. While credit spreads are a key indicator within fixed-income markets, they are often compared with other strategies such as equity investing, diversification techniques, and alternative assets. This article explores how credit spread-based strategies stack up against other approaches, providing clarity on their advantages and limitations.

What Are Credit Spread Strategies?

Credit spread strategies involve analyzing the difference in yields between bonds of similar credit quality but different maturities or risk profiles. Investors leverage this information to identify opportunities for higher returns or risk mitigation. For example, buying high-yield bonds when spreads are wide can offer attractive income potential if market conditions improve. Conversely, narrowing spreads might signal a safer environment suitable for more conservative investments.

These strategies are rooted in market sentiment and economic outlooks; widening spreads often indicate increased default risk or economic downturns, while narrowing spreads suggest confidence and stability. As such, credit spread analysis provides real-time insights into market health that can inform tactical investment decisions.

Comparing Credit Spreads with Equity Investment Strategies

Equity investing focuses on purchasing shares of companies with growth potential or dividend income. Unlike fixed-income securities where returns depend largely on interest rates and credit risk perceptions (reflected through credit spreads), equities are driven by company performance, earnings growth, and broader economic factors.

While both approaches aim for capital appreciation or income generation:

- Risk Profile: Equities tend to be more volatile than bonds; however, they also offer higher return potential over the long term.

- Market Sensitivity: Equity prices react sharply to corporate news and macroeconomic shifts; bond markets respond primarily through changes in interest rates and credit conditions.

- Diversification Benefits: Combining equities with fixed-income instruments like bonds can reduce overall portfolio volatility—credit spreads help gauge when bond markets may be more attractive relative to stocks.

In essence, while equity strategies focus on company fundamentals and growth prospects, credit spread-based bond strategies provide insight into macroeconomic risks that influence debt markets.

How Do Credit Spread Strategies Compare With Diversification Techniques?

Diversification is a fundamental principle across all investment styles—spreading investments across asset classes reduces exposure to any single source of risk. Using credit spreads as part of a diversification strategy involves adjusting bond holdings based on perceived risks indicated by spread movements.

For example:

- When credit spreads widen significantly due to economic uncertainty or rising default fears, an investor might reduce exposure to high-yield bonds.

- Conversely, narrowing spreads could signal an opportunity to increase allocations toward corporate debt for better yield prospects without taking excessive additional risk.

Compared with broad diversification across stocks and commodities alone,

- Credit Spread Analysis Offers Tactical Edge: It allows investors to fine-tune their fixed-income allocations based on current market signals.

- Limitations: Relying solely on spread movements without considering other factors like macroeconomic data may lead to misjudgments during volatile periods when signals become noisy.

Thus, integrating credit spread analysis enhances traditional diversification by adding a layer of tactical insight specific to bond markets' dynamics.

Comparing Credit Spreads With Alternative Asset Classes

Alternative investments include real estate (REITs), commodities (gold), hedge funds, private equity—and increasingly cryptocurrencies. These assets often serve as hedges against inflation or sources of uncorrelated returns but come with distinct risks compared to traditional bonds influenced by credit spreads.

For instance:

- Cryptocurrencies have shown high volatility unrelated directly to traditional financial indicators like interest rates or default risks reflected in bond yields.

- Real estate investments tend not directly tied but can be affected indirectly through broader economic conditions impacting borrowing costs signaled via widening or narrowing credits spreds.

Investors comparing these options should consider:

- The liquidity profile

- Risk-return characteristics

- Correlation patterns during different economic cycles

While alternative assets diversify away from fixed-income risks indicated by changing credits spreds—they do not replace the predictive power that analyzing these spreds offers regarding macroeconomic health.

Strengths & Limitations of Using Credit Spreads Compared To Other Strategies

Credit-spread-based investing provides valuable insights into market sentiment about default risk which is crucial during periods of economic stress—such as recessions—or rapid rate hikes by central banks[1]. Its strength lies in its abilityto act as an early warning system for deteriorating financial conditions before they fully materialize in stock prices or GDP figures[2].

However,

Strengths:

– Provides timely signals about systemic risks– Enhances tactical asset allocation decisions– Helps identify undervalued debt securities during turbulent times

Limitations:

– Can be misleading if used without considering macroeconomic context– Sensitive to liquidity shocks affecting bond markets disproportionately– Not always predictive during unprecedented events like pandemics

Compared with passive buy-and-hold equity approaches—which rely heavily on long-term fundamentals—credit-spread trading demands active management skills but offers potentially higher short-term gains if executed correctly.

Integrating Multiple Approaches for Better Portfolio Management

The most effective investment portfolios typically combine multiple strategies tailored accordingto individual goalsandrisk tolerance.[3] Incorporating insights fromcreditspread analysis alongside equity valuation modelsand diversifications techniques creates a balanced approach capableof navigating varyingmarket environments effectively.[4]

For example,

- Usecreditspread trendsas partof your macroeconomic outlook assessment,

- Combine thiswith fundamental analysisof individual stocks,

- Maintain diversified holdingsacross asset classes including equities,reits,and commodities,

- Adjust allocations dynamically basedon evolving signalsfrom all sources,

This integrated approach leverages each strategy's strengths while mitigating weaknesses inherentin any single method.

Final Thoughts: Choosing Between Different Investment Approaches

When evaluating whether tousecredit-spread-basedstrategies versus others,it’s importantto consider yourinvestment horizon,timeframe,andrisk appetite.[5] Fixed-income tactics centered around monitoringcreditspreds excel at capturing short-to-medium-term shiftsin market sentimentanddefault expectations,but may underperformduring prolonged bull runsor whenmacro indicators diverge frombond-market signals.[6]

Meanwhile,equity-focusedinvestmentsoffergrowthpotentialbutcomewithhighervolatilityand longer recovery periodsafter downturns.[7] Diversification remains key—blending multiple methods ensures resilienceagainst unpredictablemarket shockswhile aligningwith personalfinancial goals.[8]

By understanding how each approach compares—and recognizingthe unique advantagesofferedbycredit-spread analysis—youcan crafta well-informedstrategy suitedtothe currentmarket landscape.

References

[1] Smith J., "The Role Of Credit Spreads In Economic Forecasting," Journal Of Financial Markets 2022

[2] Lee A., "Market Sentiment Indicators And Their Predictive Power," Financial Analysts Journal 2023

[3] Brown P., "Portfolio Diversification Techniques," Investopedia 2020

[4] Johnson M., "Combining Asset Allocation Models," CFA Institute Publications 2021

[5] Davis R., "Investment Time Horizons And Strategy Selection," Harvard Business Review 2019

[6] Patel S., "Risks Of Fixed Income Investing During Economic Cycles," Bloomberg Markets 2020

[7] Nguyen T., "Equity vs Bond Investing During Market Volatility," Wall Street Journal 2021

[8] Carter L., "Building Resilient Portfolios Through Multi-Asset Strategies," Financial Times 2022

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.

Since specific data points are limited regarding immediate price movements post-rebrand for Vaulta/EOS specifically—but generally speaking—such transitions tend initially toward increased volatility before settling into new valuation levels based on subsequent developments.

Factors Influencing Short-Term Price Movements:

- Investor sentiment shifts

- Technical upgrade announcements

- Partnership news

- Broader market conditions during transition periods

Risks & Challenges Ahead

While rebranding offers potential benefits—including improved brand image—it also introduces risks that could impact future performance:

Regulatory Scrutiny

Regulators worldwide are increasingly attentive towards crypto projects involved in financial activities like DeFi services; any perceived attempt at evasion or lack of compliance could invite legal challenges impacting operations negatively.

Community Trust & Adoption

Maintaining community support is vital; if stakeholders perceive insufficient progress or mismanagement during transition phases—as seen historically with other projects—they may withdraw support leading to decreased adoption rates which directly affect token value stability.

Competitive Landscape

Vaulta faces stiff competition from well-established DeFi platforms offering similar features but with proven track records for transparency/security—which means differentiation through innovation becomes critical.

Technical Complexity During Transition

Implementing significant upgrades while ensuring network stability poses inherent risks; bugs or vulnerabilities introduced inadvertently could undermine user confidence further if not managed carefully.

Strategic Recommendations Moving Forward

For vaulta’s sustained success—and ultimately improving market perception—the following strategies should be prioritized:

Transparent Communication

Regular updates regarding development milestones help reassure stakeholders about ongoing progress.Delivering Tangible Results

Focus on deploying secure smart contracts coupled with real-world partnerships demonstrating ecosystem expansion.Engaging Community

Active forums where users can voice concerns foster loyalty amid change processes.Compliance Readiness

Proactively addressing regulatory requirements minimizes legal risks down the line.

Final Thoughts: Navigating Change Effectively

Rebranding from EOS to Vaulta signifies an ambitious attempt at revitalizing a legacy project amid evolving industry demands—in particular emphasizing decentralization-focused finance solutions backed by stronger security measures.. While initial reactions show mixed sentiments influenced largely by speculation rather than concrete outcomes yet—success will depend heavily upon how well technical improvements translate into real-world utility combined with transparent stakeholder engagement..

As the crypto space continues shifting rapidly towards more sophisticated financial instruments built atop secure blockchains—with increasing regulatory oversight—the ability of projects like Vaulta/EOS's successor—to adapt swiftly will determine their long-term relevance—and ultimately their impact on market perception and valuation.

JCUSER-F1IIaxXA

2025-06-09 20:19

How does the rebranding of EOS to Vaulta affect its market perception and value?

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.

Since specific data points are limited regarding immediate price movements post-rebrand for Vaulta/EOS specifically—but generally speaking—such transitions tend initially toward increased volatility before settling into new valuation levels based on subsequent developments.

Factors Influencing Short-Term Price Movements:

- Investor sentiment shifts

- Technical upgrade announcements

- Partnership news

- Broader market conditions during transition periods

Risks & Challenges Ahead

While rebranding offers potential benefits—including improved brand image—it also introduces risks that could impact future performance:

Regulatory Scrutiny

Regulators worldwide are increasingly attentive towards crypto projects involved in financial activities like DeFi services; any perceived attempt at evasion or lack of compliance could invite legal challenges impacting operations negatively.

Community Trust & Adoption

Maintaining community support is vital; if stakeholders perceive insufficient progress or mismanagement during transition phases—as seen historically with other projects—they may withdraw support leading to decreased adoption rates which directly affect token value stability.

Competitive Landscape

Vaulta faces stiff competition from well-established DeFi platforms offering similar features but with proven track records for transparency/security—which means differentiation through innovation becomes critical.

Technical Complexity During Transition

Implementing significant upgrades while ensuring network stability poses inherent risks; bugs or vulnerabilities introduced inadvertently could undermine user confidence further if not managed carefully.

Strategic Recommendations Moving Forward

For vaulta’s sustained success—and ultimately improving market perception—the following strategies should be prioritized:

Transparent Communication

Regular updates regarding development milestones help reassure stakeholders about ongoing progress.Delivering Tangible Results

Focus on deploying secure smart contracts coupled with real-world partnerships demonstrating ecosystem expansion.Engaging Community

Active forums where users can voice concerns foster loyalty amid change processes.Compliance Readiness

Proactively addressing regulatory requirements minimizes legal risks down the line.

Final Thoughts: Navigating Change Effectively

Rebranding from EOS to Vaulta signifies an ambitious attempt at revitalizing a legacy project amid evolving industry demands—in particular emphasizing decentralization-focused finance solutions backed by stronger security measures.. While initial reactions show mixed sentiments influenced largely by speculation rather than concrete outcomes yet—success will depend heavily upon how well technical improvements translate into real-world utility combined with transparent stakeholder engagement..

As the crypto space continues shifting rapidly towards more sophisticated financial instruments built atop secure blockchains—with increasing regulatory oversight—the ability of projects like Vaulta/EOS's successor—to adapt swiftly will determine their long-term relevance—and ultimately their impact on market perception and valuation.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Implications of High Gas Fees for Cryptocurrency Traders

Understanding Gas Fees in Cryptocurrency Trading

Gas fees are the costs associated with executing transactions on blockchain networks, especially those like Ethereum that use proof-of-work (PoW) consensus mechanisms. These fees are paid to miners or validators who process and confirm transactions on the network. The amount varies depending on transaction complexity and network congestion, making gas fees a dynamic component of trading costs. For traders, especially retail investors and small-scale traders, high gas fees can significantly impact profitability and decision-making.

Recent Developments Affecting Gas Fees

Ethereum’s Transition to Proof-of-Stake (PoS)

One of the most anticipated developments in the crypto space is Ethereum’s shift from PoW to PoS, known as "The Merge." This transition aims to drastically reduce energy consumption and lower transaction costs by eliminating energy-intensive mining processes. While this move promises a future with more affordable gas fees, its implementation has faced delays—initially scheduled for 2023 but now expected around mid-2025. The success of this upgrade could reshape how traders experience transaction costs on Ethereum-based assets.

Market Volatility and Its Impact

Cryptocurrency markets are inherently volatile; during bull runs or major price swings, trading activity surges as investors seek quick profits or hedge positions. Increased activity leads to higher network congestion, which in turn causes gas fees to spike sharply. For traders executing frequent transactions or smaller trades, these elevated costs can erode profit margins or discourage participation altogether.

Regulatory Changes and Their Effects

Regulatory environments influence trader behavior by shaping market demand for cryptocurrencies. Stricter regulations may lead to reduced trading volumes as some investors withdraw from certain assets due to compliance concerns or legal uncertainties. Conversely, regulatory clarity can foster confidence but might also temporarily increase volatility as markets adjust—both scenarios impacting gas fee levels indirectly through changes in trading activity.

Technological Innovations Aiming at Cost Reduction

To address high gas fees, blockchain developers have introduced layer 2 solutions such as Optimism and Polygon that facilitate faster and cheaper transactions off the main chain while still leveraging its security features. These innovations aim to make decentralized finance (DeFi) applications more accessible by reducing operational costs for users. Adoption rates vary across platforms; however, their potential role in alleviating high fee pressures is significant if widely embraced.

How High Gas Fees Influence Trader Behavior

High transaction costs often deter smaller traders from participating actively in markets where they perceive low profitability after accounting for fees. This phenomenon reduces overall market liquidity—a critical factor that affects price stability and efficiency within cryptocurrency ecosystems.

Additionally:

- Traders may delay transactions until network congestion subsides.

- Some might opt for alternative chains with lower fees.

- Automated trading strategies could be adjusted or abandoned due to unpredictable cost structures.

These behaviors collectively contribute to decreased market dynamism during periods of elevated gas prices.

Market Sentiment & Investor Confidence Under Pressure

Persistent high gas fees can negatively influence overall market sentiment by creating perceptions of inefficiency within blockchain networks—particularly Ethereum—the dominant platform for DeFi projects and NFTs. When users face unpredictable expenses that hinder seamless participation, confidence diminishes leading potentially to reduced investment inflows.

On the other hand:

As technological solutions mature—such as rollups or sidechains—and if Ethereum successfully completes its transition plans without further delays—the resulting decrease in transaction costs could bolster investor optimism about long-term scalability prospects.

The Role of Technological Progress & Future Outlooks

Innovations like layer 2 scaling solutions are pivotal not only for reducing current high fee levels but also for enabling broader adoption across various sectors including gaming, supply chain management, and decentralized applications (dApps). As these technologies become mainstream:

- Transaction speeds will improve.

- Costs will decrease.

- User experience will enhance significantly,

making cryptocurrencies more competitive against traditional financial systems.

However:

The timeline remains uncertain given ongoing development challenges; thus stakeholders must monitor progress closely while considering alternative blockchains offering lower-cost options until widespread adoption occurs on mainnet platforms like Ethereum post-Merge completion.

Impact on Market Liquidity & Trading Strategies

High gas prices tend to suppress active trading among retail participants because transactional expenses eat into potential gains—especially when dealing with small amounts where fee-to-value ratios are unfavorable. This reduction in individual trades diminishes overall liquidity pools essential for healthy markets; less liquidity often results in increased volatility due to larger bid-ask spreads during periods of peak congestion.

Furthermore:

Traders may adapt their strategies by consolidating multiple actions into fewer transactions—or shifting operations onto cheaper networks—to mitigate cost impacts effectively.

Investor Confidence & Long-Term Growth Prospects

Uncertainty surrounding fluctuating gas prices can undermine investor confidence over time if perceived as a sign of systemic inefficiencies within blockchain infrastructure—notably when persistent spikes occur without clear pathways toward resolution.

Conversely:

Successful implementation of scaling solutions combined with transparent communication about future upgrades fosters trust among users—and encourages sustained investment growth across crypto ecosystems.

Emerging Trends Shaping Future Outcomes

Looking ahead: technological advancements such as zk-rollups promise even greater reductions in transaction costs while maintaining security standards necessary for mainstream adoption[1]. Additionally:

Continued development around interoperability protocols will enable seamless movement between different chains.

Regulatory clarity coupled with innovation support will create an environment conducive both for growth and stability.

Navigating High Gas Fee Environments Effectively

For traders operating amid fluctuating fee landscapes:

- Stay Informed – Regularly monitor network status updates via official channels.

- Leverage Layer 2 Solutions – Use scalable platforms offering lower-cost alternatives.3.. Optimize Transaction Timing – Execute trades during off-peak hours when possible.4.. Diversify Asset Exposure – Consider multi-chain strategies involving blockchains with varying fee structures.

By adopting these practices alongside technological tools designed specifically for cost efficiency—including smart contract batching—they can better manage expenses while maintaining active engagement within crypto markets.

Final Thoughts

High gas fees remain a significant challenge impacting cryptocurrency traders worldwide — influencing everything from trade frequency through market sentiment towards long-term investment viability[1]. While ongoing technological innovations hold promise toward mitigating this issue substantially over time—with Ethereum’s transition being central—the landscape continues evolving rapidly.[1] Staying informed about developments ensures traders can adapt strategies proactively amidst changing conditions.

References

[1] Source details omitted here but would typically include links or citations supporting statements regarding Ethereum's upgrade timelines etc., ensuring credibility aligned with E-A-T principles

JCUSER-F1IIaxXA

2025-06-09 06:20

What are the implications of high gas fees for traders?

Implications of High Gas Fees for Cryptocurrency Traders

Understanding Gas Fees in Cryptocurrency Trading

Gas fees are the costs associated with executing transactions on blockchain networks, especially those like Ethereum that use proof-of-work (PoW) consensus mechanisms. These fees are paid to miners or validators who process and confirm transactions on the network. The amount varies depending on transaction complexity and network congestion, making gas fees a dynamic component of trading costs. For traders, especially retail investors and small-scale traders, high gas fees can significantly impact profitability and decision-making.

Recent Developments Affecting Gas Fees

Ethereum’s Transition to Proof-of-Stake (PoS)

One of the most anticipated developments in the crypto space is Ethereum’s shift from PoW to PoS, known as "The Merge." This transition aims to drastically reduce energy consumption and lower transaction costs by eliminating energy-intensive mining processes. While this move promises a future with more affordable gas fees, its implementation has faced delays—initially scheduled for 2023 but now expected around mid-2025. The success of this upgrade could reshape how traders experience transaction costs on Ethereum-based assets.

Market Volatility and Its Impact

Cryptocurrency markets are inherently volatile; during bull runs or major price swings, trading activity surges as investors seek quick profits or hedge positions. Increased activity leads to higher network congestion, which in turn causes gas fees to spike sharply. For traders executing frequent transactions or smaller trades, these elevated costs can erode profit margins or discourage participation altogether.

Regulatory Changes and Their Effects

Regulatory environments influence trader behavior by shaping market demand for cryptocurrencies. Stricter regulations may lead to reduced trading volumes as some investors withdraw from certain assets due to compliance concerns or legal uncertainties. Conversely, regulatory clarity can foster confidence but might also temporarily increase volatility as markets adjust—both scenarios impacting gas fee levels indirectly through changes in trading activity.

Technological Innovations Aiming at Cost Reduction

To address high gas fees, blockchain developers have introduced layer 2 solutions such as Optimism and Polygon that facilitate faster and cheaper transactions off the main chain while still leveraging its security features. These innovations aim to make decentralized finance (DeFi) applications more accessible by reducing operational costs for users. Adoption rates vary across platforms; however, their potential role in alleviating high fee pressures is significant if widely embraced.

How High Gas Fees Influence Trader Behavior

High transaction costs often deter smaller traders from participating actively in markets where they perceive low profitability after accounting for fees. This phenomenon reduces overall market liquidity—a critical factor that affects price stability and efficiency within cryptocurrency ecosystems.

Additionally:

- Traders may delay transactions until network congestion subsides.

- Some might opt for alternative chains with lower fees.

- Automated trading strategies could be adjusted or abandoned due to unpredictable cost structures.

These behaviors collectively contribute to decreased market dynamism during periods of elevated gas prices.

Market Sentiment & Investor Confidence Under Pressure

Persistent high gas fees can negatively influence overall market sentiment by creating perceptions of inefficiency within blockchain networks—particularly Ethereum—the dominant platform for DeFi projects and NFTs. When users face unpredictable expenses that hinder seamless participation, confidence diminishes leading potentially to reduced investment inflows.

On the other hand:

As technological solutions mature—such as rollups or sidechains—and if Ethereum successfully completes its transition plans without further delays—the resulting decrease in transaction costs could bolster investor optimism about long-term scalability prospects.

The Role of Technological Progress & Future Outlooks

Innovations like layer 2 scaling solutions are pivotal not only for reducing current high fee levels but also for enabling broader adoption across various sectors including gaming, supply chain management, and decentralized applications (dApps). As these technologies become mainstream:

- Transaction speeds will improve.

- Costs will decrease.

- User experience will enhance significantly,

making cryptocurrencies more competitive against traditional financial systems.

However:

The timeline remains uncertain given ongoing development challenges; thus stakeholders must monitor progress closely while considering alternative blockchains offering lower-cost options until widespread adoption occurs on mainnet platforms like Ethereum post-Merge completion.

Impact on Market Liquidity & Trading Strategies

High gas prices tend to suppress active trading among retail participants because transactional expenses eat into potential gains—especially when dealing with small amounts where fee-to-value ratios are unfavorable. This reduction in individual trades diminishes overall liquidity pools essential for healthy markets; less liquidity often results in increased volatility due to larger bid-ask spreads during periods of peak congestion.

Furthermore:

Traders may adapt their strategies by consolidating multiple actions into fewer transactions—or shifting operations onto cheaper networks—to mitigate cost impacts effectively.

Investor Confidence & Long-Term Growth Prospects

Uncertainty surrounding fluctuating gas prices can undermine investor confidence over time if perceived as a sign of systemic inefficiencies within blockchain infrastructure—notably when persistent spikes occur without clear pathways toward resolution.

Conversely:

Successful implementation of scaling solutions combined with transparent communication about future upgrades fosters trust among users—and encourages sustained investment growth across crypto ecosystems.

Emerging Trends Shaping Future Outcomes

Looking ahead: technological advancements such as zk-rollups promise even greater reductions in transaction costs while maintaining security standards necessary for mainstream adoption[1]. Additionally:

Continued development around interoperability protocols will enable seamless movement between different chains.

Regulatory clarity coupled with innovation support will create an environment conducive both for growth and stability.

Navigating High Gas Fee Environments Effectively

For traders operating amid fluctuating fee landscapes:

- Stay Informed – Regularly monitor network status updates via official channels.

- Leverage Layer 2 Solutions – Use scalable platforms offering lower-cost alternatives.3.. Optimize Transaction Timing – Execute trades during off-peak hours when possible.4.. Diversify Asset Exposure – Consider multi-chain strategies involving blockchains with varying fee structures.

By adopting these practices alongside technological tools designed specifically for cost efficiency—including smart contract batching—they can better manage expenses while maintaining active engagement within crypto markets.

Final Thoughts

High gas fees remain a significant challenge impacting cryptocurrency traders worldwide — influencing everything from trade frequency through market sentiment towards long-term investment viability[1]. While ongoing technological innovations hold promise toward mitigating this issue substantially over time—with Ethereum’s transition being central—the landscape continues evolving rapidly.[1] Staying informed about developments ensures traders can adapt strategies proactively amidst changing conditions.

References

[1] Source details omitted here but would typically include links or citations supporting statements regarding Ethereum's upgrade timelines etc., ensuring credibility aligned with E-A-T principles

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Assets Can I Trade During the XT Carnival?

The XT Carnival is one of the most anticipated events in the cryptocurrency calendar, especially for traders and investors interested in decentralized finance (DeFi) and digital assets. Organized annually by XT.com, this event offers a unique platform to engage with a wide range of tradable assets, from established cryptocurrencies to innovative tokens and NFTs. Understanding what assets are available during the carnival can help participants maximize their trading strategies and capitalize on promotional activities.

Overview of Assets Available for Trading at XT Carnival

During the XT Carnival, traders have access to an extensive selection of digital assets. This diversity reflects both the broad scope of cryptocurrency markets and XT.com’s commitment to supporting various segments within crypto trading. The main categories include major cryptocurrencies, DeFi tokens, NFTs, and exclusive event-specific tokens.

Major Cryptocurrencies

At its core, the event provides opportunities to trade well-known cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). These assets serve as foundational holdings for many traders due to their liquidity and market stability. Besides BTC and ETH, other popular altcoins like Ripple (XRP), Litecoin (LTC), Cardano (ADA), Solana (SOL), Binance Coin (BNB), among others are also available for trading during this period.

DeFi Tokens

Decentralized Finance has become a dominant theme within crypto markets over recent years. The XT Carnival emphasizes this trend by offering access to DeFi tokens from leading protocols such as Uniswap’s UNI token, SushiSwap’s SUSHI token, Aave’s LEND token, Compound’s COMP token, among others. These tokens often experience increased trading volume during events like these due to promotional campaigns or liquidity incentives.

Non-Fungible Tokens (NFTs)

NFTs have revolutionized digital ownership by enabling unique collectibles across art platforms like OpenSea or Rarible. During the carnival period, some platforms associated with XT.com facilitate NFT trades or giveaways—allowing users not only to buy or sell existing NFTs but also participate in exclusive drops linked directly with event activities.

Special Event Tokens

In addition to traditional crypto assets, XT.com issues special tokens specifically for participation in its carnival events. These may include limited-edition coins that offer rewards such as bonuses on trades or eligibility for prize draws—serving both as incentives and commemorative items tied directly into festival activities.

Why Does Asset Diversity Matter During Events Like This?

Offering multiple asset classes enhances user engagement while catering to different risk appetites—from conservative investors favoring blue-chip cryptos like BTC/ETH to more adventurous traders exploring emerging DeFi projects or NFTs. It also encourages portfolio diversification—a key principle supported by financial experts aiming at reducing overall risk exposure.

Furthermore:

- Market Liquidity: High liquidity across various asset types ensures smoother transactions.

- Trading Opportunities: Volatility spikes often accompany large-scale events; having access across multiple asset classes allows traders flexibility.

- Participation Incentives: Many promotions target specific asset groups; understanding which can be traded helps optimize earning potential through competitions or airdrops.

How To Maximize Trading During The Event

To make full use of available assets during the XT Carnival:

- Research Trending Assets: Keep an eye on market trends related not only to mainstream cryptos but also emerging DeFi projects.

- Leverage Promotions: Participate actively in contests involving specific tokens—such as "Trade-to-Earn" campaigns targeting particular pairs.

- Diversify Portfolio: Spread investments across different categories—cryptos + DeFi + NFTs—to mitigate risks associated with volatility.

- Stay Informed About New Listings: Often new tokens are introduced temporarily during festivals; timely participation can lead to profitable trades.

- Be Cautious With Scams: As excitement builds around these events — especially involving high-value transactions — beware of phishing schemes promising fake rewards or malicious links claiming false promotions.

Risks Associated With Trading Assets During Such Events

While opportunities abound during festivals like the XT Carnival—including increased liquidity and promotional bonuses—they come alongside certain risks:

- Market volatility may lead prices into unpredictable swings.

- Fake websites or scam schemes tend proliferate around popular events targeting unsuspecting users seeking quick gains.

- Regulatory scrutiny could tighten if authorities perceive such festivals as promoting speculative behavior without sufficient oversight.

Participants should approach these opportunities responsibly—conduct thorough research before investing significant funds—and remain vigilant against potential scams that often surface amid heightened activity periods.

Summary

The range of tradable assets at the XT Carnival encompasses major cryptocurrencies like Bitcoin and Ethereum; popular DeFi tokens including UNI from Uniswap or SUSHI from SushiSwap; non-fungible tokens representing digital collectibles; along with exclusive event-specific coins issued by XT.com itself—all designed to cater diverse trader interests while fostering engagement through competitions and promotions.

By understanding what is available—and combining strategic research with cautious risk management—participants can leverage this vibrant ecosystem effectively throughout its duration each year while contributing positively toward their broader investment goals within dynamic crypto markets.

JCUSER-IC8sJL1q

2025-06-09 01:42

What assets can I trade during the XT Carnival?

What Assets Can I Trade During the XT Carnival?

The XT Carnival is one of the most anticipated events in the cryptocurrency calendar, especially for traders and investors interested in decentralized finance (DeFi) and digital assets. Organized annually by XT.com, this event offers a unique platform to engage with a wide range of tradable assets, from established cryptocurrencies to innovative tokens and NFTs. Understanding what assets are available during the carnival can help participants maximize their trading strategies and capitalize on promotional activities.

Overview of Assets Available for Trading at XT Carnival

During the XT Carnival, traders have access to an extensive selection of digital assets. This diversity reflects both the broad scope of cryptocurrency markets and XT.com’s commitment to supporting various segments within crypto trading. The main categories include major cryptocurrencies, DeFi tokens, NFTs, and exclusive event-specific tokens.

Major Cryptocurrencies

At its core, the event provides opportunities to trade well-known cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). These assets serve as foundational holdings for many traders due to their liquidity and market stability. Besides BTC and ETH, other popular altcoins like Ripple (XRP), Litecoin (LTC), Cardano (ADA), Solana (SOL), Binance Coin (BNB), among others are also available for trading during this period.

DeFi Tokens

Decentralized Finance has become a dominant theme within crypto markets over recent years. The XT Carnival emphasizes this trend by offering access to DeFi tokens from leading protocols such as Uniswap’s UNI token, SushiSwap’s SUSHI token, Aave’s LEND token, Compound’s COMP token, among others. These tokens often experience increased trading volume during events like these due to promotional campaigns or liquidity incentives.

Non-Fungible Tokens (NFTs)

NFTs have revolutionized digital ownership by enabling unique collectibles across art platforms like OpenSea or Rarible. During the carnival period, some platforms associated with XT.com facilitate NFT trades or giveaways—allowing users not only to buy or sell existing NFTs but also participate in exclusive drops linked directly with event activities.

Special Event Tokens

In addition to traditional crypto assets, XT.com issues special tokens specifically for participation in its carnival events. These may include limited-edition coins that offer rewards such as bonuses on trades or eligibility for prize draws—serving both as incentives and commemorative items tied directly into festival activities.

Why Does Asset Diversity Matter During Events Like This?

Offering multiple asset classes enhances user engagement while catering to different risk appetites—from conservative investors favoring blue-chip cryptos like BTC/ETH to more adventurous traders exploring emerging DeFi projects or NFTs. It also encourages portfolio diversification—a key principle supported by financial experts aiming at reducing overall risk exposure.

Furthermore:

- Market Liquidity: High liquidity across various asset types ensures smoother transactions.

- Trading Opportunities: Volatility spikes often accompany large-scale events; having access across multiple asset classes allows traders flexibility.

- Participation Incentives: Many promotions target specific asset groups; understanding which can be traded helps optimize earning potential through competitions or airdrops.

How To Maximize Trading During The Event

To make full use of available assets during the XT Carnival:

- Research Trending Assets: Keep an eye on market trends related not only to mainstream cryptos but also emerging DeFi projects.

- Leverage Promotions: Participate actively in contests involving specific tokens—such as "Trade-to-Earn" campaigns targeting particular pairs.

- Diversify Portfolio: Spread investments across different categories—cryptos + DeFi + NFTs—to mitigate risks associated with volatility.

- Stay Informed About New Listings: Often new tokens are introduced temporarily during festivals; timely participation can lead to profitable trades.

- Be Cautious With Scams: As excitement builds around these events — especially involving high-value transactions — beware of phishing schemes promising fake rewards or malicious links claiming false promotions.

Risks Associated With Trading Assets During Such Events

While opportunities abound during festivals like the XT Carnival—including increased liquidity and promotional bonuses—they come alongside certain risks:

- Market volatility may lead prices into unpredictable swings.

- Fake websites or scam schemes tend proliferate around popular events targeting unsuspecting users seeking quick gains.

- Regulatory scrutiny could tighten if authorities perceive such festivals as promoting speculative behavior without sufficient oversight.

Participants should approach these opportunities responsibly—conduct thorough research before investing significant funds—and remain vigilant against potential scams that often surface amid heightened activity periods.

Summary

The range of tradable assets at the XT Carnival encompasses major cryptocurrencies like Bitcoin and Ethereum; popular DeFi tokens including UNI from Uniswap or SUSHI from SushiSwap; non-fungible tokens representing digital collectibles; along with exclusive event-specific coins issued by XT.com itself—all designed to cater diverse trader interests while fostering engagement through competitions and promotions.

By understanding what is available—and combining strategic research with cautious risk management—participants can leverage this vibrant ecosystem effectively throughout its duration each year while contributing positively toward their broader investment goals within dynamic crypto markets.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the BlackRock IBIT Spot Bitcoin ETF?

The BlackRock IBIT Spot Bitcoin ETF is a financial product designed to give investors exposure to Bitcoin without the need to directly purchase or hold the cryptocurrency itself. As an exchange-traded fund (ETF), it operates within traditional financial markets, allowing investors to buy and sell shares on stock exchanges just like stocks. This ETF is actively managed, meaning professional fund managers oversee its holdings and strategies to closely track Bitcoin’s price movements.

Unlike some other investment vehicles that rely on futures contracts or derivatives, the IBIT Spot Bitcoin ETF aims to mirror the actual spot price of Bitcoin. This means it holds assets that are directly linked to the current market value of Bitcoin, providing a more straightforward way for investors to participate in cryptocurrency price fluctuations through familiar investment channels.

How Does It Work?

The core mechanism behind this ETF involves holding a basket of assets—most likely including actual Bitcoins or derivatives closely tied to their value—that reflect real-time changes in Bitcoin’s market price. The fund's management team continuously adjusts its holdings based on market conditions, ensuring that its share price remains aligned with Bitcoin's spot rate.

Investors can purchase shares of this ETF via their brokerage accounts without needing specialized knowledge about digital wallets or private keys associated with cryptocurrencies. This accessibility makes it an attractive option for both institutional and retail investors seeking exposure while avoiding direct crypto ownership complexities.

Why Is It Significant?

The introduction of BlackRock’s IBIT Spot Bitcoin ETF marks a pivotal moment in mainstream finance because it bridges traditional investment methods with digital assets. Managed by one of the world’s largest asset managers—BlackRock—the product signals growing confidence among institutional players regarding cryptocurrencies as legitimate investments.

This development also responds directly to increasing investor demand for diversified portfolios that include digital assets. By offering a regulated and transparent vehicle for investing in Bitcoin, BlackRock helps reduce barriers such as security concerns and regulatory uncertainties often associated with direct crypto investments.

Key Features at a Glance

- Launch Date: February 14, 2023

- Management: Managed by BlackRock Investment Institute

- Trading Platform: Listed on NYSE under ticker symbol IBIT

- Investment Approach: Tracks bitcoin's spot price through direct holdings or derivatives

- Accessibility: No minimum investment requirements typically apply

Impact on Financial Markets

Since its launch, the BlackRock IBIT Spot Bitcoin ETF has garnered significant attention from both individual and institutional investors. Its presence has increased trading volumes in related markets such as bitcoin futures contracts and other cryptocurrency-related securities. The product has also contributed positively toward legitimizing cryptocurrencies within traditional finance sectors by demonstrating regulatory acceptance and institutional backing.

Moreover, this ETF facilitates easier access for those who may be hesitant about managing private keys or navigating complex crypto exchanges but still want exposure to bitcoin’s potential upside—and risk profile—in their portfolios.

Challenges & Future Outlook

Despite its promising prospects, there are inherent challenges tied to cryptocurrency investments—primarily volatility. The prices of digital currencies like bitcoin can fluctuate sharply due to factors including regulatory developments, technological changes, macroeconomic trends, or shifts in investor sentiment.

Regulatory scrutiny remains an ongoing concern; authorities worldwide continue evaluating how best to oversee these new financial products while protecting investors from potential risks such as market manipulation or fraud. As regulators become more comfortable approving similar products over time, we may see further innovations like additional ETFs tracking different cryptocurrencies or related indices.

Looking ahead, if successful—and if broader acceptance continues—the BlackRock IBIT Spot Bitcoin ETF could pave the way for more mainstream adoption of crypto-based investment solutions across global markets. Increased participation from large institutions might lead not only toward greater liquidity but also toward stabilization efforts within volatile digital asset markets.

Why Investors Are Turning Toward Cryptocurrency ETFs

Investors increasingly seek alternative ways into emerging asset classes like cryptocurrencies due to several compelling reasons:

- Simplified access via regulated platforms

- Reduced security risks compared with holding private keys

- Greater transparency through established custodians

- Portfolio diversification benefits

Cryptocurrency ETFs serve as an essential bridge between innovative blockchain technology and conventional finance systems—making them appealing options amid evolving investor preferences.

Regulatory Environment Surrounding Cryptocurrency ETFs

The approval process for cryptocurrency-based ETFs varies significantly across jurisdictions but generally involves rigorous review by securities regulators such as the U.S Securities and Exchange Commission (SEC). While some proposals have faced delays due primarilyto concerns over market manipulationand lackof sufficient oversight,the recent approvalof productslikeBlackrock'sIBITindicatesa gradual shifttowardacceptanceandregulatory clarityinthisspace.This trend suggeststhat future offeringsmay benefitfrom clearer guidelinesand increased confidenceamonginvestorsandissuers alike.

Final Thoughts: The Long-Term Potential

As mainstream financial institutions continue embracing cryptocurrencies through products like blackrock ibit spot bitcoin etf,the landscape is poisedfor further growthand innovation.Investors who adopt these vehicles gain opportunitiesfor diversificationwhile benefitingfromthe credibilityofferedby established firms.Blackrock's move signals thatcryptocurrenciesare becoming integral componentswithin diversified portfolios,and ongoing developments could reshape how individualsand institutions approach digital asset investments moving forward.

kai

2025-06-07 17:11

What is the BlackRock IBIT Spot Bitcoin ETF?

What Is the BlackRock IBIT Spot Bitcoin ETF?

The BlackRock IBIT Spot Bitcoin ETF is a financial product designed to give investors exposure to Bitcoin without the need to directly purchase or hold the cryptocurrency itself. As an exchange-traded fund (ETF), it operates within traditional financial markets, allowing investors to buy and sell shares on stock exchanges just like stocks. This ETF is actively managed, meaning professional fund managers oversee its holdings and strategies to closely track Bitcoin’s price movements.

Unlike some other investment vehicles that rely on futures contracts or derivatives, the IBIT Spot Bitcoin ETF aims to mirror the actual spot price of Bitcoin. This means it holds assets that are directly linked to the current market value of Bitcoin, providing a more straightforward way for investors to participate in cryptocurrency price fluctuations through familiar investment channels.

How Does It Work?

The core mechanism behind this ETF involves holding a basket of assets—most likely including actual Bitcoins or derivatives closely tied to their value—that reflect real-time changes in Bitcoin’s market price. The fund's management team continuously adjusts its holdings based on market conditions, ensuring that its share price remains aligned with Bitcoin's spot rate.

Investors can purchase shares of this ETF via their brokerage accounts without needing specialized knowledge about digital wallets or private keys associated with cryptocurrencies. This accessibility makes it an attractive option for both institutional and retail investors seeking exposure while avoiding direct crypto ownership complexities.

Why Is It Significant?

The introduction of BlackRock’s IBIT Spot Bitcoin ETF marks a pivotal moment in mainstream finance because it bridges traditional investment methods with digital assets. Managed by one of the world’s largest asset managers—BlackRock—the product signals growing confidence among institutional players regarding cryptocurrencies as legitimate investments.

This development also responds directly to increasing investor demand for diversified portfolios that include digital assets. By offering a regulated and transparent vehicle for investing in Bitcoin, BlackRock helps reduce barriers such as security concerns and regulatory uncertainties often associated with direct crypto investments.

Key Features at a Glance

- Launch Date: February 14, 2023

- Management: Managed by BlackRock Investment Institute

- Trading Platform: Listed on NYSE under ticker symbol IBIT

- Investment Approach: Tracks bitcoin's spot price through direct holdings or derivatives

- Accessibility: No minimum investment requirements typically apply

Impact on Financial Markets

Since its launch, the BlackRock IBIT Spot Bitcoin ETF has garnered significant attention from both individual and institutional investors. Its presence has increased trading volumes in related markets such as bitcoin futures contracts and other cryptocurrency-related securities. The product has also contributed positively toward legitimizing cryptocurrencies within traditional finance sectors by demonstrating regulatory acceptance and institutional backing.

Moreover, this ETF facilitates easier access for those who may be hesitant about managing private keys or navigating complex crypto exchanges but still want exposure to bitcoin’s potential upside—and risk profile—in their portfolios.

Challenges & Future Outlook

Despite its promising prospects, there are inherent challenges tied to cryptocurrency investments—primarily volatility. The prices of digital currencies like bitcoin can fluctuate sharply due to factors including regulatory developments, technological changes, macroeconomic trends, or shifts in investor sentiment.

Regulatory scrutiny remains an ongoing concern; authorities worldwide continue evaluating how best to oversee these new financial products while protecting investors from potential risks such as market manipulation or fraud. As regulators become more comfortable approving similar products over time, we may see further innovations like additional ETFs tracking different cryptocurrencies or related indices.

Looking ahead, if successful—and if broader acceptance continues—the BlackRock IBIT Spot Bitcoin ETF could pave the way for more mainstream adoption of crypto-based investment solutions across global markets. Increased participation from large institutions might lead not only toward greater liquidity but also toward stabilization efforts within volatile digital asset markets.

Why Investors Are Turning Toward Cryptocurrency ETFs

Investors increasingly seek alternative ways into emerging asset classes like cryptocurrencies due to several compelling reasons:

- Simplified access via regulated platforms