How Can Machine Learning Algorithms Classify Chart Patterns?

Machine learning has transformed many industries, and financial markets are no exception. One of the most promising applications is in classifying chart patterns—visual representations of price movements that traders rely on for decision-making. Understanding how machine learning algorithms can identify and categorize these patterns offers insights into the future of automated trading and technical analysis.

What Are Chart Pattern Classifications?

Chart pattern classification involves using advanced algorithms to analyze financial charts—such as candlestick or line graphs—and automatically recognize specific formations like head and shoulders, double tops/bottoms, flags, or triangles. These patterns often signal potential trend reversals or continuations, guiding traders on when to buy or sell assets.

Traditionally, human analysts interpret these visual cues based on experience. However, manual analysis can be subjective and time-consuming. Machine learning automates this process by training models to detect subtle features within chart data rapidly and with high accuracy.

The Role of Machine Learning in Financial Market Analysis

The integration of machine learning into finance isn't new but has gained momentum due to increased computational power and data availability. Early efforts focused on simple models; today’s deep learning techniques enable complex pattern recognition akin to image processing tasks.

In cryptocurrency markets—characterized by high volatility and rapid price changes—the need for real-time analysis makes machine learning especially valuable. Automated systems can process vast amounts of historical data quickly, providing timely signals that might be missed through manual analysis.

Types of Machine Learning Algorithms Used in Chart Pattern Recognition

Different types of machine learning approaches serve various purposes in pattern classification:

Supervised Learning: This method trains models using labeled datasets where each chart is tagged with its corresponding pattern type (e.g., bullish flag). Once trained, the model can classify new charts based on learned features.

Unsupervised Learning: Here, algorithms like clustering group similar patterns without predefined labels. This approach helps discover new or rare formations that may not fit traditional categories.

Reinforcement Learning: Models learn optimal trading strategies through trial-and-error interactions with market environments rather than static datasets. They adapt over time to maximize profits based on feedback signals.

Popular Techniques & Architectures

Convolutional Neural Networks (CNNs): Originally designed for image recognition tasks, CNNs excel at analyzing visual data such as chart images—they identify edges, shapes, and textures indicative of specific patterns.

Recurrent Neural Networks (RNNs): Suitable for sequential data like time series; RNNs analyze the order-dependent nature of price movements over time.

Gradient Boosting Machines (GBMs): Ensemble methods combining multiple weak classifiers; effective for structured tabular data derived from technical indicators alongside raw chart images.

Challenges Faced by Machine Learning Models

Despite their advantages, deploying machine learning for chart pattern classification comes with hurdles:

Data Quality & Noise: Financial market data often contains noise due to random fluctuations or incomplete records which can mislead models if not properly preprocessed.

Overfitting Risks: Complex models might memorize training examples rather than generalize well across unseen data—a problem known as overfitting—which reduces predictive reliability during live trading.

Regulatory Considerations: As automated strategies become more prevalent, compliance with legal frameworks becomes critical—especially regarding transparency and fairness in algorithmic decision-making.

Recent Advances Enhancing Pattern Recognition Accuracy

Recent developments have significantly improved how effectively machines classify chart patterns:

Deep neural networks incorporating attention mechanisms allow models to focus selectively on relevant parts of a chart image or sequence.

Transformer architectures—originally popularized in natural language processing—are now being adapted for financial time-series analysis due to their ability to capture long-term dependencies within market data.

Combining multiple analytical tools such as sentiment analysis from news feeds alongside technical indicators creates more holistic trading signals driven by comprehensive AI systems.

Open-source frameworks like TensorFlow and PyTorch have democratized access so researchers worldwide can develop sophisticated models without starting from scratch—all contributing toward faster innovation cycles in this domain.

Impact & Future Outlook

The widespread adoption of machine learning-based classification could influence overall market efficiency by reducing information asymmetry among traders who leverage these tools extensively. While this democratization enhances transparency overall—it also raises concerns about potential market manipulation if used irresponsibly.

Automation may lead some roles traditionally performed manually by analysts becoming obsolete; however—as with any technological shift—it also opens opportunities for professionals skilled at developing advanced AI-driven strategies.

Regulators are increasingly scrutinizing algorithmic trading practices; ensuring ethical standards remain vital as AI's role expands within financial ecosystems.

Key Takeaways:

- Machine learning automates identification/classification of complex chart formations

- Deep architectures like CNNs/RNNs improve detection accuracy

- Challenges include noisy datasets & overfitting risks

- Recent innovations involve attention mechanisms & transformer-based models

- Widespread use impacts market dynamics & regulatory landscape

By understanding how these intelligent systems work behind the scenes—from training neural networks on historical charts to deploying them live—you gain a clearer picture of modern technical analysis's future trajectory—and how it continues transforming investment strategies worldwide.

Semantic Keywords:

machine learning finance | stock/chart pattern recognition | deep neural networks trading | automated technical analysis | AI cryptocurrency markets | supervised vs unsupervised ML | reinforcement learning trading strategies

kai

2025-05-09 21:30

How can machine learning algorithms classify chart patterns?

How Can Machine Learning Algorithms Classify Chart Patterns?

Machine learning has transformed many industries, and financial markets are no exception. One of the most promising applications is in classifying chart patterns—visual representations of price movements that traders rely on for decision-making. Understanding how machine learning algorithms can identify and categorize these patterns offers insights into the future of automated trading and technical analysis.

What Are Chart Pattern Classifications?

Chart pattern classification involves using advanced algorithms to analyze financial charts—such as candlestick or line graphs—and automatically recognize specific formations like head and shoulders, double tops/bottoms, flags, or triangles. These patterns often signal potential trend reversals or continuations, guiding traders on when to buy or sell assets.

Traditionally, human analysts interpret these visual cues based on experience. However, manual analysis can be subjective and time-consuming. Machine learning automates this process by training models to detect subtle features within chart data rapidly and with high accuracy.

The Role of Machine Learning in Financial Market Analysis

The integration of machine learning into finance isn't new but has gained momentum due to increased computational power and data availability. Early efforts focused on simple models; today’s deep learning techniques enable complex pattern recognition akin to image processing tasks.

In cryptocurrency markets—characterized by high volatility and rapid price changes—the need for real-time analysis makes machine learning especially valuable. Automated systems can process vast amounts of historical data quickly, providing timely signals that might be missed through manual analysis.

Types of Machine Learning Algorithms Used in Chart Pattern Recognition

Different types of machine learning approaches serve various purposes in pattern classification:

Supervised Learning: This method trains models using labeled datasets where each chart is tagged with its corresponding pattern type (e.g., bullish flag). Once trained, the model can classify new charts based on learned features.

Unsupervised Learning: Here, algorithms like clustering group similar patterns without predefined labels. This approach helps discover new or rare formations that may not fit traditional categories.

Reinforcement Learning: Models learn optimal trading strategies through trial-and-error interactions with market environments rather than static datasets. They adapt over time to maximize profits based on feedback signals.

Popular Techniques & Architectures

Convolutional Neural Networks (CNNs): Originally designed for image recognition tasks, CNNs excel at analyzing visual data such as chart images—they identify edges, shapes, and textures indicative of specific patterns.

Recurrent Neural Networks (RNNs): Suitable for sequential data like time series; RNNs analyze the order-dependent nature of price movements over time.

Gradient Boosting Machines (GBMs): Ensemble methods combining multiple weak classifiers; effective for structured tabular data derived from technical indicators alongside raw chart images.

Challenges Faced by Machine Learning Models

Despite their advantages, deploying machine learning for chart pattern classification comes with hurdles:

Data Quality & Noise: Financial market data often contains noise due to random fluctuations or incomplete records which can mislead models if not properly preprocessed.

Overfitting Risks: Complex models might memorize training examples rather than generalize well across unseen data—a problem known as overfitting—which reduces predictive reliability during live trading.

Regulatory Considerations: As automated strategies become more prevalent, compliance with legal frameworks becomes critical—especially regarding transparency and fairness in algorithmic decision-making.

Recent Advances Enhancing Pattern Recognition Accuracy

Recent developments have significantly improved how effectively machines classify chart patterns:

Deep neural networks incorporating attention mechanisms allow models to focus selectively on relevant parts of a chart image or sequence.

Transformer architectures—originally popularized in natural language processing—are now being adapted for financial time-series analysis due to their ability to capture long-term dependencies within market data.

Combining multiple analytical tools such as sentiment analysis from news feeds alongside technical indicators creates more holistic trading signals driven by comprehensive AI systems.

Open-source frameworks like TensorFlow and PyTorch have democratized access so researchers worldwide can develop sophisticated models without starting from scratch—all contributing toward faster innovation cycles in this domain.

Impact & Future Outlook

The widespread adoption of machine learning-based classification could influence overall market efficiency by reducing information asymmetry among traders who leverage these tools extensively. While this democratization enhances transparency overall—it also raises concerns about potential market manipulation if used irresponsibly.

Automation may lead some roles traditionally performed manually by analysts becoming obsolete; however—as with any technological shift—it also opens opportunities for professionals skilled at developing advanced AI-driven strategies.

Regulators are increasingly scrutinizing algorithmic trading practices; ensuring ethical standards remain vital as AI's role expands within financial ecosystems.

Key Takeaways:

- Machine learning automates identification/classification of complex chart formations

- Deep architectures like CNNs/RNNs improve detection accuracy

- Challenges include noisy datasets & overfitting risks

- Recent innovations involve attention mechanisms & transformer-based models

- Widespread use impacts market dynamics & regulatory landscape

By understanding how these intelligent systems work behind the scenes—from training neural networks on historical charts to deploying them live—you gain a clearer picture of modern technical analysis's future trajectory—and how it continues transforming investment strategies worldwide.

Semantic Keywords:

machine learning finance | stock/chart pattern recognition | deep neural networks trading | automated technical analysis | AI cryptocurrency markets | supervised vs unsupervised ML | reinforcement learning trading strategies

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are Common Crypto Scams? An In-Depth Overview

Cryptocurrency has revolutionized the financial landscape, offering new opportunities for investment and innovation. However, this rapidly evolving market also attracts scammers who exploit investors’ lack of awareness or security measures. Understanding the most common crypto scams—such as rug pulls, phishing attacks, and Ponzi schemes—is essential for anyone involved in digital assets. This article provides a comprehensive overview of these scams, their mechanisms, recent developments, and how to protect yourself.

Rug Pulls: The Sudden Disappearance of Promising Projects

A rug pull is a type of scam where developers create a new cryptocurrency project or token with attractive features but then abruptly abandon it after attracting investor funds. Typically, scammers will hype up their project through social media or online communities to generate interest and investment. Once enough capital is gathered—often from unsuspecting retail investors—the developers withdraw all liquidity or sell off their holdings en masse, causing the token’s value to crash.

This scam often targets lesser-known cryptocurrencies that lack rigorous security audits or active community oversight. The allure lies in promises of high returns with minimal risk; however, once the developers disappear with investor funds—sometimes amounting to hundreds of millions—they leave behind worthless tokens.

Recent high-profile incidents include the infamous Poly Network hack in 2022 where over $600 million was stolen by hackers exploiting vulnerabilities rather than traditional rug pull tactics. While not always classified strictly as rug pulls, such exploits highlight how malicious actors can cause significant financial damage within crypto ecosystems.

Investors should exercise caution by researching projects thoroughly before investing and avoiding tokens without transparent development teams or clear use cases.

Phishing Attacks: Deceiving Users into Revealing Sensitive Data

Phishing remains one of the most prevalent threats in cryptocurrency security today. It involves cybercriminals masquerading as legitimate entities—such as exchanges like Coinbase or popular wallet providers—to trick users into revealing private keys, login credentials, or seed phrases.

These scams often take place via fake websites that mimic official platforms closely enough to deceive even experienced users. Attackers may send convincing emails containing links directing victims to these counterfeit sites or use social media messages that appear trustworthy but are designed solely for data theft.

In recent years—including 2023—the sophistication level of phishing attacks has increased significantly with AI-generated content and deepfake videos making scams more convincing than ever before. Cybercriminals also leverage fake apps on app stores that look identical to genuine ones but are designed solely for stealing user information upon installation.

The consequences can be severe: stolen cryptocurrencies can be transferred instantly once attackers gain access; additionally, compromised accounts may lead to further identity theft issues beyond just financial loss.

To mitigate risks:

- Always verify URLs before entering sensitive information.

- Enable two-factor authentication (2FA) on your accounts.

- Be cautious about unsolicited messages requesting personal data.

- Use reputable security tools like password managers and anti-phishing extensions.

Ponzi Schemes: Unsustainable Investment Promises

Ponzi schemes are fraudulent investment operations promising high returns over short periods without actual profit-generating activities backing those promises. Instead of earning profits from legitimate business ventures—or blockchain-based innovations—these schemes pay existing investors using funds contributed by new participants until they inevitably collapse when recruitment slows down.

In the context of cryptocurrencies:

- Many Ponzi schemes promise unrealistic gains through trading bots or “guaranteed” investments.

- Some have been disguised as NFT projects promising rapid appreciation.

Recent examples include several uncovered schemes in 2024 involving NFT collections claiming extraordinary returns which proved unsustainable upon investigation by authorities and industry watchdogs alike.

The fallout from Ponzi schemes extends beyond individual losses; they erode trust within the broader crypto ecosystem and discourage genuine innovation due to skepticism among potential investors who have been burned previously.

Key Indicators That Might Signal a Scam

To avoid falling victim:

- Be wary if an investment guarantees unusually high returns with little risk.

- Check whether there’s transparency about how profits are generated.

- Investigate whether there’s an active community discussing legitimacy.

Understanding these warning signs helps safeguard your investments against falling prey to fraudulent operations posing as legitimate opportunities.

Recent Developments Highlighting Crypto Scam Risks

The landscape continues evolving rapidly amid increasing sophistication among cybercriminals:

Major Data Breaches

In May 2025—a significant event involved Coinbase disclosing a data breach where cybercriminals bribed overseas support agents into stealing sensitive customer information[1]. Such breaches expose vulnerabilities even within reputable exchanges known for robust security measures emphasizing industry-wide risks associated with centralized platforms handling vast amounts of user data.

Industry Response & Security Enhancements

Recognizing these threats:

- Google released Android 16 updates featuring advanced security protocols aimed at combating cryptocurrency fraud[2].

These developments reflect ongoing efforts across sectors—from tech giants like Google implementing enhanced protections—to better defend users against emerging threats such as phishing campaigns and malware targeting digital wallets.

The Importance Of Vigilance

As scams become more sophisticated—with AI-driven tactics becoming commonplace—it’s crucial for users not only rely on technological safeguards but also stay informed about current scam trends through trusted sources like cybersecurity advisories issued by industry leaders.

How To Protect Yourself From Crypto Scams

Being proactive is key when navigating the volatile world of cryptocurrencies:

Educate Yourself: Stay updated on common scam techniques via reputable sources such as official exchange blogs or cybersecurity organizations’ reports.

Use Secure Platforms: Only transact through well-known exchanges with strong reputations for security practices—including regular audits—and enable all available safety features (e.g., two-factor authentication).

Verify Before Acting: Always double-check website URLs; avoid clicking links from unsolicited emails; confirm authenticity directly via official channels rather than third-party messages unless verified independently .

Secure Your Private Keys: Never share seed phrases nor store them insecurely—in physical form if possible—and consider hardware wallets for long-term storage instead of keeping assets online vulnerable to hacking attempts .

Stay Alert For Red Flags: Be suspicious if an offer sounds too good-to-be-real; watch out for urgent language pressuring quick decisions; scrutinize project backgrounds thoroughly before investing.

By understanding common crypto scams such as rug pulls, phishing attacks,and Ponzi schemes—and recognizing recent developments—you can better navigate this dynamic environment safely while contributing positively toward building trustworthiness within blockchain communities.

References

- Coinbase offers bounty after data breach exposes sensitive customer information.

- Google showcases Android 16 with enhanced security features.

Note: Always consult multiple sources when researching specific incidents related to cybersecurity threats in cryptocurrency markets since threat landscapes evolve rapidly.*

Lo

2025-05-23 00:44

What are common crypto scams—rug pulls, phishing, Ponzi schemes?

What Are Common Crypto Scams? An In-Depth Overview

Cryptocurrency has revolutionized the financial landscape, offering new opportunities for investment and innovation. However, this rapidly evolving market also attracts scammers who exploit investors’ lack of awareness or security measures. Understanding the most common crypto scams—such as rug pulls, phishing attacks, and Ponzi schemes—is essential for anyone involved in digital assets. This article provides a comprehensive overview of these scams, their mechanisms, recent developments, and how to protect yourself.

Rug Pulls: The Sudden Disappearance of Promising Projects

A rug pull is a type of scam where developers create a new cryptocurrency project or token with attractive features but then abruptly abandon it after attracting investor funds. Typically, scammers will hype up their project through social media or online communities to generate interest and investment. Once enough capital is gathered—often from unsuspecting retail investors—the developers withdraw all liquidity or sell off their holdings en masse, causing the token’s value to crash.

This scam often targets lesser-known cryptocurrencies that lack rigorous security audits or active community oversight. The allure lies in promises of high returns with minimal risk; however, once the developers disappear with investor funds—sometimes amounting to hundreds of millions—they leave behind worthless tokens.

Recent high-profile incidents include the infamous Poly Network hack in 2022 where over $600 million was stolen by hackers exploiting vulnerabilities rather than traditional rug pull tactics. While not always classified strictly as rug pulls, such exploits highlight how malicious actors can cause significant financial damage within crypto ecosystems.

Investors should exercise caution by researching projects thoroughly before investing and avoiding tokens without transparent development teams or clear use cases.

Phishing Attacks: Deceiving Users into Revealing Sensitive Data

Phishing remains one of the most prevalent threats in cryptocurrency security today. It involves cybercriminals masquerading as legitimate entities—such as exchanges like Coinbase or popular wallet providers—to trick users into revealing private keys, login credentials, or seed phrases.

These scams often take place via fake websites that mimic official platforms closely enough to deceive even experienced users. Attackers may send convincing emails containing links directing victims to these counterfeit sites or use social media messages that appear trustworthy but are designed solely for data theft.

In recent years—including 2023—the sophistication level of phishing attacks has increased significantly with AI-generated content and deepfake videos making scams more convincing than ever before. Cybercriminals also leverage fake apps on app stores that look identical to genuine ones but are designed solely for stealing user information upon installation.

The consequences can be severe: stolen cryptocurrencies can be transferred instantly once attackers gain access; additionally, compromised accounts may lead to further identity theft issues beyond just financial loss.

To mitigate risks:

- Always verify URLs before entering sensitive information.

- Enable two-factor authentication (2FA) on your accounts.

- Be cautious about unsolicited messages requesting personal data.

- Use reputable security tools like password managers and anti-phishing extensions.

Ponzi Schemes: Unsustainable Investment Promises

Ponzi schemes are fraudulent investment operations promising high returns over short periods without actual profit-generating activities backing those promises. Instead of earning profits from legitimate business ventures—or blockchain-based innovations—these schemes pay existing investors using funds contributed by new participants until they inevitably collapse when recruitment slows down.

In the context of cryptocurrencies:

- Many Ponzi schemes promise unrealistic gains through trading bots or “guaranteed” investments.

- Some have been disguised as NFT projects promising rapid appreciation.

Recent examples include several uncovered schemes in 2024 involving NFT collections claiming extraordinary returns which proved unsustainable upon investigation by authorities and industry watchdogs alike.

The fallout from Ponzi schemes extends beyond individual losses; they erode trust within the broader crypto ecosystem and discourage genuine innovation due to skepticism among potential investors who have been burned previously.

Key Indicators That Might Signal a Scam

To avoid falling victim:

- Be wary if an investment guarantees unusually high returns with little risk.

- Check whether there’s transparency about how profits are generated.

- Investigate whether there’s an active community discussing legitimacy.

Understanding these warning signs helps safeguard your investments against falling prey to fraudulent operations posing as legitimate opportunities.

Recent Developments Highlighting Crypto Scam Risks

The landscape continues evolving rapidly amid increasing sophistication among cybercriminals:

Major Data Breaches

In May 2025—a significant event involved Coinbase disclosing a data breach where cybercriminals bribed overseas support agents into stealing sensitive customer information[1]. Such breaches expose vulnerabilities even within reputable exchanges known for robust security measures emphasizing industry-wide risks associated with centralized platforms handling vast amounts of user data.

Industry Response & Security Enhancements

Recognizing these threats:

- Google released Android 16 updates featuring advanced security protocols aimed at combating cryptocurrency fraud[2].

These developments reflect ongoing efforts across sectors—from tech giants like Google implementing enhanced protections—to better defend users against emerging threats such as phishing campaigns and malware targeting digital wallets.

The Importance Of Vigilance

As scams become more sophisticated—with AI-driven tactics becoming commonplace—it’s crucial for users not only rely on technological safeguards but also stay informed about current scam trends through trusted sources like cybersecurity advisories issued by industry leaders.

How To Protect Yourself From Crypto Scams

Being proactive is key when navigating the volatile world of cryptocurrencies:

Educate Yourself: Stay updated on common scam techniques via reputable sources such as official exchange blogs or cybersecurity organizations’ reports.

Use Secure Platforms: Only transact through well-known exchanges with strong reputations for security practices—including regular audits—and enable all available safety features (e.g., two-factor authentication).

Verify Before Acting: Always double-check website URLs; avoid clicking links from unsolicited emails; confirm authenticity directly via official channels rather than third-party messages unless verified independently .

Secure Your Private Keys: Never share seed phrases nor store them insecurely—in physical form if possible—and consider hardware wallets for long-term storage instead of keeping assets online vulnerable to hacking attempts .

Stay Alert For Red Flags: Be suspicious if an offer sounds too good-to-be-real; watch out for urgent language pressuring quick decisions; scrutinize project backgrounds thoroughly before investing.

By understanding common crypto scams such as rug pulls, phishing attacks,and Ponzi schemes—and recognizing recent developments—you can better navigate this dynamic environment safely while contributing positively toward building trustworthiness within blockchain communities.

References

- Coinbase offers bounty after data breach exposes sensitive customer information.

- Google showcases Android 16 with enhanced security features.

Note: Always consult multiple sources when researching specific incidents related to cybersecurity threats in cryptocurrency markets since threat landscapes evolve rapidly.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📣 Limited benefit for new trading pair! Listing $DAM/USDT Futures trading with 50% off trading fees for 10 days! 🎉

🔥 To celebrate the official launch of $DAM-USDT futures, #JuCoin offers a special promotion: Users who trade $DAM/USDT Futures during the event will enjoy a 50% off trading fee for 10 days!

⏰ Time: 19:30 18/08/2025 – 19:30 28/08/2025 (UTC+7)

👉 Register for JuCoin now: https://bit.ly/3BVxlZ2

👉 Details: https://support.jucoin.blog/hc/en-001/articles/49893231322009

#JuCoin #JuCoinVietnam #DAM #JuCoinTrading #TradingFutures #JuCoinFutures #JuCoinListing #NewListing

Lee Jucoin

2025-08-19 06:43

📣 Limited benefit for new trading pair! 🎉

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Do Ecosystem Grants and Incentives Drive Project Growth?

Ecosystem grants and incentives have become essential tools for fostering innovation and sustainable development within the crypto and investment sectors. As blockchain technology, decentralized finance (DeFi), and emerging tech continue to evolve rapidly, these financial supports help projects overcome early-stage funding hurdles while encouraging community participation. Understanding how these grants influence project growth is key for entrepreneurs, investors, and community members alike.

What Are Ecosystem Grants in Crypto and Investment?

Ecosystem grants are financial awards provided by organizations—such as blockchain foundations, venture capital firms, or community groups—to support promising projects. These grants serve as catalysts for development by offering resources that enable teams to focus on building their solutions without the immediate pressure of fundraising. In the crypto space especially, these funds often target specific areas like blockchain infrastructure, decentralized applications (dApps), or innovative protocols.

There are generally three types of ecosystem grants:

- Crypto-specific Grants: Focused on blockchain development, smart contract creation, security audits, or DeFi innovations.

- General Ecosystem Grants: Broader in scope; they may support AI integration with fintech platforms or other emerging technologies.

- Community-driven Grants: Funded directly by user communities or organizations aligned with specific values; they emphasize social impact or grassroots initiatives.

These varied grant types reflect a strategic approach to nurturing diverse technological advancements while fostering inclusive growth within ecosystems.

How Do Ecosystem Incentives Promote Project Development?

The primary goal of ecosystem incentives is to accelerate project growth through targeted funding coupled with non-financial benefits such as mentorships, technical support, networking opportunities, and visibility within the community. These incentives motivate developers to innovate confidently because they reduce initial financial risks—a critical factor during early stages when securing traditional funding can be challenging.

By providing clear pathways for project validation—through milestones like product launches or user adoption—ecosystem incentives also encourage accountability among recipients. This structured approach ensures that funded projects align with broader ecosystem goals such as decentralization principles or interoperability standards.

Furthermore,these programs often foster collaboration among startups,established companies,and academic institutions,creating a vibrant environment conducive to knowledge sharingand joint innovation efforts.

The Impact of Funding Growth on Project Success

Recent years have seen a surge in funds allocated toward ecosystem grants globally. This increase correlates strongly with the expansion of DeFi platforms and enterprise-grade blockchain solutions seeking mainstream adoption. Larger grant pools mean more ambitious projects can get off the ground—ranging from scalable Layer 2 solutions to privacy-preserving protocols—and contribute significantly toward industry evolution.

Moreover,diversification in grant programs has broadened access across various sectors beyond pure cryptocurrency applications.For instance:

- Fintech startups integrating blockchain

- AI-powered analytics tools

- Sustainability-focused crypto initiatives

This diversification not only fuels technological progress but also attracts a wider range of talent into ecosystems previously dominated solely by core crypto developers.

Community Engagement: A Key Driver

Community-driven grants have gained prominence because they leverage collective enthusiasm around particular projects or causes. When users invest their time and resources into supporting initiatives aligned with their values—such as environmental sustainability through green tokens—they create organic momentum that sustains long-term project viability.

In addition,community engagement enhances transparencyand accountability since stakeholders directly influence decision-making processes related to fund allocation.This participatory model fosters trust between developers and users—a crucial element amid increasing regulatory scrutiny worldwide.

Challenges Facing Ecosystem Grant Programs

Despite their benefits,ecosystem grants face several challenges that could impede long-term success:

Regulatory Uncertainty: As governments tighten regulations around cryptocurrencies and token offerings,compliance becomes complex.Grant providers must ensure programs adhere to legal frameworks to avoid reputational damage or legal repercussions.

Market Volatility: Cryptocurrency markets are highly volatile;the value of granted tokens can fluctuate dramatically.This volatility impacts project sustainability if revenue models depend heavily on token appreciation rather than real-world utility.

Over-reliance on External Funding: Projects overly dependent on continuous grant inflows risk stagnation once funding diminishes unless diversified revenue streams develop over time.

Navigating Future Trends in Ecosystem Incentives

Looking ahead,

the landscape will likely see increased emphasis on compliance mechanisms,

more sophisticated evaluation criteria,

and greater integration between public-private partnerships.

Additionally,

regulators may introduce clearer guidelines tailored specifically for grant programs,

ensuring transparency while protecting investor interests.

Projects should focus not only on securing initial funding but also establishing sustainable business models that leverage ecosystem support effectively over time.

Final Thoughts: Supporting Sustainable Innovation Through Strategic Incentives

Ecosystem grants play an instrumental role in shaping the future trajectory of crypto innovations by lowering barriers for new entrants while promoting collaborative growth environments. They act as accelerators—not just providing capital but also fostering community involvement vital for long-term success.

However,

stakeholders must remain vigilant about regulatory developments

and market dynamics

to maximize benefits from these incentive structures without exposing themselves unnecessarily to risks.

As this field continues evolving rapidly,

a balanced approach combining strategic funding with compliance awareness will be essential

for ensuring resilient growth across all facets of the digital economy.

Keywords: ecosystem grants crypto | investment incentives | blockchain project funding | DeFi development support | community-driven crypto projects | startup incubation crypto | regulatory challenges in crypto financing

JCUSER-F1IIaxXA

2025-05-22 02:51

How do ecosystem grants and incentives drive project growth?

How Do Ecosystem Grants and Incentives Drive Project Growth?

Ecosystem grants and incentives have become essential tools for fostering innovation and sustainable development within the crypto and investment sectors. As blockchain technology, decentralized finance (DeFi), and emerging tech continue to evolve rapidly, these financial supports help projects overcome early-stage funding hurdles while encouraging community participation. Understanding how these grants influence project growth is key for entrepreneurs, investors, and community members alike.

What Are Ecosystem Grants in Crypto and Investment?

Ecosystem grants are financial awards provided by organizations—such as blockchain foundations, venture capital firms, or community groups—to support promising projects. These grants serve as catalysts for development by offering resources that enable teams to focus on building their solutions without the immediate pressure of fundraising. In the crypto space especially, these funds often target specific areas like blockchain infrastructure, decentralized applications (dApps), or innovative protocols.

There are generally three types of ecosystem grants:

- Crypto-specific Grants: Focused on blockchain development, smart contract creation, security audits, or DeFi innovations.

- General Ecosystem Grants: Broader in scope; they may support AI integration with fintech platforms or other emerging technologies.

- Community-driven Grants: Funded directly by user communities or organizations aligned with specific values; they emphasize social impact or grassroots initiatives.

These varied grant types reflect a strategic approach to nurturing diverse technological advancements while fostering inclusive growth within ecosystems.

How Do Ecosystem Incentives Promote Project Development?

The primary goal of ecosystem incentives is to accelerate project growth through targeted funding coupled with non-financial benefits such as mentorships, technical support, networking opportunities, and visibility within the community. These incentives motivate developers to innovate confidently because they reduce initial financial risks—a critical factor during early stages when securing traditional funding can be challenging.

By providing clear pathways for project validation—through milestones like product launches or user adoption—ecosystem incentives also encourage accountability among recipients. This structured approach ensures that funded projects align with broader ecosystem goals such as decentralization principles or interoperability standards.

Furthermore,these programs often foster collaboration among startups,established companies,and academic institutions,creating a vibrant environment conducive to knowledge sharingand joint innovation efforts.

The Impact of Funding Growth on Project Success

Recent years have seen a surge in funds allocated toward ecosystem grants globally. This increase correlates strongly with the expansion of DeFi platforms and enterprise-grade blockchain solutions seeking mainstream adoption. Larger grant pools mean more ambitious projects can get off the ground—ranging from scalable Layer 2 solutions to privacy-preserving protocols—and contribute significantly toward industry evolution.

Moreover,diversification in grant programs has broadened access across various sectors beyond pure cryptocurrency applications.For instance:

- Fintech startups integrating blockchain

- AI-powered analytics tools

- Sustainability-focused crypto initiatives

This diversification not only fuels technological progress but also attracts a wider range of talent into ecosystems previously dominated solely by core crypto developers.

Community Engagement: A Key Driver

Community-driven grants have gained prominence because they leverage collective enthusiasm around particular projects or causes. When users invest their time and resources into supporting initiatives aligned with their values—such as environmental sustainability through green tokens—they create organic momentum that sustains long-term project viability.

In addition,community engagement enhances transparencyand accountability since stakeholders directly influence decision-making processes related to fund allocation.This participatory model fosters trust between developers and users—a crucial element amid increasing regulatory scrutiny worldwide.

Challenges Facing Ecosystem Grant Programs

Despite their benefits,ecosystem grants face several challenges that could impede long-term success:

Regulatory Uncertainty: As governments tighten regulations around cryptocurrencies and token offerings,compliance becomes complex.Grant providers must ensure programs adhere to legal frameworks to avoid reputational damage or legal repercussions.

Market Volatility: Cryptocurrency markets are highly volatile;the value of granted tokens can fluctuate dramatically.This volatility impacts project sustainability if revenue models depend heavily on token appreciation rather than real-world utility.

Over-reliance on External Funding: Projects overly dependent on continuous grant inflows risk stagnation once funding diminishes unless diversified revenue streams develop over time.

Navigating Future Trends in Ecosystem Incentives

Looking ahead,

the landscape will likely see increased emphasis on compliance mechanisms,

more sophisticated evaluation criteria,

and greater integration between public-private partnerships.

Additionally,

regulators may introduce clearer guidelines tailored specifically for grant programs,

ensuring transparency while protecting investor interests.

Projects should focus not only on securing initial funding but also establishing sustainable business models that leverage ecosystem support effectively over time.

Final Thoughts: Supporting Sustainable Innovation Through Strategic Incentives

Ecosystem grants play an instrumental role in shaping the future trajectory of crypto innovations by lowering barriers for new entrants while promoting collaborative growth environments. They act as accelerators—not just providing capital but also fostering community involvement vital for long-term success.

However,

stakeholders must remain vigilant about regulatory developments

and market dynamics

to maximize benefits from these incentive structures without exposing themselves unnecessarily to risks.

As this field continues evolving rapidly,

a balanced approach combining strategic funding with compliance awareness will be essential

for ensuring resilient growth across all facets of the digital economy.

Keywords: ecosystem grants crypto | investment incentives | blockchain project funding | DeFi development support | community-driven crypto projects | startup incubation crypto | regulatory challenges in crypto financing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is Sharding in Blockchain?

Sharding is a transformative scalability solution designed to enhance the performance and efficiency of blockchain networks. As blockchain technology gains widespread adoption, the need to process increasing numbers of transactions quickly and securely becomes critical. Sharding addresses this challenge by dividing the entire network into smaller, manageable segments called shards, each capable of processing transactions independently. This division allows multiple transactions to be processed simultaneously, significantly reducing congestion and improving overall throughput.

In essence, sharding enables a blockchain network to operate more like a distributed database rather than a single monolithic ledger. Each shard functions as its own mini-blockchain with its unique state and transaction history but remains interconnected within the larger network framework. This structure not only boosts transaction speeds but also helps in scaling blockchain solutions for real-world applications such as decentralized finance (DeFi), supply chain management, and enterprise solutions.

How Does Sharding Work in Blockchain Networks?

The core idea behind sharding involves splitting the workload across various smaller components—shards—that work concurrently. Each shard processes a subset of all transactions based on specific criteria such as user accounts or data types. For example, one shard might handle payment transactions while another manages smart contract interactions.

To maintain consistency across these independent shards, mechanisms like cross-shard communication are implemented. These protocols ensure that when users perform transactions involving multiple shards—say transferring assets from one account managed by one shard to another managed by different shards—the system can verify and record these operations accurately without compromising security or integrity.

Shards typically operate as separate blockchains known as "shard chains." They maintain their own states—such as account balances or smart contract data—and process their designated set of transactions independently before periodically syncing with other shards through consensus protocols designed for cross-shard validation.

Types of Sharding

There are primarily two types of sharding used in blockchain systems:

Horizontal Sharding: This approach divides the network based on transaction types or user groups—for instance, separating payment processing from smart contract execution.

Vertical Sharding: Here, data is partitioned based on storage needs or data categories—for example, storing different kinds of information (user profiles vs transactional logs) separately across various shards.

Both methods aim to optimize resource utilization while maintaining security and decentralization principles inherent in blockchain technology.

Benefits of Implementing Sharding

Implementing sharding offers several significant advantages:

Enhanced Scalability: By distributing transaction loads across multiple shards, networks can handle many more operations per second compared to traditional single-chain architectures.

Reduced Transaction Fees: Faster processing times mean less congestion; consequently, users often experience lower fees during peak usage periods.

Improved Network Efficiency: Smaller nodes manage fewer tasks within each shard—they require less computational power and storage capacity—making participation easier for more validators.

Parallel Processing: Multiple parts of the network work simultaneously rather than sequentially; this parallelism accelerates overall throughput significantly.

These benefits make sharded blockchains suitable for large-scale applications where high speed and low latency are essential requirements.

Challenges Associated With Blockchain Sharding

Despite its promising potential, implementing sharding introduces complex technical challenges that must be addressed:

Inter-Shard Communication

Ensuring seamless communication between different shards is vital yet difficult. Transactions involving multiple shards require secure protocols that prevent double-spending or inconsistencies—a problem known as cross-shard communication complexity.

Consensus Mechanisms Across Multiple Shards

Traditional consensus algorithms like Proof-of-Work (PoW) are not inherently designed for multi-shard environments. Developing efficient consensus models that work reliably across numerous independent chains remains an ongoing research area within blockchain development communities.

Security Concerns

Dividing a network into smaller segments increases vulnerability risks; if one shard becomes compromised due to an attack or bug exploitation—a scenario called "shard takeover"—it could threaten the entire ecosystem's security integrity unless robust safeguards are implemented effectively throughout all parts of the system.

Standardization & Adoption Barriers

For widespread adoption beyond experimental phases requires industry-wide standards governing how sharded networks communicate and interoperate seamlessly. Without standardization efforts among developers and stakeholders worldwide—including major platforms like Ethereum—the risk exists that fragmentation could hinder progress rather than accelerate it.

Recent Developments in Blockchain Sharding Technology

Major projects have made notable strides toward integrating sharding into their ecosystems:

Ethereum 2.0 has been at the forefront with plans for scalable upgrades through its phased rollout strategy involving beacon chains (launched December 2020). The next steps include deploying dedicated shard chains alongside cross-shard communication protocols aimed at enabling Ethereum’s massive ecosystem to scale efficiently without sacrificing decentralization or security standards.

Polkadot employs relay chains connecting parachains—independent blockchains optimized for specific use cases—that communicate via shared security models facilitating interoperability among diverse networks.

Cosmos, utilizing Tendermint Core consensus algorithm architecture allows developers to create zones (independent blockchains) capable of interoperation within an overarching hub-and-spoke model similar to Polkadot’s relay chain approach.

Research continues globally exploring innovative techniques such as state sharding, which aims at optimizing how state information is stored across nodes—a crucial factor influencing scalability limits further improvements.

Potential Risks Impacting Future Adoption

While promising solutions exist today—and ongoing research promises even better approaches—the path forward faces hurdles related mainly to:

Security Risks: Smaller individual shards may become targets due to reduced validation power compared with full nodes operating on entire networks.

Interoperability Challenges: Achieving flawless interaction between diverse systems requires standardized protocols; otherwise fragmentation may occur leading toward isolated ecosystems instead of unified platforms.

Adoption Hurdles & Industry Standardization

Without broad agreement on technical standards governing cross-shard communications—as well as regulatory considerations—widespread deployment might slow down considerably despite technological readiness.

Understanding How Blockchain Scaling Evolves Through Sharding

As demand grows exponentially—from DeFi applications demanding rapid trades versus enterprise-level integrations requiring high throughput—the importance lies not just in creating faster blockchains but ensuring they remain secure against evolving threats while interoperable enough for global adoption.

By addressing current limitations through continuous innovation—in protocol design improvements like state sharing techniques—and fostering collaboration among industry leaders worldwide who develop open standards —the future landscape looks promising: scalable yet secure decentralized systems capable enough for mainstream use.

This comprehensive overview provides clarity about what sharding entails within blockchain technology: how it works technically; why it matters; what benefits it offers; what challenges lie ahead; along with recent advancements shaping its future trajectory—all aligned towards helping users understand both foundational concepts and cutting-edge developments effectively.

Lo

2025-05-15 02:38

What is sharding in blockchain?

What Is Sharding in Blockchain?

Sharding is a transformative scalability solution designed to enhance the performance and efficiency of blockchain networks. As blockchain technology gains widespread adoption, the need to process increasing numbers of transactions quickly and securely becomes critical. Sharding addresses this challenge by dividing the entire network into smaller, manageable segments called shards, each capable of processing transactions independently. This division allows multiple transactions to be processed simultaneously, significantly reducing congestion and improving overall throughput.

In essence, sharding enables a blockchain network to operate more like a distributed database rather than a single monolithic ledger. Each shard functions as its own mini-blockchain with its unique state and transaction history but remains interconnected within the larger network framework. This structure not only boosts transaction speeds but also helps in scaling blockchain solutions for real-world applications such as decentralized finance (DeFi), supply chain management, and enterprise solutions.

How Does Sharding Work in Blockchain Networks?

The core idea behind sharding involves splitting the workload across various smaller components—shards—that work concurrently. Each shard processes a subset of all transactions based on specific criteria such as user accounts or data types. For example, one shard might handle payment transactions while another manages smart contract interactions.

To maintain consistency across these independent shards, mechanisms like cross-shard communication are implemented. These protocols ensure that when users perform transactions involving multiple shards—say transferring assets from one account managed by one shard to another managed by different shards—the system can verify and record these operations accurately without compromising security or integrity.

Shards typically operate as separate blockchains known as "shard chains." They maintain their own states—such as account balances or smart contract data—and process their designated set of transactions independently before periodically syncing with other shards through consensus protocols designed for cross-shard validation.

Types of Sharding

There are primarily two types of sharding used in blockchain systems:

Horizontal Sharding: This approach divides the network based on transaction types or user groups—for instance, separating payment processing from smart contract execution.

Vertical Sharding: Here, data is partitioned based on storage needs or data categories—for example, storing different kinds of information (user profiles vs transactional logs) separately across various shards.

Both methods aim to optimize resource utilization while maintaining security and decentralization principles inherent in blockchain technology.

Benefits of Implementing Sharding

Implementing sharding offers several significant advantages:

Enhanced Scalability: By distributing transaction loads across multiple shards, networks can handle many more operations per second compared to traditional single-chain architectures.

Reduced Transaction Fees: Faster processing times mean less congestion; consequently, users often experience lower fees during peak usage periods.

Improved Network Efficiency: Smaller nodes manage fewer tasks within each shard—they require less computational power and storage capacity—making participation easier for more validators.

Parallel Processing: Multiple parts of the network work simultaneously rather than sequentially; this parallelism accelerates overall throughput significantly.

These benefits make sharded blockchains suitable for large-scale applications where high speed and low latency are essential requirements.

Challenges Associated With Blockchain Sharding

Despite its promising potential, implementing sharding introduces complex technical challenges that must be addressed:

Inter-Shard Communication

Ensuring seamless communication between different shards is vital yet difficult. Transactions involving multiple shards require secure protocols that prevent double-spending or inconsistencies—a problem known as cross-shard communication complexity.

Consensus Mechanisms Across Multiple Shards

Traditional consensus algorithms like Proof-of-Work (PoW) are not inherently designed for multi-shard environments. Developing efficient consensus models that work reliably across numerous independent chains remains an ongoing research area within blockchain development communities.

Security Concerns

Dividing a network into smaller segments increases vulnerability risks; if one shard becomes compromised due to an attack or bug exploitation—a scenario called "shard takeover"—it could threaten the entire ecosystem's security integrity unless robust safeguards are implemented effectively throughout all parts of the system.

Standardization & Adoption Barriers

For widespread adoption beyond experimental phases requires industry-wide standards governing how sharded networks communicate and interoperate seamlessly. Without standardization efforts among developers and stakeholders worldwide—including major platforms like Ethereum—the risk exists that fragmentation could hinder progress rather than accelerate it.

Recent Developments in Blockchain Sharding Technology

Major projects have made notable strides toward integrating sharding into their ecosystems:

Ethereum 2.0 has been at the forefront with plans for scalable upgrades through its phased rollout strategy involving beacon chains (launched December 2020). The next steps include deploying dedicated shard chains alongside cross-shard communication protocols aimed at enabling Ethereum’s massive ecosystem to scale efficiently without sacrificing decentralization or security standards.

Polkadot employs relay chains connecting parachains—independent blockchains optimized for specific use cases—that communicate via shared security models facilitating interoperability among diverse networks.

Cosmos, utilizing Tendermint Core consensus algorithm architecture allows developers to create zones (independent blockchains) capable of interoperation within an overarching hub-and-spoke model similar to Polkadot’s relay chain approach.

Research continues globally exploring innovative techniques such as state sharding, which aims at optimizing how state information is stored across nodes—a crucial factor influencing scalability limits further improvements.

Potential Risks Impacting Future Adoption

While promising solutions exist today—and ongoing research promises even better approaches—the path forward faces hurdles related mainly to:

Security Risks: Smaller individual shards may become targets due to reduced validation power compared with full nodes operating on entire networks.

Interoperability Challenges: Achieving flawless interaction between diverse systems requires standardized protocols; otherwise fragmentation may occur leading toward isolated ecosystems instead of unified platforms.

Adoption Hurdles & Industry Standardization

Without broad agreement on technical standards governing cross-shard communications—as well as regulatory considerations—widespread deployment might slow down considerably despite technological readiness.

Understanding How Blockchain Scaling Evolves Through Sharding

As demand grows exponentially—from DeFi applications demanding rapid trades versus enterprise-level integrations requiring high throughput—the importance lies not just in creating faster blockchains but ensuring they remain secure against evolving threats while interoperable enough for global adoption.

By addressing current limitations through continuous innovation—in protocol design improvements like state sharing techniques—and fostering collaboration among industry leaders worldwide who develop open standards —the future landscape looks promising: scalable yet secure decentralized systems capable enough for mainstream use.

This comprehensive overview provides clarity about what sharding entails within blockchain technology: how it works technically; why it matters; what benefits it offers; what challenges lie ahead; along with recent advancements shaping its future trajectory—all aligned towards helping users understand both foundational concepts and cutting-edge developments effectively.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔍 David Schwartz (CTO) rappelle que :

• Ripple opère moins de **1% des validateurs**

• Les évolutions de XRPL dépendent du **consensus communautaire**

• Les milliards en escrow sont **verrouillés par smart contracts**, sans accès direct

👉 Une piqûre de rappel importante sur la gouvernance réelle des protocoles.

#XRP #crypto #cryptocurrency

Carmelita

2025-08-07 14:15

🚨 Fin des fantasmes : Ripple ne contrôle pas le $XRP Ledger.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is DBSCAN and How Does It Detect Unusual Market Conditions?

Understanding how financial markets, especially volatile ones like cryptocurrencies, can be monitored for anomalies is crucial for traders, analysts, and regulators alike. One powerful tool gaining traction in this space is DBSCAN—short for Density-Based Spatial Clustering of Applications with Noise. This clustering algorithm helps identify unusual patterns or outliers in complex datasets by grouping similar data points together based on their density.

How Does DBSCAN Work?

At its core, DBSCAN analyzes data points—such as price movements or trading volumes—and groups them into clusters where points are densely packed. It operates based on two key parameters: Eps (epsilon), which defines the radius around a point to consider neighboring points, and MinPts (minimum points), the minimum number of neighboring points needed to form a cluster.

The process begins by selecting an unvisited data point. If this point has at least MinPts within its Eps-neighborhood, it becomes a core point and initiates a new cluster. The algorithm then expands this cluster by recursively including all neighboring core points and their neighbors that meet the density criteria. Points that do not belong to any cluster are labeled as noise or outliers—potential indicators of anomalies.

This approach makes DBSCAN particularly effective at handling noisy financial data because it naturally distinguishes between normal market fluctuations and genuine anomalies without requiring prior knowledge about the number of clusters.

Why Is Detecting Anomalies Important in Cryptocurrency Markets?

Cryptocurrency markets are known for their high volatility and rapid price swings. Identifying abnormal market conditions early can provide traders with critical insights into potential risks or opportunities. For example:

- Market Manipulation: Sudden spikes or drops might indicate pump-and-dump schemes.

- Systemic Risks: Unusual trading volumes could signal systemic issues or impending crashes.

- Fraud Detection: Outlier transactions may reveal fraudulent activities such as wash trading.

By applying algorithms like DBSCAN to historical price data, traders can detect these irregularities more effectively than traditional methods that might overlook subtle but significant deviations.

Recent Advances in Using DBSCAN for Market Analysis

Recent research highlights several innovative applications of DBSCAN within financial analytics:

Cryptocurrency Anomaly Detection: Studies have demonstrated how applying DBSCAN to Bitcoin's price movements helps identify unusual patterns preceding market downturns [1]. These insights enable better risk management strategies.

Real-Time Monitoring Systems: With advancements in computational power, integrating DBSCAN into live monitoring tools allows instant detection of anomalies as they occur [2]. Traders receive timely alerts that inform decision-making processes.

Combining Machine Learning Techniques: Combining density-based clustering with neural networks enhances anomaly detection accuracy [3]. This hybrid approach leverages both pattern recognition capabilities and statistical robustness.

These developments underscore how machine learning integrations make anomaly detection more precise while enabling real-time analysis—a vital feature given cryptocurrency markets' speed and unpredictability.

Key Factors Influencing Effective Use of DBSCAN

While powerful, deploying DBSCAN effectively requires attention to several factors:

Parameter Tuning: Selecting appropriate values for Eps and MinPts is critical; too small Eps may fragment genuine clusters into noise, while too large could merge distinct patterns incorrectly [4][5].

Handling Noisy Data: Financial datasets often contain significant noise due to random fluctuations; thus, understanding how well the algorithm manages false positives is essential [6].

Computational Efficiency: Although generally efficient with O(n log n) complexity [4], large-scale datasets demand optimized implementations for real-time applications.

Validation & Testing: Regular validation ensures that detected anomalies genuinely reflect abnormal conditions rather than false alarms caused by parameter misconfiguration [7].

Challenges & Considerations When Using Density-Based Clustering

Despite its strengths, practitioners should be aware of potential pitfalls:

False Positives: Incorrectly flagging normal market behavior as anomalous can lead to unnecessary trades or panic selling.

Market Volatility: Cryptocurrency prices are inherently volatile; distinguishing between regular swings and true anomalies requires careful calibration.

Regulatory Implications: As anomaly detection influences trading decisions significantly—sometimes automatically—it’s vital these systems comply with relevant regulations concerning transparency and fairness [8][9].

Incorporating robust validation procedures alongside advanced algorithms like DBSCAN helps mitigate these issues while enhancing trustworthiness in automated analysis systems.

By leveraging density-based clustering techniques such as DBSCAN within cryptocurrency markets’ dynamic environment—and combining them with machine learning enhancements—traders gain a sophisticated method for detecting early signs of abnormal activity. Proper parameter tuning combined with ongoing validation ensures reliable performance amid high volatility levels typical of digital assets today.

References

- "Anomaly Detection in Bitcoin Price Movements Using DBSCAN" (2023) - Journal of Financial Data Science

- "Real-Time Anomaly Detection in Cryptocurrency Markets Using Dbscan" (2024) - International Journal of Financial Engineering

- "Enhancing Anomaly Detection in Cryptocurrency Markets with Dbscan and Neural Networks" (2024) - IEEE Transactions on Neural Networks & Learning Systems

4."Time Complexity Analysis of Dbscan" (2019) - Journal Of Algorithms

5."Optimal Parameter Selection For Dbscan In Financial Data" (2022) - Journal Of Data Science

6."Noise Handling In Dbscan For Financial Data Analysis" (2021) - International Journal Of Data Mining And Bioinformatics

7."False Positive Reduction In Anomaly Detection Using Dbscan" (2023) - Journal Of Artificial Intelligence Research

8."Regulatory Compliance For Anomaly Detection Systems In Financial Markets" (2023) - Journal Of Financial Regulation

JCUSER-IC8sJL1q

2025-05-09 23:09

What is DBSCAN and how does it identify unusual market conditions?

What Is DBSCAN and How Does It Detect Unusual Market Conditions?

Understanding how financial markets, especially volatile ones like cryptocurrencies, can be monitored for anomalies is crucial for traders, analysts, and regulators alike. One powerful tool gaining traction in this space is DBSCAN—short for Density-Based Spatial Clustering of Applications with Noise. This clustering algorithm helps identify unusual patterns or outliers in complex datasets by grouping similar data points together based on their density.

How Does DBSCAN Work?

At its core, DBSCAN analyzes data points—such as price movements or trading volumes—and groups them into clusters where points are densely packed. It operates based on two key parameters: Eps (epsilon), which defines the radius around a point to consider neighboring points, and MinPts (minimum points), the minimum number of neighboring points needed to form a cluster.

The process begins by selecting an unvisited data point. If this point has at least MinPts within its Eps-neighborhood, it becomes a core point and initiates a new cluster. The algorithm then expands this cluster by recursively including all neighboring core points and their neighbors that meet the density criteria. Points that do not belong to any cluster are labeled as noise or outliers—potential indicators of anomalies.

This approach makes DBSCAN particularly effective at handling noisy financial data because it naturally distinguishes between normal market fluctuations and genuine anomalies without requiring prior knowledge about the number of clusters.

Why Is Detecting Anomalies Important in Cryptocurrency Markets?

Cryptocurrency markets are known for their high volatility and rapid price swings. Identifying abnormal market conditions early can provide traders with critical insights into potential risks or opportunities. For example:

- Market Manipulation: Sudden spikes or drops might indicate pump-and-dump schemes.

- Systemic Risks: Unusual trading volumes could signal systemic issues or impending crashes.

- Fraud Detection: Outlier transactions may reveal fraudulent activities such as wash trading.

By applying algorithms like DBSCAN to historical price data, traders can detect these irregularities more effectively than traditional methods that might overlook subtle but significant deviations.

Recent Advances in Using DBSCAN for Market Analysis

Recent research highlights several innovative applications of DBSCAN within financial analytics:

Cryptocurrency Anomaly Detection: Studies have demonstrated how applying DBSCAN to Bitcoin's price movements helps identify unusual patterns preceding market downturns [1]. These insights enable better risk management strategies.

Real-Time Monitoring Systems: With advancements in computational power, integrating DBSCAN into live monitoring tools allows instant detection of anomalies as they occur [2]. Traders receive timely alerts that inform decision-making processes.

Combining Machine Learning Techniques: Combining density-based clustering with neural networks enhances anomaly detection accuracy [3]. This hybrid approach leverages both pattern recognition capabilities and statistical robustness.

These developments underscore how machine learning integrations make anomaly detection more precise while enabling real-time analysis—a vital feature given cryptocurrency markets' speed and unpredictability.

Key Factors Influencing Effective Use of DBSCAN

While powerful, deploying DBSCAN effectively requires attention to several factors:

Parameter Tuning: Selecting appropriate values for Eps and MinPts is critical; too small Eps may fragment genuine clusters into noise, while too large could merge distinct patterns incorrectly [4][5].

Handling Noisy Data: Financial datasets often contain significant noise due to random fluctuations; thus, understanding how well the algorithm manages false positives is essential [6].

Computational Efficiency: Although generally efficient with O(n log n) complexity [4], large-scale datasets demand optimized implementations for real-time applications.

Validation & Testing: Regular validation ensures that detected anomalies genuinely reflect abnormal conditions rather than false alarms caused by parameter misconfiguration [7].

Challenges & Considerations When Using Density-Based Clustering

Despite its strengths, practitioners should be aware of potential pitfalls:

False Positives: Incorrectly flagging normal market behavior as anomalous can lead to unnecessary trades or panic selling.

Market Volatility: Cryptocurrency prices are inherently volatile; distinguishing between regular swings and true anomalies requires careful calibration.

Regulatory Implications: As anomaly detection influences trading decisions significantly—sometimes automatically—it’s vital these systems comply with relevant regulations concerning transparency and fairness [8][9].

Incorporating robust validation procedures alongside advanced algorithms like DBSCAN helps mitigate these issues while enhancing trustworthiness in automated analysis systems.

By leveraging density-based clustering techniques such as DBSCAN within cryptocurrency markets’ dynamic environment—and combining them with machine learning enhancements—traders gain a sophisticated method for detecting early signs of abnormal activity. Proper parameter tuning combined with ongoing validation ensures reliable performance amid high volatility levels typical of digital assets today.

References

- "Anomaly Detection in Bitcoin Price Movements Using DBSCAN" (2023) - Journal of Financial Data Science

- "Real-Time Anomaly Detection in Cryptocurrency Markets Using Dbscan" (2024) - International Journal of Financial Engineering

- "Enhancing Anomaly Detection in Cryptocurrency Markets with Dbscan and Neural Networks" (2024) - IEEE Transactions on Neural Networks & Learning Systems

4."Time Complexity Analysis of Dbscan" (2019) - Journal Of Algorithms

5."Optimal Parameter Selection For Dbscan In Financial Data" (2022) - Journal Of Data Science

6."Noise Handling In Dbscan For Financial Data Analysis" (2021) - International Journal Of Data Mining And Bioinformatics

7."False Positive Reduction In Anomaly Detection Using Dbscan" (2023) - Journal Of Artificial Intelligence Research

8."Regulatory Compliance For Anomaly Detection Systems In Financial Markets" (2023) - Journal Of Financial Regulation

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚀 Want to grab the opportunity early? Try #JuCoinOnChain!

✅ Faster order matching

✅ More flexibility

✅ Focus on new projects & assets early

✅ Trade directly with JuCoin account – no external wallet needed

👉 Discover now: https://jucoin.com/en/onchain

👉 Register for JuCoin now: https://bit.ly/3BVxlZ2

#JuCoin #JuCoinVietnam #JuCoinOnChain #Crypto #Blockchain #DeFi #Web3 #CryptoCommunity

Lee Jucoin

2025-08-21 07:56

🚀 Want to grab the opportunity early?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

It's never been easy to crack how to become a millionaire, but it seems like there's finally a way... Check out our YouTube Channel 👉

JuCoin Media

2025-08-11 13:20

How to Become A Millionaire - Dump First, Dance Later 💰

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

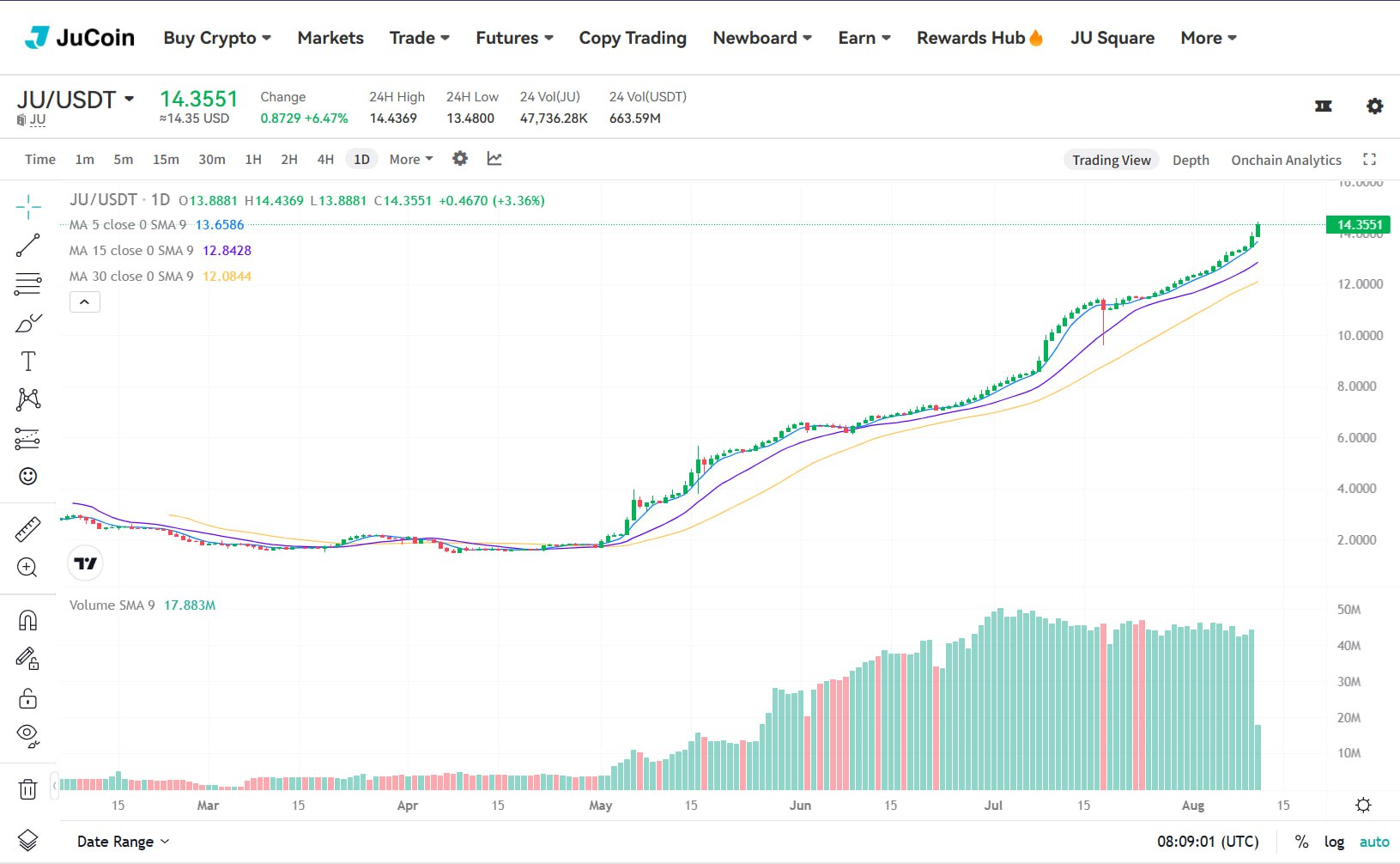

+140x ROI depuis le lancement — du jamais vu dans le marché actuel. Merci à tous les builders, holders & believers Le sommet ? Ce n’est que le départ. Jusqu’au 12 août, 19h00 (UTC+8)

Carmelita

2025-08-11 21:33

$JU explose un nouveau record : 14 $ franchis !

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Environmental Concerns Surrounding NFT Minting and Trading

NFTs, or Non-Fungible Tokens, have revolutionized the digital landscape by enabling artists, collectors, and gamers to buy, sell, and showcase unique digital assets. While their popularity continues to soar, growing awareness of their environmental impact has sparked significant concern among industry stakeholders and consumers alike. This article explores the key environmental issues associated with NFT minting and trading, recent developments addressing these challenges, and what the future might hold for sustainable digital assets.

What Are NFTs and How Are They Created?

NFTs are blockchain-based tokens that certify ownership of a specific digital item—be it artwork, music, in-game items, or even real-world assets. Unlike cryptocurrencies such as Bitcoin or Ethereum that are interchangeable (fungible), NFTs are unique (non-fungible), making them ideal for representing scarce or one-of-a-kind items.

The process of creating an NFT is called minting. It involves recording a new token on a blockchain network through complex computational processes that validate ownership rights. Most NFTs are minted on platforms using blockchain protocols like Ethereum’s Proof of Work (PoW) consensus algorithm—a method requiring substantial computational power to verify transactions.

The Environmental Impact of NFT Minting